Sensata Technologies (ST): Losses Worsen, but Forecasts Call for 40% Annual Earnings Growth Ahead

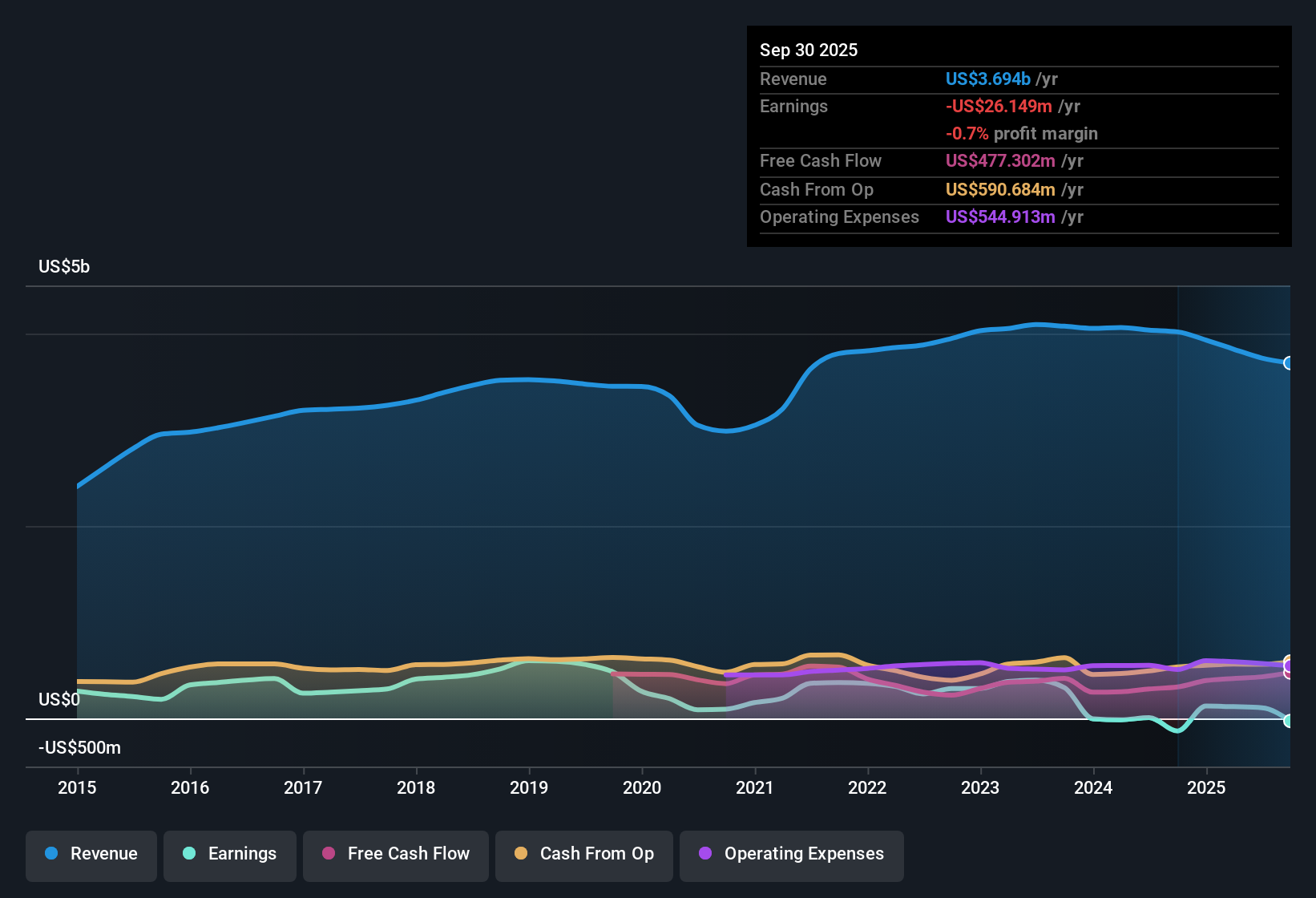

Sensata Technologies Holding (ST) remains unprofitable, with annual losses accelerating by 26.9% per year over the past five years. Despite these steady setbacks, forecasts point to a sharp turnaround, with earnings expected to climb 40.35% per year and the company anticipated to reach profitability within three years. This performance is expected to outperform the broader market’s typical growth. Revenue is projected to grow at 4% per year, but this lags behind the US market’s 10.2% benchmark. Investors are prompted to weigh Sensata’s attractive Price-To-Sales ratio of 1.3x and pricing below estimated fair value against ongoing financial and sustainability risks.

See our full analysis for Sensata Technologies Holding.Now, let’s see how these latest figures measure up against the main narratives in the market. The next section puts Sensata’s numbers head-to-head with what investors are really saying.

See what the community is saying about Sensata Technologies Holding

Profit Margins Projected to Quadruple by 2028

- Sensata's profit margins are expected to rise sharply, from 3.0% today to 11.9% over the next three years, outpacing margin trends typical in the US electrical industry.

- According to the analysts' consensus view, significant growth is projected as higher-margin specialty sensing products and regulatory trends support an improved mix.

- The consensus highlights that profit margins could nearly quadruple, fueled by scaling regulatory-driven solutions across industrial and automotive markets.

- This forecasted improvement assumes that operational initiatives will also continue to strengthen gross margin and free cash flow, supporting Sensata’s margin expansion plans despite volatile end markets.

- Consensus narrative underscores how stabilizing earnings through diversified end markets, including grid hardening and non-automotive sectors, gives Sensata resilience to industry cyclicality and provides cushion for sustained margin improvement.

- If margin improvements keep pace with these projections, Sensata’s shift to profitability could accelerate, lending credibility to upbeat market expectations.

- Recent numbers bolster the case for robust margin expansion over the next three years. See why analysts think this could fundamentally reshape Sensata's valuation compared to peers. 📊 Read the full Sensata Technologies Holding Consensus Narrative.

Debt Leverage Flags Financial Flexibility Concerns

- Sensata’s net leverage stands at 3.0x trailing 12-month EBITDA, with elevated debt levels likely to constrain capital allocation in the near term.

- Critics highlight that such elevated leverage could become a significant headwind, especially if high rates or macro uncertainty persist, and this could limit Sensata’s flexibility to fund growth, dividends, or new initiatives.

- Potential increases in interest expense or reductions in cash flow conversion could weigh on both future earnings and net margins.

- The consensus view warns that persistent supply chain or geopolitical risks, especially relating to China operations, could amplify these financial pressures and raise the risk of operational disruptions or unexpected costs.

Valuation Points to Discounted Opportunity Versus Peers

- At a Price-to-Sales ratio of 1.3x, Sensata trades well below the peer group average of 4.7x and the US electrical industry’s norm of 2.5x, and below its own DCF fair value of $39.96 with a current share price of $32.64.

- Consensus narrative notes that, while current pricing offers a clear discount to fair value and analyst targets ($38.87), this upside is only compelling if robust earnings and margin expansion materialize as forecast.

- The market appears to have baked in caution around ongoing unprofitability and financial sustainability risks, but also leaves room for re-rating if the anticipated turnaround gains traction.

- Lower expected outstanding shares over the next three years could additionally support per-share value if operational and revenue targets are hit.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sensata Technologies Holding on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a unique take on the latest numbers? Share your insight and shape your own story in just minutes with Do it your way.

A great starting point for your Sensata Technologies Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Sensata’s high debt load and limited financial flexibility could present risks if macro uncertainty persists or cash flow weakens.

If you want to prioritize financial strength, use our solid balance sheet and fundamentals stocks screener (1988 results) to discover companies with stronger balance sheets and better resilience in uncertain markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal