Littelfuse (LFUS) Net Margin Falls to 5.1% on $111.9M Loss, Testing Growth Narrative

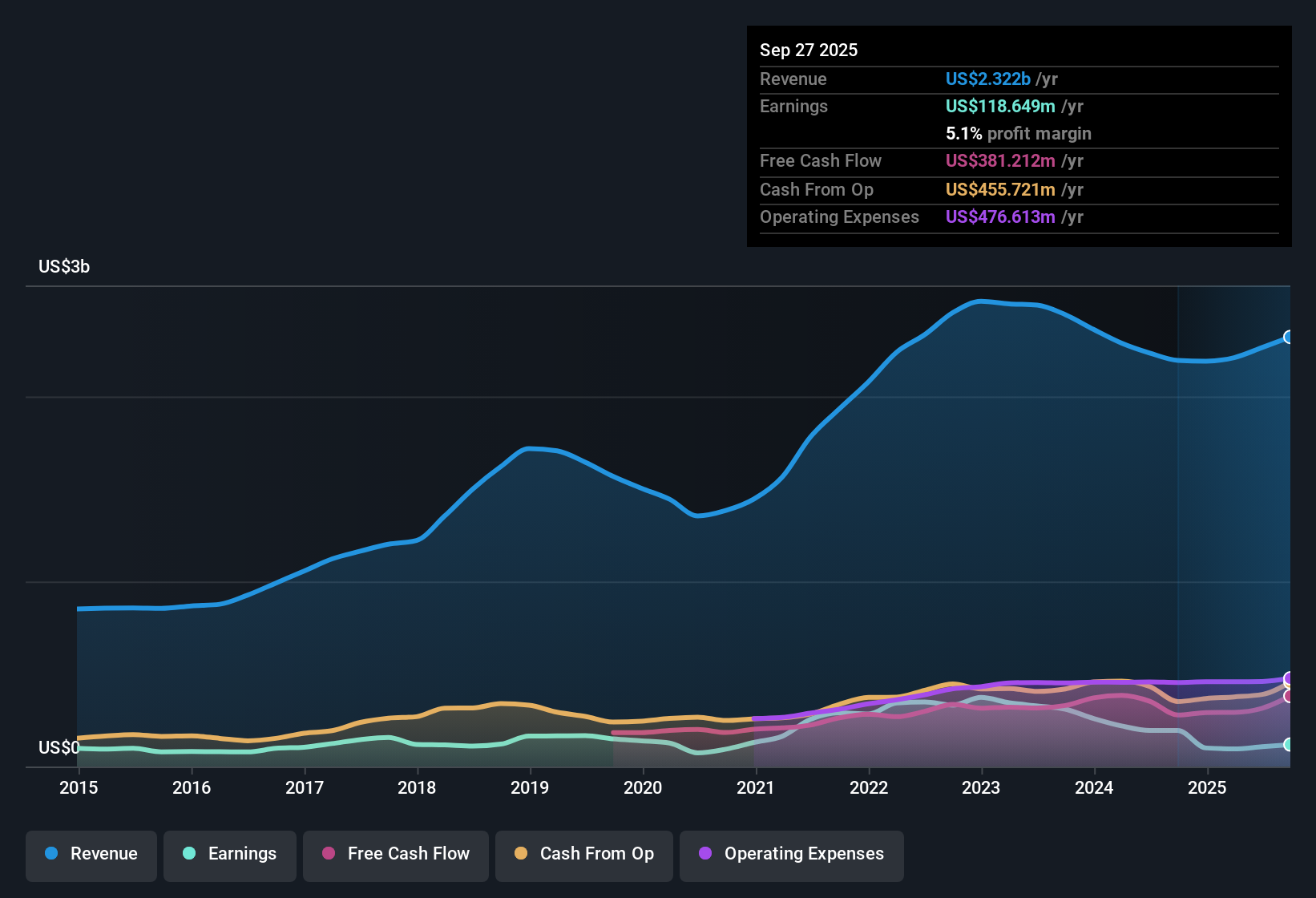

Littelfuse (LFUS) posted a net profit margin of 5.1% for the period ending September 27, 2025, down from 8.9% a year ago, impacted by a one-off loss of $111.9 million. Over the past five years, earnings have declined by 7.6% per year. Looking ahead, revenue is expected to grow at 7.7% per year and EPS at 22.7% per year, outpacing broader US market earnings forecasts. With the stock currently trading below estimated fair value, investors will be closely watching whether Littelfuse can deliver on these ambitious growth expectations despite recent profitability pressures.

See our full analysis for Littelfuse.Next, we’ll see how these headline numbers compare with the dominant narratives around Littelfuse and whether any expectations may be challenged by the latest results.

See what the community is saying about Littelfuse

Margins Hit by One-Off Loss

- The latest $111.9 million one-off loss drove net profit margin down to 5.1%, a notable drop from last year's 8.9% and well below the 13.8% margin level analysts hope Littelfuse will reach by 2028.

- According to the analysts' consensus view, this margin setback challenges expectations of steady profit improvement. At the same time, operational efficiency initiatives and segment margin expansion in transportation and industrial suggest potential for future recovery.

- The company’s margin trajectory now depends heavily on how quickly these cost initiatives can offset current pressures.

- Consensus narrative points out that market share gains in electric vehicles and grid infrastructure are critical to beating the margin targets embedded in price forecasts.

Premium Valuation vs. Peers

- Littelfuse's price-to-earnings ratio stands at 50.7x, significantly higher than the US electronic industry average of 25.7x and peer average of 39.2x. Yet, the share price of $242.83 trades at a discount to the DCF fair value of $282.93 and analyst price target of 303.75.

- Analysts' consensus view argues that investors are pricing in rapid earnings growth to justify the premium. The stock’s DCF fair value implies upside, but realization depends on achieving projected growth and margin expansion.

- If Littelfuse falls short of the expected $400.8 million in earnings and 13.8% margin by 2028, a rerating closer to industry PE multiples could erase the current valuation gap.

- The tension between premium multiples and current operational headwinds means any shortfall in earnings could lead to sharper price corrections compared to less expensive peers.

Growth Forecast Exceeds Market Average

- While revenue is forecast to grow at 7.7% annually based on EDGAR summary, the company’s projected 22.7% per year earnings growth rate outpaces the broader US market’s 15.7% forecast. This reflects strong expectations for scaling up profitability.

- Analysts' consensus view credits this bullish outlook to Littelfuse's exposure to booming electrification, renewable energy demand, and high-value markets, but warns that failure to capture emerging technology trends or integrate new acquisitions could put future growth at risk.

- Opportunities in grid infrastructure, electric vehicles, and sustainable energy sectors offer real pipeline for revenue and margin gains if seized successfully.

- The consensus narrative cautions that ongoing weakness in power semiconductors or missed integration targets could quickly undermine the high growth estimates currently priced in.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Littelfuse on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own angle on these results? Craft your perspective and share your take in just a few minutes: Do it your way

A great starting point for your Littelfuse research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite impressive growth forecasts, Littelfuse faces uncertainty over its ability to deliver consistent profit margins and maintain premium valuation multiples in the face of operational headwinds.

If steady financial performance is a priority, use our stable growth stocks screener ( results) to discover companies with reliable track records and predictable growth even when challenges arise.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal