Will Offshore Gains and Debt Focus Shift Genesis Energy's (GEL) Prospects for Future Cash Flow?

- Genesis Energy reported a Q3 net income attributable of US$9.2 million, reversing a loss from the prior year, with strong results driven by its offshore pipeline segment following resolution of mechanical issues and new production from the Shenandoah and Salamanca units.

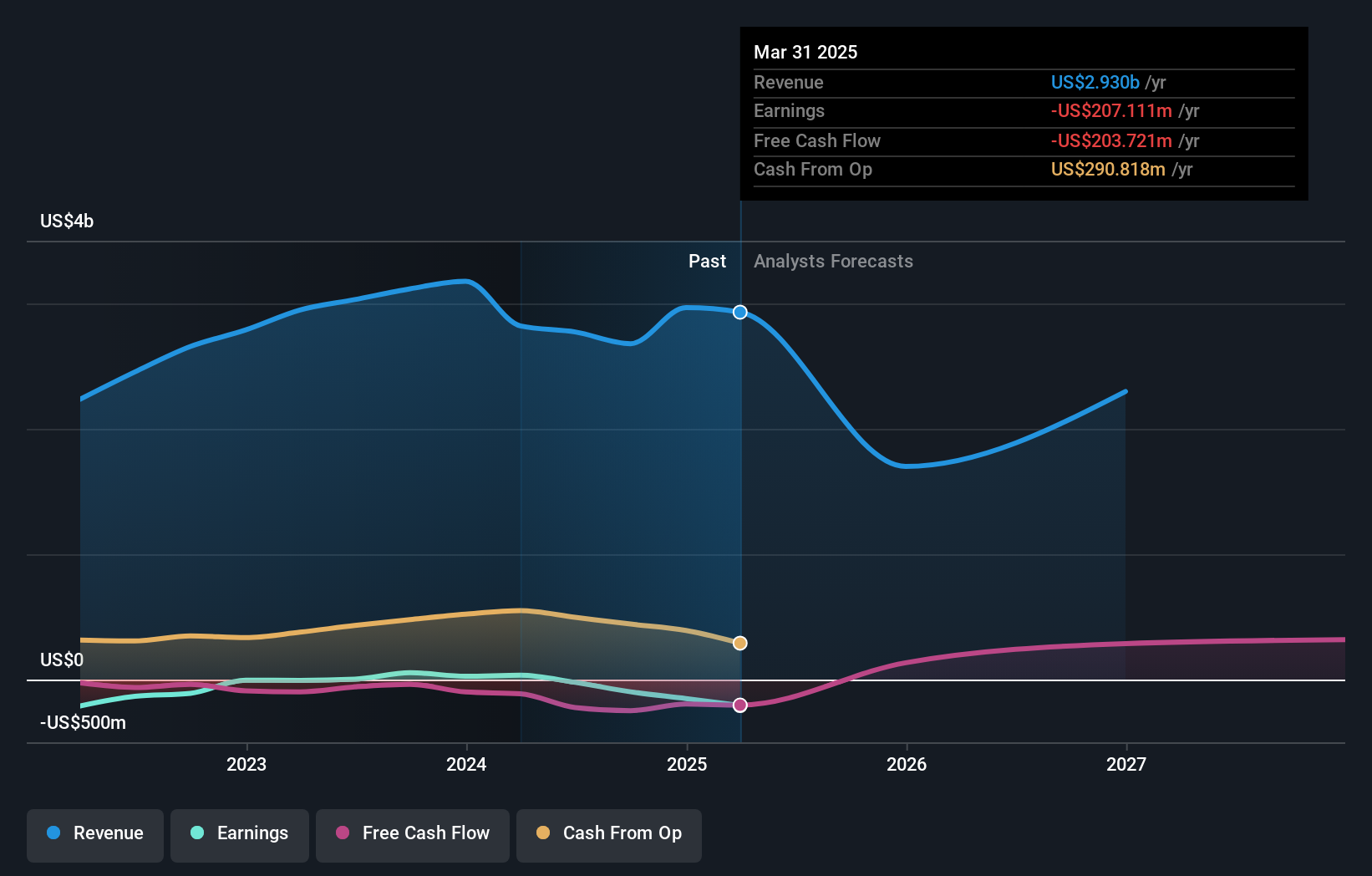

- An interesting aspect is the company's renewed focus on debt reduction and the potential for higher future distributions, underpinned by anticipated increases in adjusted EBITDA and free cash flow in 2026.

- We'll explore how the ramp-up of new offshore production facilities strengthens Genesis Energy's investment narrative and future cash flow outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Genesis Energy's Investment Narrative?

The key thesis for a Genesis Energy shareholder centers on the company’s ability to turn around operational setbacks and strengthen its cash generation. The recent swing back to profitability in Q3, aided by improved performance in the offshore pipeline segment and the ramp-up at Shenandoah and Salamanca, directly addresses previous operational risks and sets a new tone for the near-term outlook. While analysts previously cautioned about ongoing revenue declines and sustainability of dividends, these latest results may temporarily shift attention to cash flow stability and debt reduction, two catalysts that could reshape short-term sentiment if sustained. However, uncertainties remain; revenue trends are still uneven, and with GEL’s dividend not yet well covered by earnings or free cash flow, investors may want to watch if recent improvements translate into a sustainable shift in fundamentals.

But volatility around revenues and dividend coverage might not be behind us. Genesis Energy's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Genesis Energy - why the stock might be worth just $19.33!

Build Your Own Genesis Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genesis Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Genesis Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genesis Energy's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 23 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal