Assessing Littelfuse (LFUS) Valuation After Recent Share Price Momentum

See our latest analysis for Littelfuse.

Littelfuse has seen a bit of volatility this year, with its share price recently easing after a sharp run-up earlier in 2024. Even so, the 11.86% year-to-date share price return stands out, and the 2.54% total shareholder return over the past year hints that momentum is steady, though a little subdued compared to prior years.

If you’re keen to capitalize on fresh trends beyond the usual names, this is a great time to widen your search with our fast growing stocks with high insider ownership.

With the stock trading below analyst price targets and showing strong growth in both revenue and net income, is Littelfuse undervalued in the current market, or has future growth already been fully factored in?

Most Popular Narrative: 14.6% Undervalued

With the current fair value set $45 above the last close, the narrative sees material upside for Littelfuse at today's price levels. The popularity of this perspective stems from ambitious projections on both market opportunity and margin expansion. This creates a compelling scene for what is driving the valuation.

The rapid buildout of renewable energy infrastructure, grid storage, and sustainable grid ecosystems is resulting in double-digit sales growth and a robust opportunity pipeline for Littelfuse. This positions the company to benefit from continued secular tailwinds and expands its addressable market, which should positively impact both revenues and margins.

Which financial bets justify this bullish take? The most closely watched narrative subtly hinges its optimism on future margins and long-term top-line acceleration, but the underlying projections go far beyond conventional market averages. Could analyst expectations for outsized growth and a steep drop in profit multiples hold up? Only a deep dive reveals the numbers fueling this double-digit upside call.

Result: Fair Value of $307.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing challenges in power semiconductors and rapid tech shifts could quickly change Littelfuse's outlook if demand trends reverse or if adaptation lags.

Find out about the key risks to this Littelfuse narrative.

Another View: What Do Multiples Say?

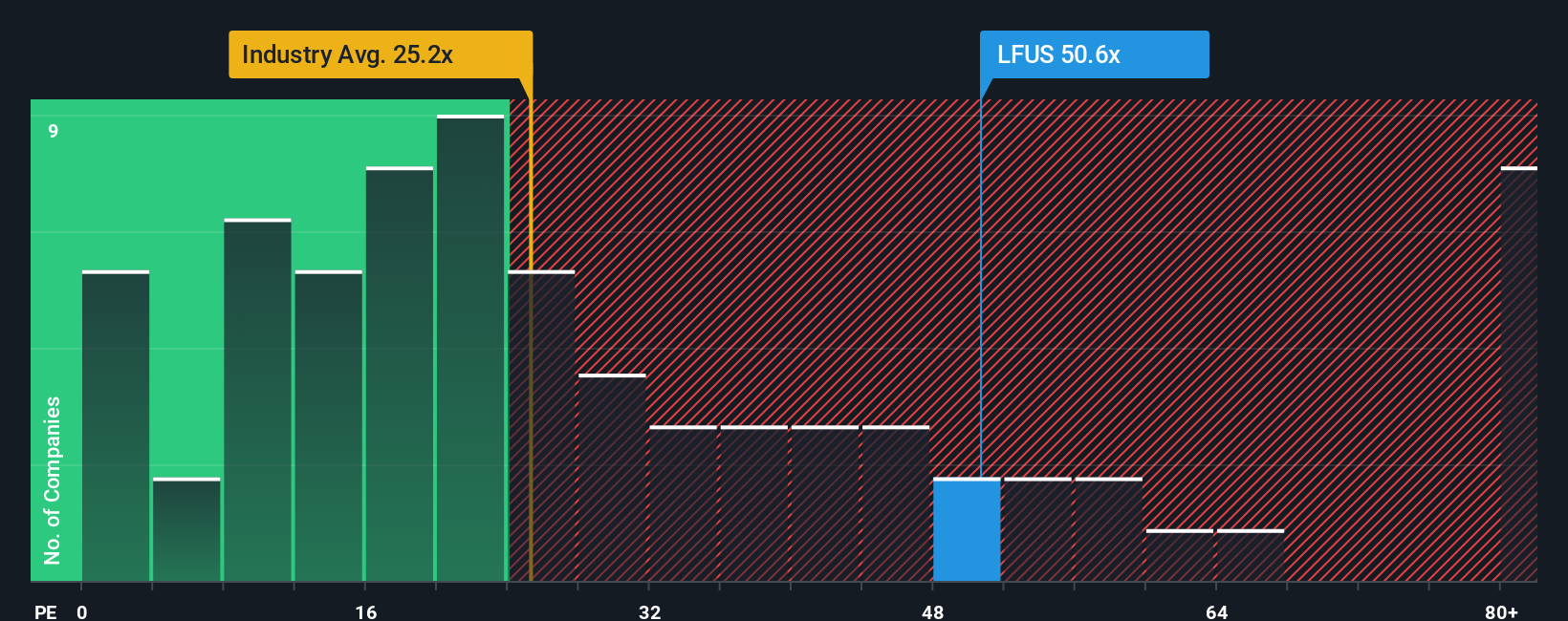

While the fair value model points to upside, looking at Littelfuse's price-to-earnings ratio shows a different story. The stock trades at 60.7x, which is much higher than both the US Electronic industry average of 25.9x and its peer average of 50.4x. Even compared to a fair ratio of 34.4x, Littelfuse appears quite expensive. This kind of gap can signal elevated expectations and valuation risk. Does the market see something special, or could it be overshooting?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Littelfuse Narrative

If you see things differently or want to dig into the numbers yourself, it takes just a few minutes to build your own view, your way. Do it your way.

A great starting point for your Littelfuse research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Even More Smart Investment Ideas?

Don't let great opportunities slip by while others step ahead. Gain an edge with the right tools for finding undervalued gems, sector leaders, and trendsetters. Let your next big win start here:

- Boost your income potential by targeting strong yields from these 21 dividend stocks with yields > 3%, tapping into companies delivering reliable cash returns.

- Capitalize on tomorrow’s tech with these 26 AI penny stocks, where automation and artificial intelligence are redefining what’s possible in the market.

- Spot hidden value quickly with these 866 undervalued stocks based on cash flows and seize the chance to buy quality businesses at attractive prices before they catch wider attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal