Autoliv (ALV) Delivers Strong Earnings and Buyback: What Does This Signal for Investors?

- Autoliv, Inc. announced in October 2025 that it reported strong third-quarter earnings with increased sales, higher net income, and improved earnings per share compared to the prior year, while also completing a €300 million fixed-income offering and a US$100 million share repurchase program.

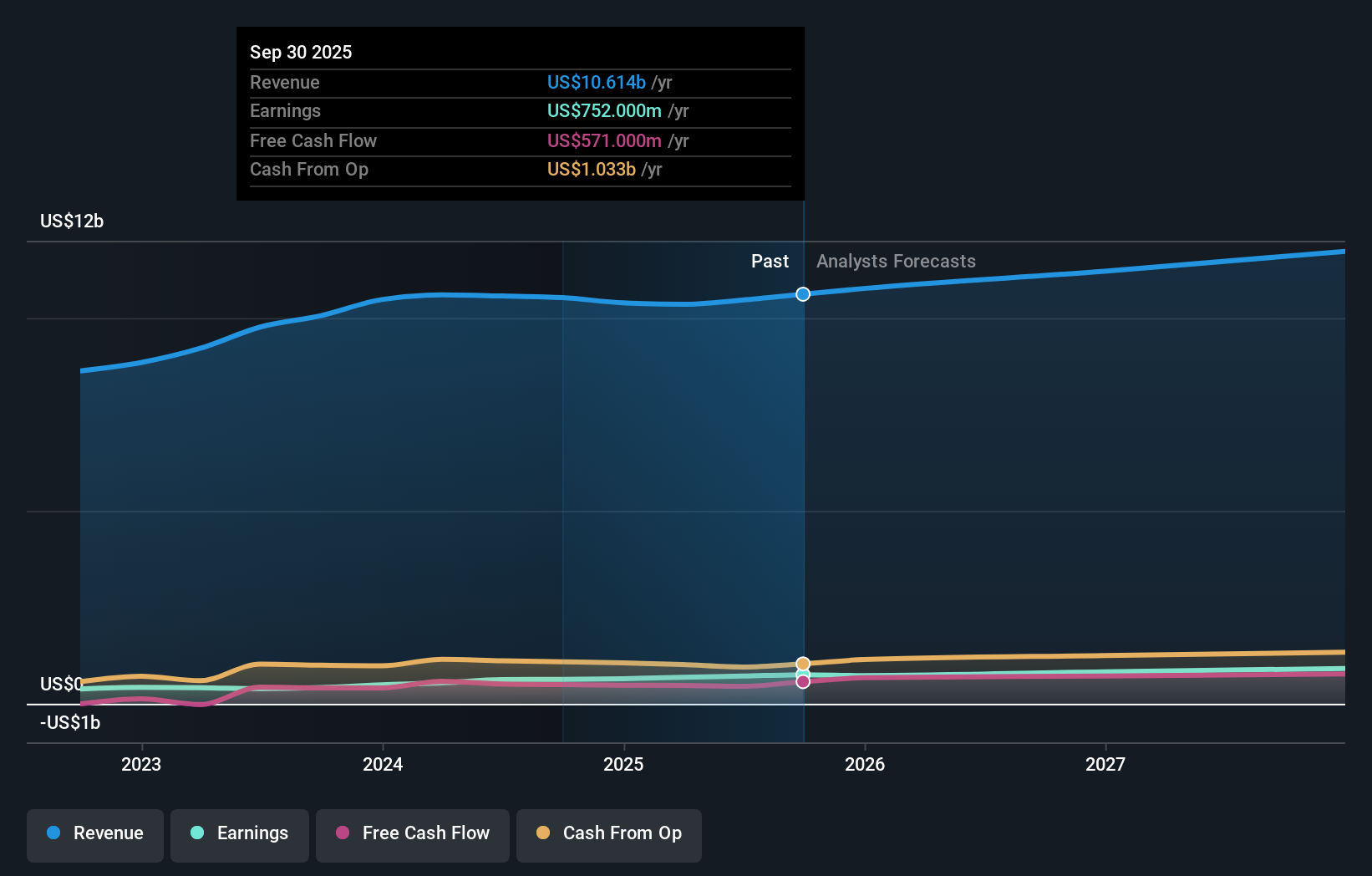

- The company reaffirmed its full-year 2025 financial guidance, expressing confidence in achieving its targeted operating margin and projecting operating cash flow of about US$1.2 billion.

- We'll examine how Autoliv’s earnings growth and steady outlook impact its investment narrative and future expectations for shareholders.

Find companies with promising cash flow potential yet trading below their fair value.

Autoliv Investment Narrative Recap

To invest in Autoliv, you need to believe in its ability to leverage global vehicle safety trends, maintain leadership in advanced restraint systems, and capitalize on strong relationships with automakers, especially in China. Recent earnings showcased growth in sales and profits, and while the completed €300 million fixed-income offering and share buyback support capital flexibility, they do not materially change the most important catalyst, sustained demand for safety content per vehicle, or address the biggest short-term risk: slowing light vehicle production in key global markets.

Among the recent updates, Autoliv's reaffirmed 2025 full-year guidance stands out. By maintaining its outlook for operating margin and operating cash flow, the company is signaling that current business momentum may be resilient even as sector volatility persists, which connects closely to confidence in regulatory-driven safety demand.

However, investors should be aware that, despite these positives, the risk of softening auto production and its effect on quarterly results is not fully behind Autoliv...

Read the full narrative on Autoliv (it's free!)

Autoliv's outlook anticipates $11.8 billion in revenue and $896.4 million in earnings by 2028. This projection is based on a 4.2% annual revenue growth rate and a $181.4 million increase in earnings from the current $715.0 million.

Uncover how Autoliv's forecasts yield a $135.98 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair values for Autoliv ranging from US$126.97 to US$165.71 across three estimates. While many highlight efficiency gains and higher safety content as positives, the risk of declining vehicle production remains an important factor shaping future outcomes.

Explore 3 other fair value estimates on Autoliv - why the stock might be worth as much as 41% more than the current price!

Build Your Own Autoliv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autoliv research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Autoliv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autoliv's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal