BorgWarner (BWA): Evaluating Valuation After Q3 Beat and Upgraded 2025 Guidance

BorgWarner (BWA) delivered some fresh numbers that caught investor attention, as it topped third-quarter profit forecasts and tightened its sales outlook for 2025 after raising its margin, EPS, and cash flow guidance.

See our latest analysis for BorgWarner.

While BorgWarner’s latest results and upbeat 2025 outlook grabbed headlines, the stock’s momentum has been steadily building for much of the year. Its 36.8% year-to-date share price return and nearly 30% total shareholder return over the last twelve months suggest that investors have grown more optimistic, especially as new contracts in electrified propulsion and advanced AWD systems reinforce expectations for future growth.

If recent developments in the auto sector have you interested, now is a smart time to explore what is happening with other manufacturers via our hand-picked See the full list for free.

Yet with shares already delivering strong returns and the outlook now brighter, the question remains: is BorgWarner's current valuation underestimating the company’s growth potential, or have markets already priced in these ambitious expectations?

Most Popular Narrative: 8.9% Undervalued

BorgWarner closed at $42.83, while the most popular narrative assigns a fair value of $47. This positions the stock at a moderate discount, reflecting potential optimism about the company's forward momentum in electrified auto components.

Expanding platform wins, particularly with major Chinese OEMs for inverters, electric motors, and differential technologies, reflect deeper integration into next-generation EV architectures and can drive higher content per vehicle. This can strengthen long-term earnings visibility through recurring, higher-margin supply contracts.

Curious about the catalysts underpinning that higher fair value? Unlock the narrative's bold revenue and profit forecasts that could redefine how the market views BorgWarner's margin potential. There’s a quant-driven story here you won’t want to miss.

Result: Fair Value of $47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on combustion product lines and ongoing volatility in the battery and charging segment remain potential hurdles to BorgWarner’s growth story.

Find out about the key risks to this BorgWarner narrative.

Another View: Earnings Multiple Puts Price in a Different Light

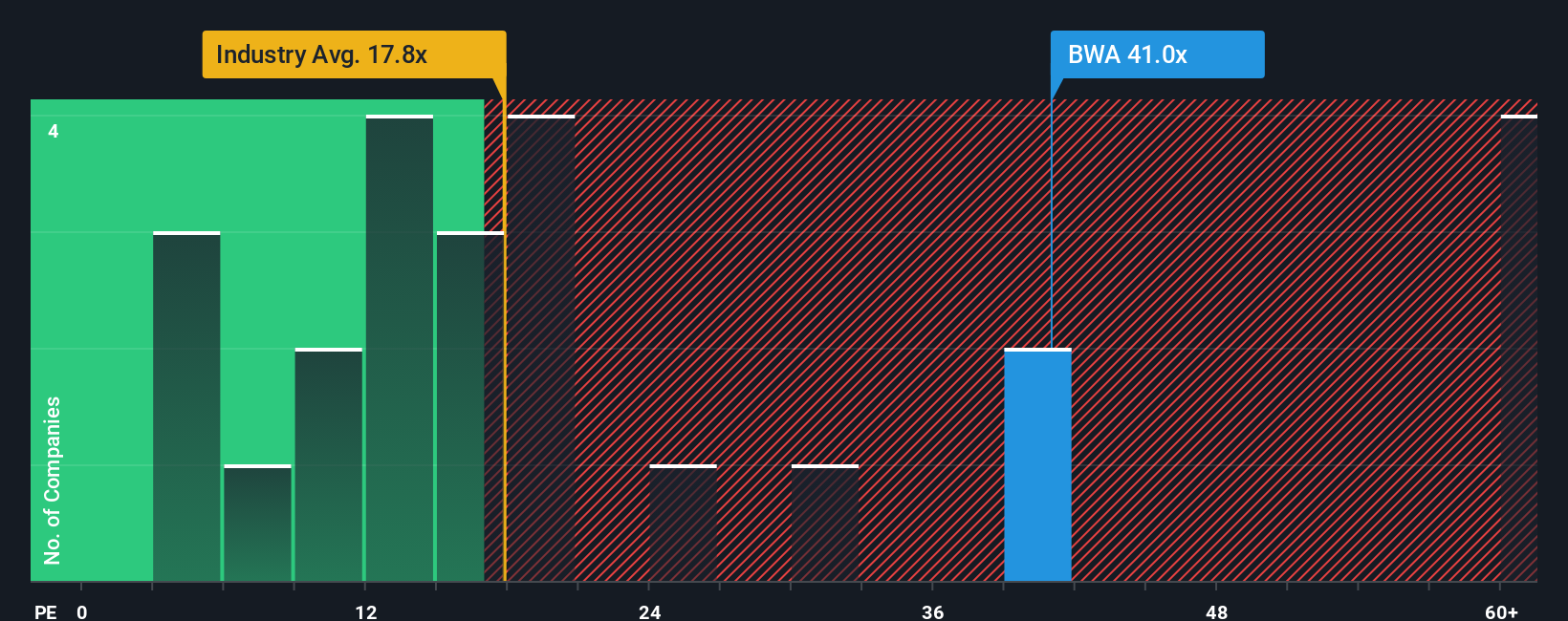

Looking at BorgWarner's valuation through its price-to-earnings ratio presents a more cautious picture. Shares trade at 42.1 times earnings, well above the US Auto Components industry’s 18.6 and the peer average of 20.3. Even compared to the fair ratio of 16.4, the stock looks expensive, which raises questions about how much future growth is already factored in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BorgWarner Narrative

If you see things differently, or want to dive into the numbers on your own terms, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your BorgWarner research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Investing Opportunities?

Don’t limit your strategy to just one company. Give yourself the edge by checking out curated stock lists and spot tomorrow’s leaders before everyone else does.

- Cement your portfolio’s foundation by tapping into stable cash flows and long-term potential with these 849 undervalued stocks based on cash flows.

- Ride the momentum of healthcare innovation and advanced data science as you scan these 34 healthcare AI stocks.

- Target untapped potential and rapid growth by searching through these 3584 penny stocks with strong financials, which are reshaping their industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal