IQVIA (IQV) Margin Decline Reinforces Profitability Concerns Despite Attractive Valuation

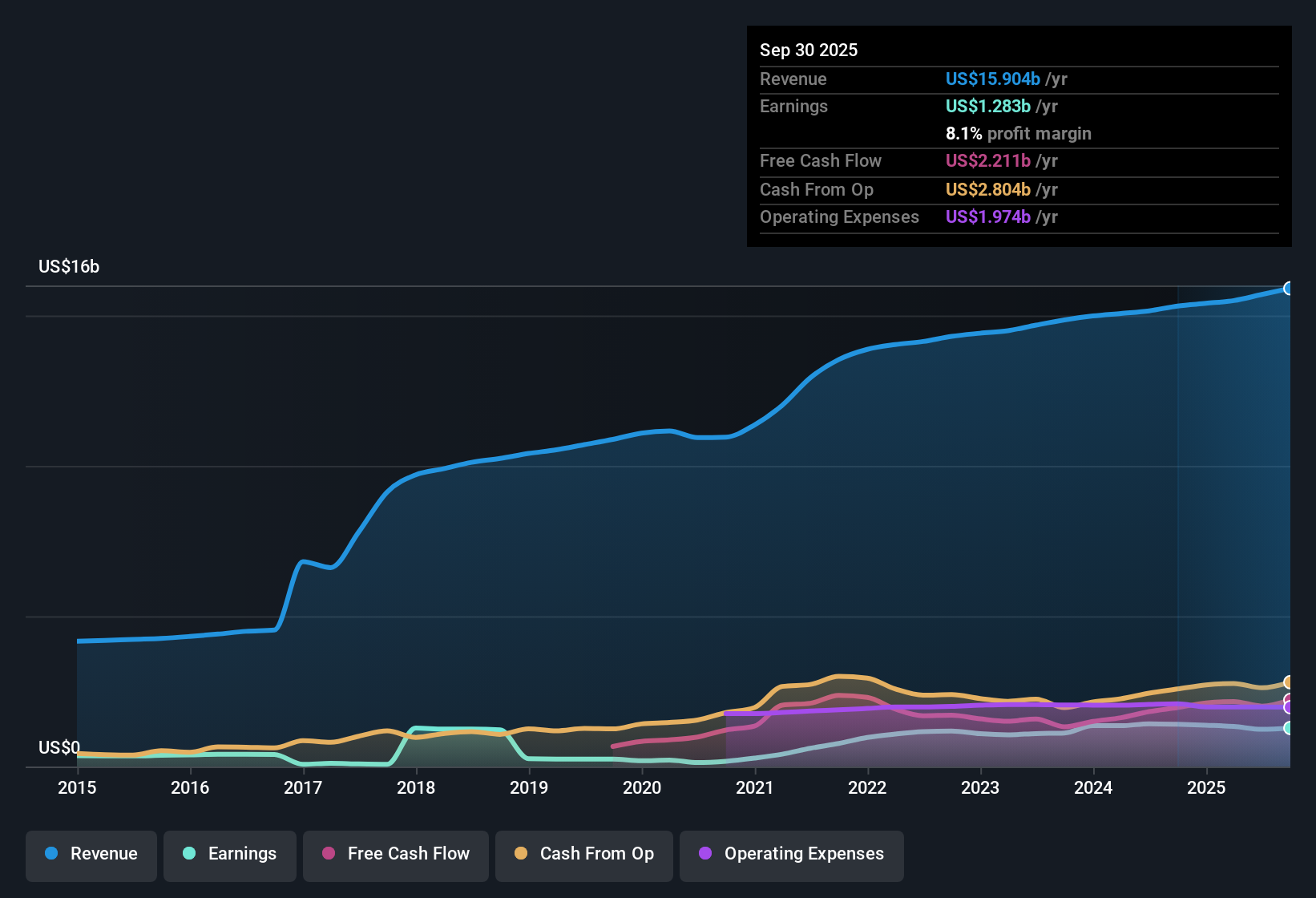

IQVIA Holdings (IQV) reported net profit margins of 8.1%, down from 9.2% last year, with last year’s earnings growth turning negative despite a five-year average earnings growth rate of 20.1% per year. Looking ahead, analysts forecast that earnings will grow at 13.99% per year and revenue at 5.3% annually, both of which are slower than the broader US market. For investors, that mixed results picture is complicated further by valuation measures suggesting the stock is attractively priced compared to industry averages and internal fair value estimates.

See our full analysis for IQVIA Holdings.Next, we compare these headline numbers to the widely discussed narratives to see which market stories hold up and where the latest results could change sentiment.

See what the community is saying about IQVIA Holdings

AI Partnerships and Platforms Propel Competitive Edge

- IQVIA has accelerated its adoption of AI-driven analytics and proprietary platforms, supported by strategic partnerships such as its work with NVIDIA. This enables faster project execution and operational efficiency, which differentiates it in a crowded marketplace.

- According to the analysts' consensus view, these technology investments create high switching costs and competitive barriers:

- They expand the company’s backlog and visibility for long-term revenue streams as seen in multi-year contracts and industry recognition,

- and help offset some of the margin pressure noted from the recent decline to 8.1% net profit margin.

- The consensus narrative highlights that while technology-driven gains are boosting efficiencies and backlog, IQVIA’s forecasted annual earnings growth of 13.99% and revenue growth of 5.3% remain slower than US market averages. This supports moderate but resilient expansion.

- For the full breakdown on how the consensus outlook aligns with IQVIA’s technology and backlog momentum, see the latest deep-dive. 📊 Read the full IQVIA Holdings Consensus Narrative.

Margin Recovery Faces Industry Headwinds

- Net profit margins declined from 9.2% to 8.1% amid ongoing margin pressures, intensified competition in the contract research organization segment, and a business mix shift toward lower-margin offerings like real-world evidence.

- Bears argue that rising competition and persistent pricing pressure, along with high debt levels (with a net leverage ratio of 3.61x adjusted EBITDA):

- This may limit IQVIA’s ability to recover margins and invest for long-term growth, and

- regulatory uncertainty could further slow down client decision-making, putting additional pressure on revenue visibility and earnings power.

Valuation Discount Versus Peers and DCF Fair Value

- IQVIA trades at a price-to-earnings ratio of 28.9x, notably lower than the peer average (35.1x) and well below its DCF fair value of $326.02 per share. With its actual trading price at $217.83, this indicates a substantial discount on both industry and intrinsic value bases.

- Analysts' consensus view notes this valuation gap is compelling for value-focused investors:

- This is especially true considering the company’s forecast earnings growth and backlog visibility,

- yet with projected future PE ratios (21.1x by 2028) falling under current industry benchmarks, the moderate growth outlook keeps expectations in check for a full re-rating.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for IQVIA Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Take just a few minutes to turn your insights into a unique perspective. Do it your way

A great starting point for your IQVIA Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

IQVIA’s declining net profit margins, slower growth forecasts, and elevated debt suggest challenges with both profitability and financial resilience in a competitive sector.

If you want businesses with stronger fundamentals and healthier balance sheets, focus your search on solid balance sheet and fundamentals stocks screener (1980 results) to spot companies better positioned for consistent performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal