A Look at Keysight Technologies (KEYS) Valuation Following Recent Modest Share Price Gain

Keysight Technologies (KEYS) shares edged up 1% over the past day, showing modest movement even as the broader tech sector remained fairly subdued. For investors, the steady climb this month invites a closer look at the drivers behind recent sentiment.

See our latest analysis for Keysight Technologies.

Keysight’s latest share price move builds on a more gradual trend, with the stock notching a year-to-date share price return of 5.7%. While the pace has cooled after last year’s 9.5% total shareholder return, momentum remains constructive as investors weigh the company’s steady growth and shifting sector sentiment.

If you’re curious about where else momentum is building in tech, take the next step and check out the See the full list for free..

That leaves investors with a pressing question: is Keysight Technologies currently trading at an attractive valuation, or has the market already factored in all of the company’s future growth potential?

Most Popular Narrative: 9.4% Undervalued

With Keysight closing at $170.04 and the most popular narrative suggesting a fair value of $187.60, there is a notable gap between perception and potential upside. This sets the scene for the core argument underpinning the bullish expectations for the stock.

Early engagement and leadership in next-generation wireless technologies, such as ongoing 5G-Advanced deployments, direct-to-cell, non-terrestrial networks, and active participation in 6G research, position Keysight to capture significant share as new wireless standards roll out globally. This supports future revenue growth and a stable order outlook.

Want to know what is powering this ambitious outlook? Analysts are betting on compounding financial gains and a jump in margins usually reserved for industry giants. The full narrative uncovers the pivotal projections. See the figures that make or break this valuation.

Result: Fair Value of $187.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, newly announced tariffs and shifting demand for AI infrastructure could challenge Keysight’s margin expansion and earnings growth if not carefully managed.

Find out about the key risks to this Keysight Technologies narrative.

Another View: What Do Market Ratios Reveal?

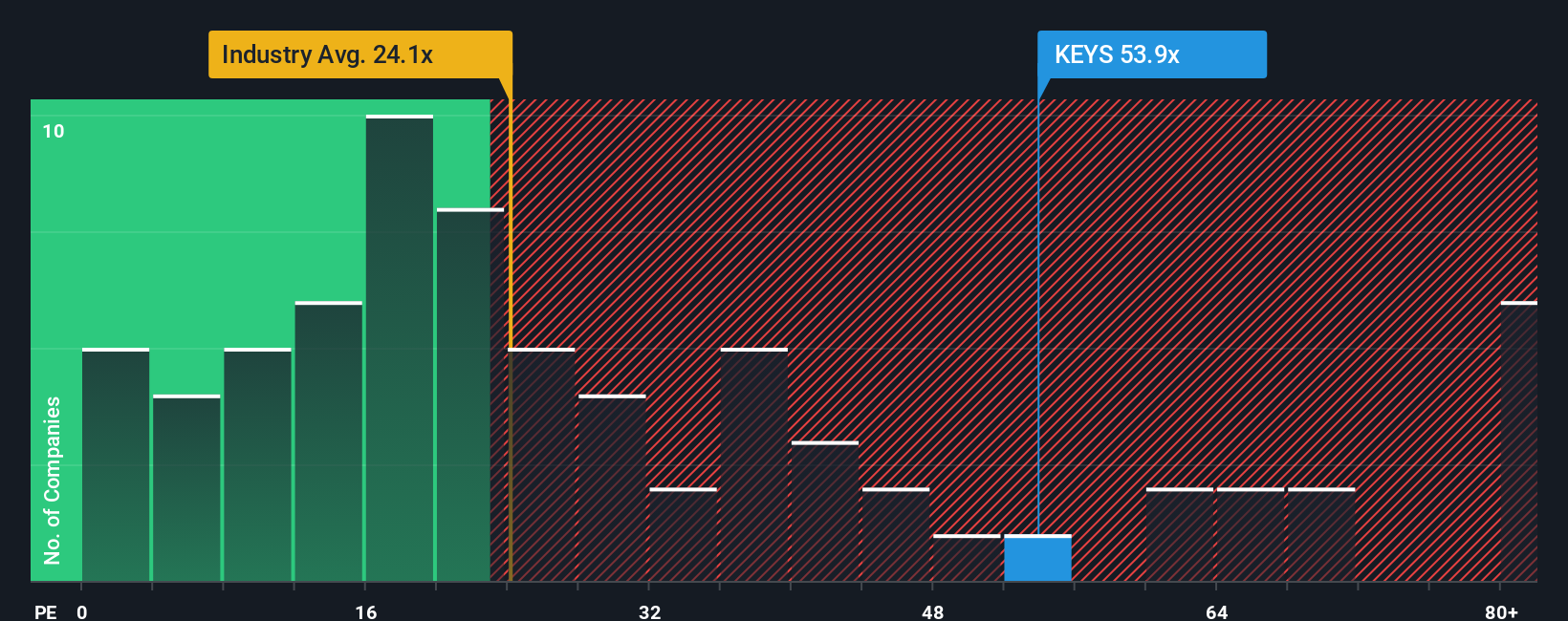

Looking beyond analyst forecasts, the market’s favored price-to-earnings ratio for Keysight tells a different story. The company’s P/E stands at 53.7x, much higher than both the US Electronic industry average of 25.9x and key peer averages. It also sits above the fair ratio of 33.1x, which the market may eventually move toward. This places Keysight at a valuation premium. Is this a risk or an opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Keysight Technologies Narrative

If you see the story differently or want to test your own ideas using the latest data, it takes less than three minutes to put your perspective to the test and Do it your way.

A great starting point for your Keysight Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Real opportunities go beyond the obvious picks. Give yourself the edge with these three promising investment approaches you simply should not overlook right now.

- Unearth the potential of tomorrow’s market leaders by starting your search with these 866 undervalued stocks based on cash flows, which are backed by robust financials and future-focused strategies.

- Tap into high-yield income streams as you weigh these 21 dividend stocks with yields > 3%, which deliver consistent returns above 3% and provide solid portfolio stability.

- Step into the world of technological breakthroughs by researching these 28 quantum computing stocks, which are driving innovation in advanced computing and redefining entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal