Can Kingsford's "Slow Burn" Campaign Reveal Clorox's (CLX) Strategy for Consumer Loyalty Amid Frugality?

- Kingsford, a Clorox brand, recently partnered with football legend Jason Kelce to launch "Slow Burn," a limited-edition fragrance inspired by the aromas of grilling, available exclusively on Kingsford's website starting November 3, 2025.

- This collaboration highlights Clorox's push for innovative brand experiences, even as frugal consumer habits and demand for defensive, dividend-paying companies shift the consumer products landscape.

- We'll examine how Clorox's Kingsford innovation shapes expectations for growth and resilience amidst changing consumer spending patterns.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Clorox Investment Narrative Recap

To be a shareholder in Clorox, you need to believe in the company's ability to remain resilient and grow in a challenging environment where consumer spending is shifting toward value and essentials. While the Kingsford "Slow Burn" fragrance launch is an attention-grabbing innovation, it is unlikely to offset the near-term pressures from heightened price competition and cautious consumer behavior, these remain the most important short-term catalyst and risk, respectively.

One of the most relevant recent announcements is Clorox's guidance for fiscal 2026, where management expects a 6% to 10% decline in net sales, primarily due to ERP transition and divestitures. This sets a cautious tone for the coming quarters, reinforcing the need to monitor how brand-driven innovations contribute to regaining momentum as these operational headwinds play out.

But despite eye-catching launches, investors should be aware that intensified promotional activity and private label competition in categories like Glad and Cat Litter could...

Read the full narrative on Clorox (it's free!)

Clorox's outlook projects $7.0 billion in revenue and $881.8 million in earnings by 2028. This implies a 0.4% annual decline in revenue and a $71.8 million increase in earnings from the current $810.0 million.

Uncover how Clorox's forecasts yield a $129.88 fair value, a 17% upside to its current price.

Exploring Other Perspectives

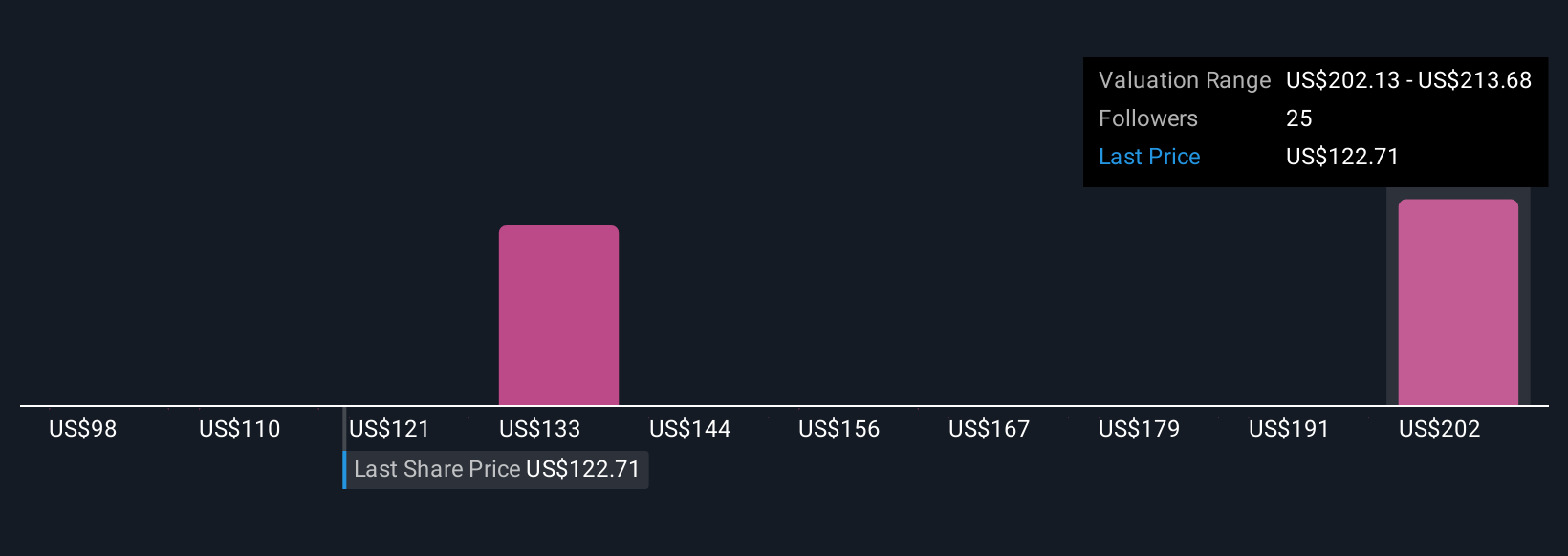

Six recent fair value estimates from the Simply Wall St Community span from US$98.22 to US$213.68 per share, revealing wide-ranging views about Clorox's future prospects. With category growth still sluggish and consumer habits changing rapidly, you should explore these varied perspectives to better understand the full picture.

Explore 6 other fair value estimates on Clorox - why the stock might be worth as much as 93% more than the current price!

Build Your Own Clorox Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clorox research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clorox research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clorox's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal