The Bull Case For Kaspi.kz (KSPI) Could Change Following Entry into Turkish Digital Finance Market

- In recent months, Kaspi.kz has made headlines by acquiring stakes in Turkey’s Hepsiburada and Rabobank Turkey as part of its international expansion, aiming to replicate its successful super-app model beyond Kazakhstan.

- This move not only broadens Kaspi.kz's addressable market but also signals its intention to compete internationally, leveraging its dominant position in Kazakhstan’s digital financial services sector.

- We'll explore how Kaspi.kz's push into Turkey could shift the company's investment outlook and long-term growth prospects.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Kaspi.kz Investment Narrative Recap

The core belief for Kaspi.kz shareholders centers on the company’s ability to extend its super-app dominance from Kazakhstan into new markets like Turkey, using recent acquisitions to unlock further growth. While these moves are high-profile, the most important short-term catalyst remains operational progress in Turkey, and the biggest risk is execution missteps during this international expansion, factors that remain largely unchanged by the latest news event.

Among recent developments, Kaspi.kz’s partnership with Alipay+ for cross-border QR payments is especially relevant, as it strengthens the infrastructure needed for a broader international footprint. This announcement ties directly into the company’s efforts to support increased payment flows and merchant acceptance both in Kazakhstan and abroad, a key element, especially as the business looks to scale quickly in competitive new markets.

However, despite this expansion, investors should be keenly aware that, in contrast, regulatory hurdles in markets like Turkey could...

Read the full narrative on Kaspi.kz (it's free!)

Kaspi.kz's narrative projects KZT 5,094.9 billion revenue and KZT 1,669.2 billion earnings by 2028. This requires 17.0% yearly revenue growth and a KZT 578.2 billion earnings increase from the current KZT 1,091.0 billion.

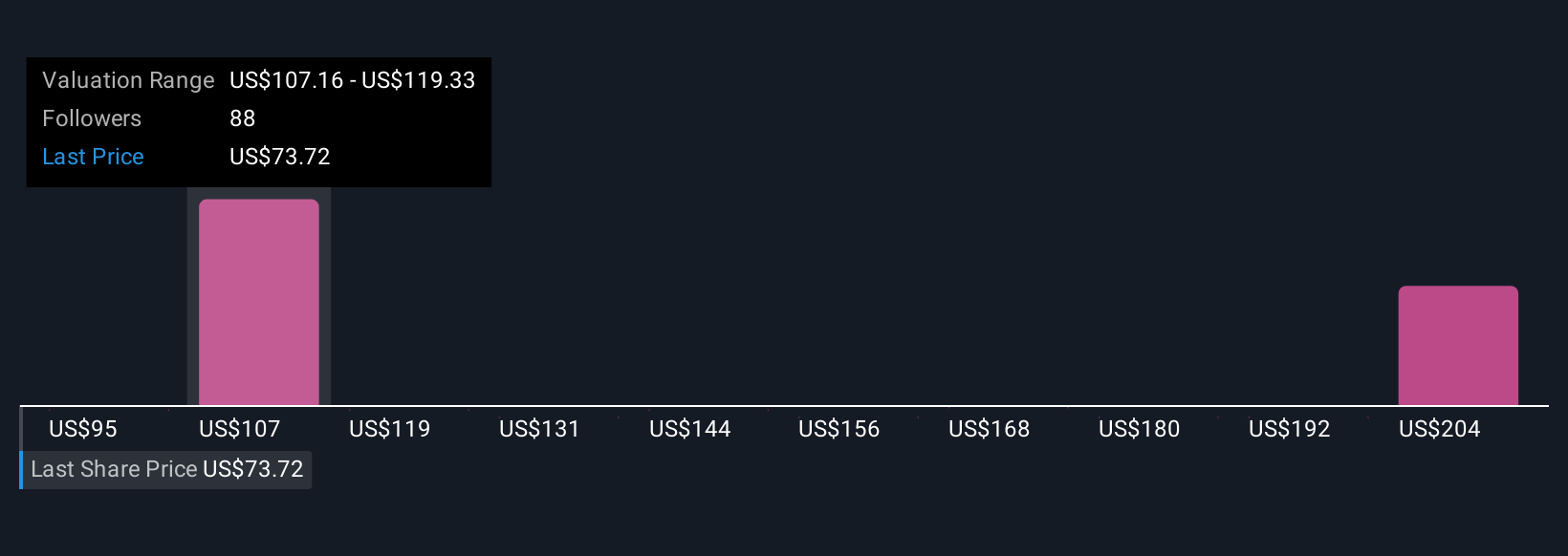

Uncover how Kaspi.kz's forecasts yield a $111.40 fair value, a 48% upside to its current price.

Exploring Other Perspectives

Eighteen Simply Wall St Community members assessed Kaspi.kz’s fair value, giving a range from KZT 95 to KZT 312,902,460 per share. With international expansion presenting significant execution risk, you should consider how sharply views on potential outcomes can differ.

Explore 18 other fair value estimates on Kaspi.kz - why the stock might be worth just $95.00!

Build Your Own Kaspi.kz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kaspi.kz research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kaspi.kz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kaspi.kz's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal