Assessing Modine Manufacturing (MOD) Valuation After Strong Recent Share Price Gains

See our latest analysis for Modine Manufacturing.

Momentum has clearly been building for Modine Manufacturing. After a string of upbeat sessions, the stock price has climbed nearly 10% in the past month and delivered a 33.7% year-to-date share price return. Its three-year total shareholder return sits at a remarkable 822%. That kind of performance points to renewed optimism about the company’s growth potential and a shift in how investors are assessing risk and reward at current valuation levels.

If you’re interested in what else might be gaining traction in this space, it could be the perfect moment to broaden your search and discover See the full list for free.

After such a strong run, the key question now is whether Modine Manufacturing shares still have room to climb or if all that future growth is already reflected in the current price. This could leave little on the table for new buyers.

Most Popular Narrative: 10.8% Undervalued

With Modine Manufacturing's fair value estimated at $174, almost $19 above the last close, many investors are watching to see if price momentum continues. The most widely followed narrative highlights several fundamental drivers that could shape where the stock heads next.

The accelerating build-out of data centers and the need for next-generation cooling solutions are driving extraordinary demand for Modine's products, with management forecasting the potential to double data center revenues from approximately $1 billion in fiscal '26 to $2 billion by fiscal '28. This structural demand from digital infrastructure is set to materially boost revenue growth and deliver significant operating leverage over time.

Curious what ambitious forecasts underpin that fair value? Analysts see margins and earnings jumping to levels rarely found outside of high-growth tech, with projections that have surprised even seasoned industry watchers. The full narrative breaks down these big calls—dare to see if you agree?

Result: Fair Value of $174 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration challenges from recent acquisitions and the risk of slower data center demand could temper Modine's ambitious outlook in the years ahead.

Find out about the key risks to this Modine Manufacturing narrative.

Another View: Are Shares Really a Bargain?

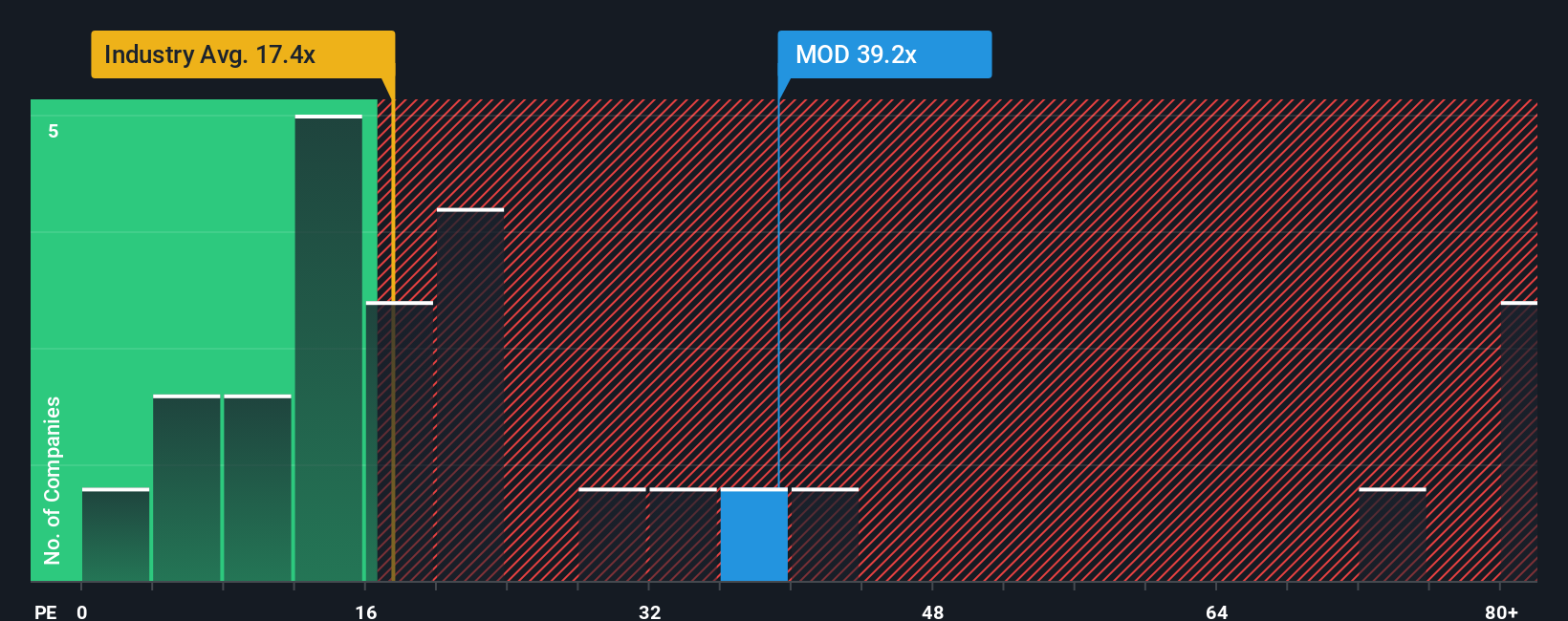

Looking from a different angle, Modine Manufacturing trades on an earnings ratio of 43.8 times, which is notably higher than both its industry peers at 18.9 times and the fair ratio of 31.4 times our model estimates the market could shift toward. This premium suggests that investors are paying up for growth, but it also brings higher valuation risk. Are the expectations already priced in, or does the growth story have more to run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Modine Manufacturing Narrative

If you want to check the numbers for yourself or add your own insight to the mix, you can easily craft a personalized perspective in just a few minutes. Do it your way

A great starting point for your Modine Manufacturing research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Opportunities?

Opportunities move quickly, and you deserve an edge. Simply Wall Street's tools make it easy to spot exceptional stocks positioned for long-term growth and value. Don't settle for just one great idea when you can unlock more smart choices in minutes.

- Uncover high-yield potential and supplement your income stream by reviewing these 21 dividend stocks with yields > 3% that meet strict cash flow and payout criteria.

- Capitalize on the surge in artificial intelligence with these 26 AI penny stocks poised to benefit from automation, machine learning, and disruptive software advances.

- Get ahead of the crowd and pinpoint undervalued opportunities using these 854 undervalued stocks based on cash flows crafted to spotlight companies trading below their intrinsic worth based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal