Does Moody’s (MCO) Aggressive Buybacks Reveal New Priorities for Its Capital Allocation Strategy?

- Moody's Corporation recently reported its third-quarter 2025 results, recording US$2.01 billion in sales and US$646 million in net income, both higher than the prior year, and affirmed its quarterly dividend while continuing share repurchases.

- An interesting development is Moody's ongoing investment in its share buyback program, having retired nearly 7% of its shares since 2020, which can have long-term effects on earnings per share and shareholder returns.

- We'll explore how Moody's strong sales and earnings growth this quarter inform its broader investment narrative amid ongoing buyback activity.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Moody's Investment Narrative Recap

Owning shares in Moody's often comes down to believing in the continued demand for independent credit ratings and advanced analytics, especially as private credit markets grow and regulatory scrutiny increases. The latest strong quarterly results reinforce the company’s earnings stability, but the most immediate catalyst, ongoing growth in private credit, remains unchanged, while the biggest risk continues to be heightened regulation, neither materially affected by this news cycle.

This quarter’s update on Moody’s share buyback program is especially relevant, given it has retired nearly 7% of its shares since 2020, which can influence earnings per share and bolster shareholder returns at a time when consistency in capital allocation matters to many investors. The additional US$511.94 million spent on buybacks last quarter shows a continued focus on returning value, aligning with recent trends in earnings and margins.

But in contrast to robust buybacks and profit growth, investors should be alert to the risk of increased regulatory focus on private credit, as...

Read the full narrative on Moody's (it's free!)

Moody's is projected to reach $9.0 billion in revenue and $3.0 billion in earnings by 2028. This outlook assumes a 7.3% annual revenue growth rate and a $0.9 billion increase in earnings from the current $2.1 billion.

Uncover how Moody's forecasts yield a $545.50 fair value, a 16% upside to its current price.

Exploring Other Perspectives

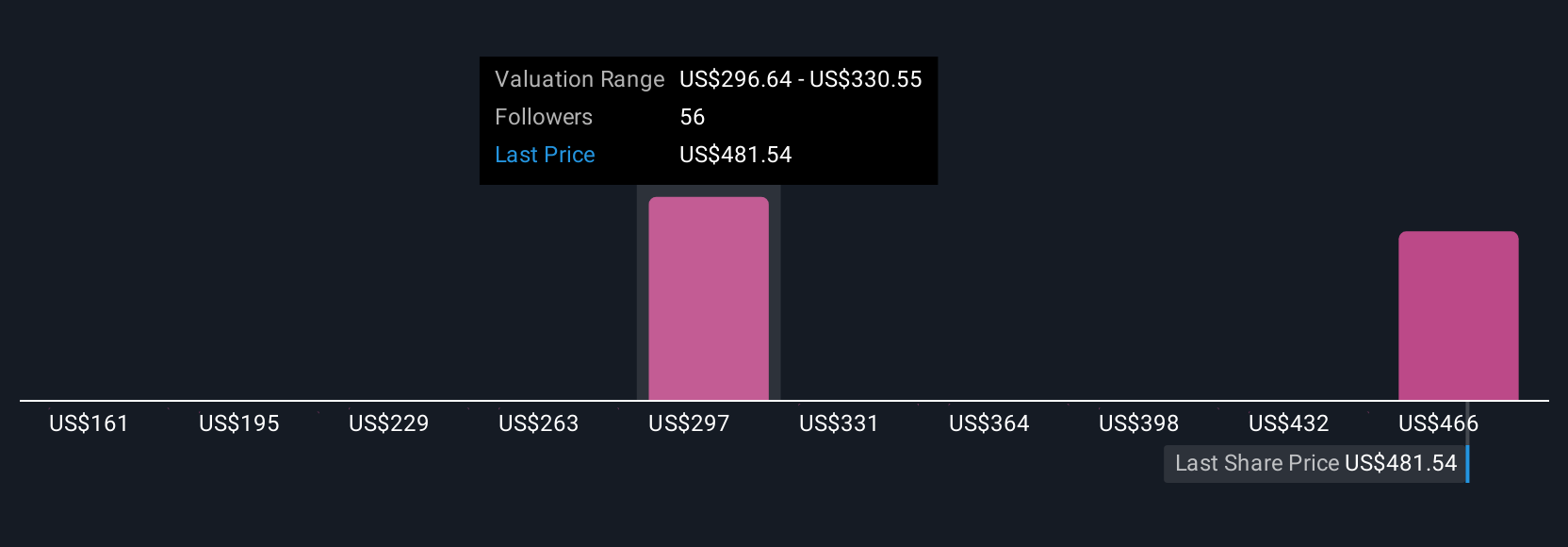

With nine independent fair value estimates from the Simply Wall St Community ranging from US$282.56 to US$545.50, you can see just how widely views on Moody’s valuation vary. As you consider these viewpoints, remember the company’s future may hinge on persistent regulatory attention in its fastest growing segments.

Explore 9 other fair value estimates on Moody's - why the stock might be worth as much as 16% more than the current price!

Build Your Own Moody's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moody's research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Moody's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moody's overall financial health at a glance.

No Opportunity In Moody's?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal