PC Connection (CNXN) Profit Margins Narrow, Challenging Bullish Narrative on Near-Term Earnings Recovery

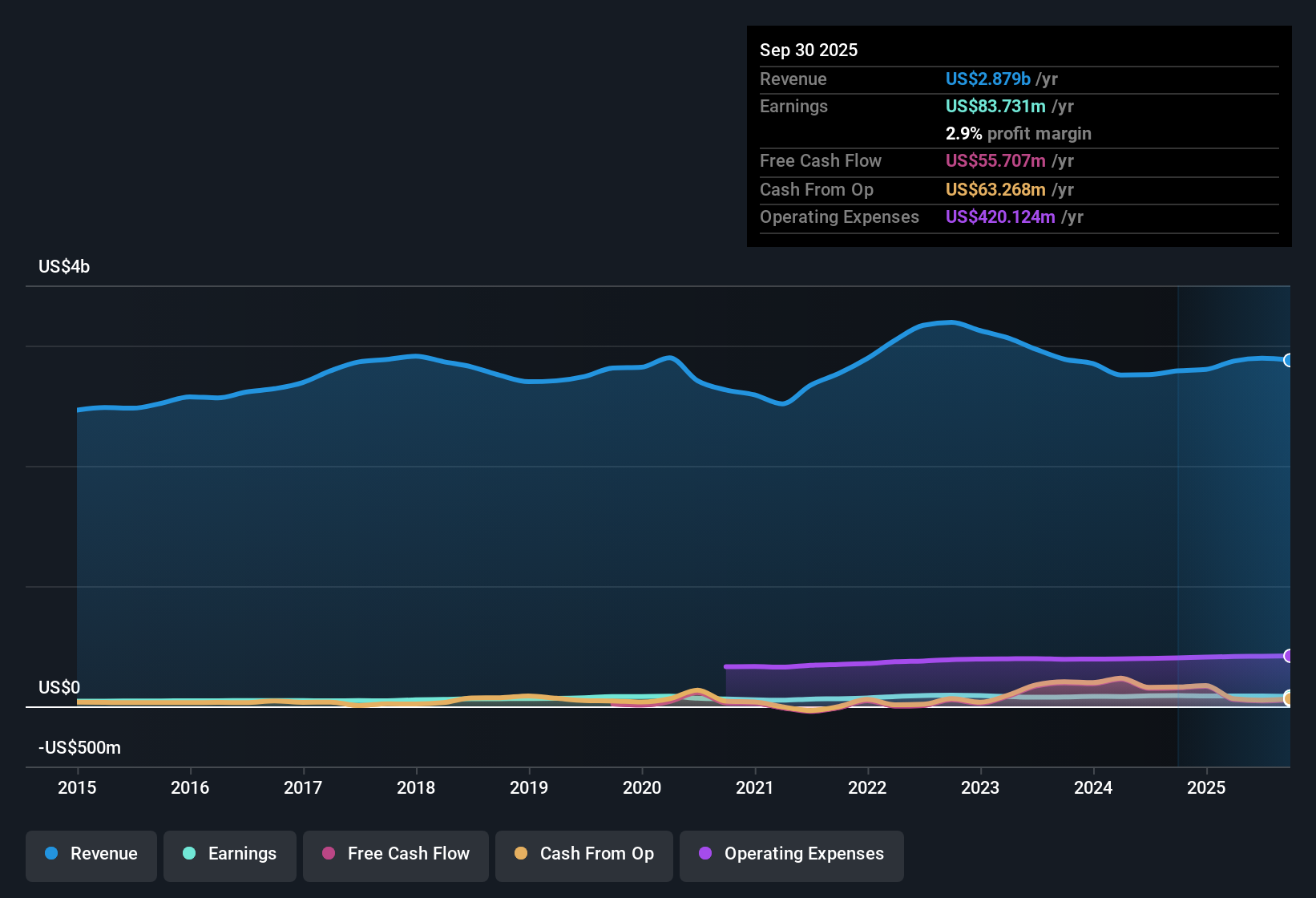

PC Connection (CNXN) posted net profit margins of 2.9%, down from last year's 3.2%, with earnings declining over the past year despite averaging 7.7% annual growth across the previous five years. Looking forward, analysts project annual earnings growth of 12.4% and revenue growth of 4.8%, both trailing broader US market forecasts. With shares trading below some valuation metrics and risk assessments showing no material concerns, investors are turning their attention to whether expected improvements in profitability will materialize and if the company can maintain its current value advantage compared to the sector.

See our full analysis for PC Connection.Next up, we will see how these reported numbers hold up when compared with the most widely followed community and market narratives.

See what the community is saying about PC Connection

Margin Expansion Hinges on Services Shift

- Analysts are projecting a margin increase from the current 3.0% to 3.4% over the next three years, driven by a pivot toward higher-margin managed services and integrated IT solutions.

- According to the analysts' consensus view, future net margin gains depend on PC Connection’s transition away from hardware reselling and its ability to grow recurring revenues from services.

- This optimism heavily relies on a strong pipeline in areas like AI, cybersecurity, and digital infrastructure, sectors that are expected to drive higher-value and stickier customer relationships.

- The focus on subscription-based and digital solutions, alongside operational efficiency improvements, is viewed as the key catalyst for both near-term and durable margin improvement. This echoes the consensus narrative’s positive tone on structural change.

- Curious how numbers become stories that shape markets? Explore Community Narratives Curious how numbers become stories that shape markets? Explore Community Narratives

Hardware Dependence Still a Profit Risk

- Recent financials show continued reliance on hardware resales, with public sector sales experiencing a double-digit year-over-year decline. This exposes the company to margin pressure and customer concentration risk.

- Analysts' consensus narrative highlights heavy dependence on commodity hardware as a structural business weakness, warning that shrinking margins and segment-specific declines could limit PC Connection’s profitability upside.

- As partner subscription licensing revenue drops and hardware commoditization increases, future margin expansion could be capped without greater service mix.

- Inventory build-up and rising accounts receivable introduce cash flow and liquidity risks, making earnings vulnerable if customer demand weakens.

Price Target Sets a Measured Upside

- With a current share price of $59.96 and an analyst price target of $76.00, there is a 26.8% implied upside if consensus earnings and margin improvements materialize by 2028.

- Analysts’ consensus view is that this target assumes revenue will reach $3.4 billion and net profit will hit $116 million by 2028, but these expectations require ongoing margin recovery and a shift in business mix toward solutions and services.

- The needed price-to-earnings ratio for the target is 18.2x. This would place PC Connection below the broader US electronic industry average but still at a premium to some peers.

- Consensus perspective suggests that achieving both the margin goal and share reduction plan is essential for the stock to reach this valuation in three years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PC Connection on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to look at the figures from a new angle? Share your outlook and make your narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding PC Connection.

See What Else Is Out There

PC Connection’s ongoing reliance on hardware sales and recent sector declines increase the risk of uneven earnings and may dampen its margin outlook.

If you want steadier momentum, use our stable growth stocks screener (2113 results) to find companies with proven histories of consistent revenue and earnings growth regardless of market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal