One-off Loss Drives Materion (MTRN) Margin Drop, Undermining Bullish Turnaround Narratives

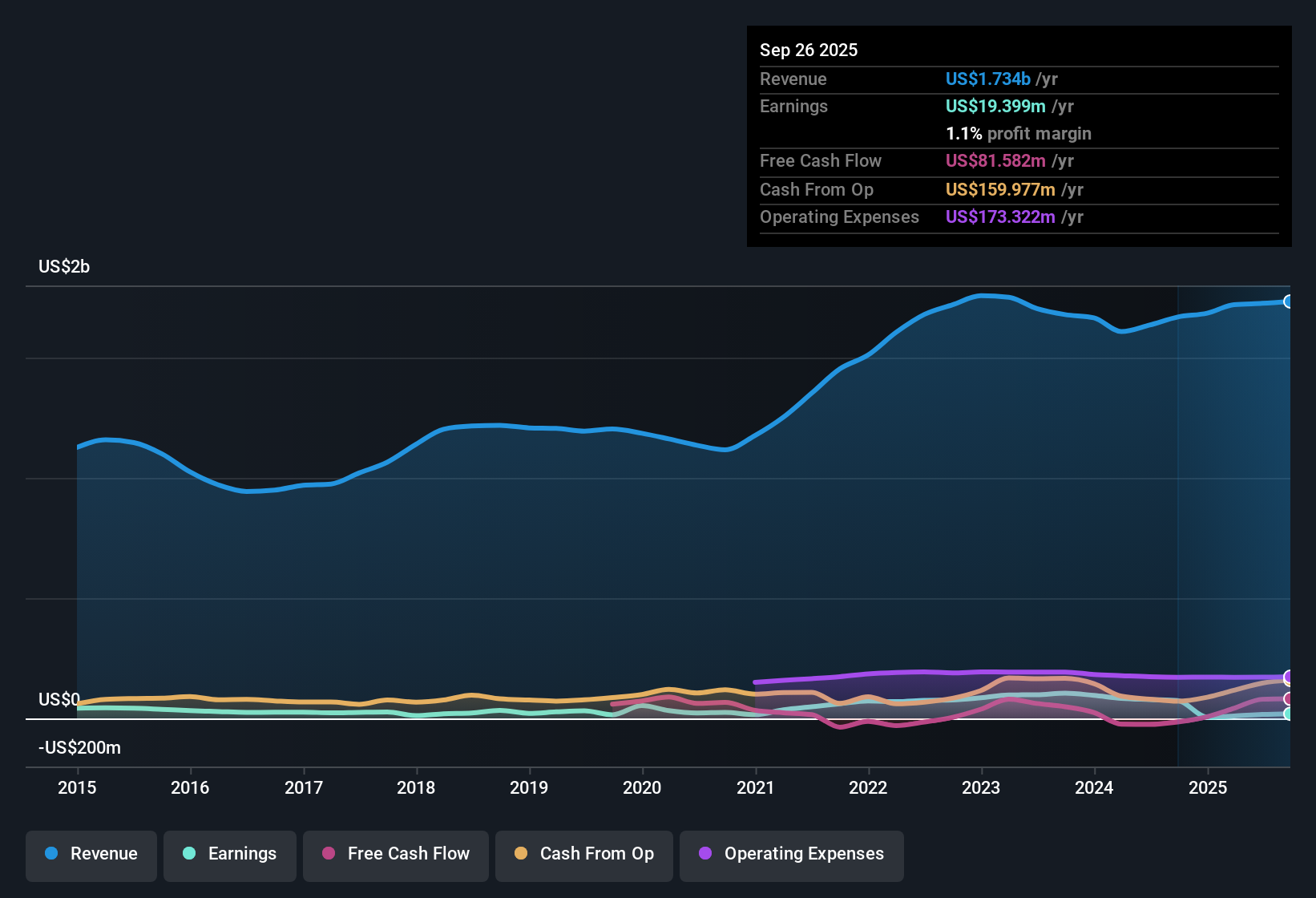

Materion (MTRN) reported revenue growth forecasts of 7.6% per year, which lags the broader US market's 10.2% yearly pace. Net profit margins fell to 0.9% from 4.8% in the prior year. The company’s earnings were also affected by a one-off $84.3 million loss. Recent results show negative earnings growth compared to the prior period, despite a five-year average growth rate of 1.6% annually. With profitability under pressure, investors are weighing the outlook as Materion trades below fair value on some estimates but remains expensive by traditional earnings multiples.

See our full analysis for Materion.Next, we will see how this latest batch of numbers holds up against the dominant narratives shaping discussion around Materion’s outlook. Some expectations could be validated while others may face a reality check.

See what the community is saying about Materion

Margins Projected to Jump Over 16%

- Analysts forecast Materion’s profit margins rising from 0.9% today to 16.7% within three years, which would be a significant improvement if achieved.

- According to the analysts' consensus view, this expected margin growth is anchored by

- record-high EBITDA margins seen in Electronic Materials, attributed to operational efficiencies and a stronger, value-added product mix, and

- management’s guidance for continued year-over-year margin expansion as volumes recover in semiconductor and electronics markets.

- Analysts also expect earnings to climb from $16.3 million now to $355.2 million by 2028, reflecting agreement among analysts on a substantial turnaround. This projection strongly supports the consensus case for long-term earnings growth, provided new capacity ramps as planned.

See the bigger picture for Materion in the full consensus narrative: 📊 Read the full Materion Consensus Narrative.

Valuation Signals: DCF Discount But Lofty PE

- The current share price of $116.12 sits well below the DCF fair value of $192.47, indicating a meaningful discount on discounted cash flow metrics. However, the 139.6x PE ratio remains far higher than the sector average of 22.5x.

- Analysts' consensus view recognizes this mixed message. While Materion appears attractive based on DCF analysis, bulls must have confidence in a steep margin turnaround and major earnings growth to justify today's valuation, especially since the share price already anticipates significant upside.

- For the current share price to align with analysts' projections, Materion would need to trade at just 8.8x forward earnings by 2028, representing a substantial drop from today’s PE.

- This suggests the story ultimately depends on the company’s ability to deliver on margin expansion and large-scale profit gains, instead of short-term price movements.

One-off Losses Skewed Short-term Profits

- Materion reported an $84.3 million one-off loss, which sharply distorted net income and profit margins in the last period.

- In the analysts' consensus view, the current low margin should be seen as a result of these non-recurring charges rather than a sign of permanent earnings weakness.

- Consensus argues that with cost improvements and volumes normalizing, profit margins should rebound sharply in future reporting periods.

- This perspective directly addresses concerns that recent margin compression is structural rather than temporary.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Materion on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the results? You can craft your own narrative and share your insights in just a few minutes. Do it your way

A great starting point for your Materion research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Materion’s weak near-term profitability, high PE, and reliance on margin expansion make its growth outlook riskier compared to peers that consistently expand.

If steady gains and fewer surprises are your priority, use our stable growth stocks screener (2121 results) to spot companies consistently delivering reliable growth through shifts in the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal