What EnerSys (ENS)'s Early ESRS Compliance Means for Shareholder Trust and Regulatory Readiness

- EnerSys recently published its FY25 Sustainability Report, highlighting advancements in energy efficiency, operational resilience, and early compliance with European Sustainability Reporting Standards (ESRS) ahead of regulatory deadlines.

- This proactive approach in disclosing ESRS information underscores EnerSys’s focus on transparency and readiness for evolving sustainability regulations worldwide.

- We’ll explore how EnerSys’s early ESRS disclosures could reinforce its investment narrative and support stakeholder confidence in regulatory readiness.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

EnerSys Investment Narrative Recap

To see value in EnerSys, investors typically need to believe that strengthened energy efficiency and operational resilience, combined with regulatory readiness, will drive sustainable growth. The FY25 Sustainability Report, while an important transparency milestone, does not materially affect near-term catalysts, such as momentum in data center and industrial electrification markets, nor does it address the main risk involving customer hesitation tied to global tariff uncertainty.

Among EnerSys’s recent updates, the July 2025 announcement of a workforce reduction and $80 million annual savings goal stands out in relation to current catalysts. With macro uncertainties and end-market pressure, cost discipline measures may be key to preserving earnings quality and supporting R&D investment, especially as investors weigh the potential of margin improvement versus organic growth headwinds.

Yet, as transparency grows, investors should be alert to unresolved exposure to global trade policy and tariffs that could still disrupt...

Read the full narrative on EnerSys (it's free!)

EnerSys' outlook anticipates $3.9 billion in revenue and $394.7 million in earnings by 2028. This is based on a 1.9% annual revenue growth rate and a $43.6 million increase in earnings from the current $351.1 million.

Uncover how EnerSys' forecasts yield a $120.00 fair value, in line with its current price.

Exploring Other Perspectives

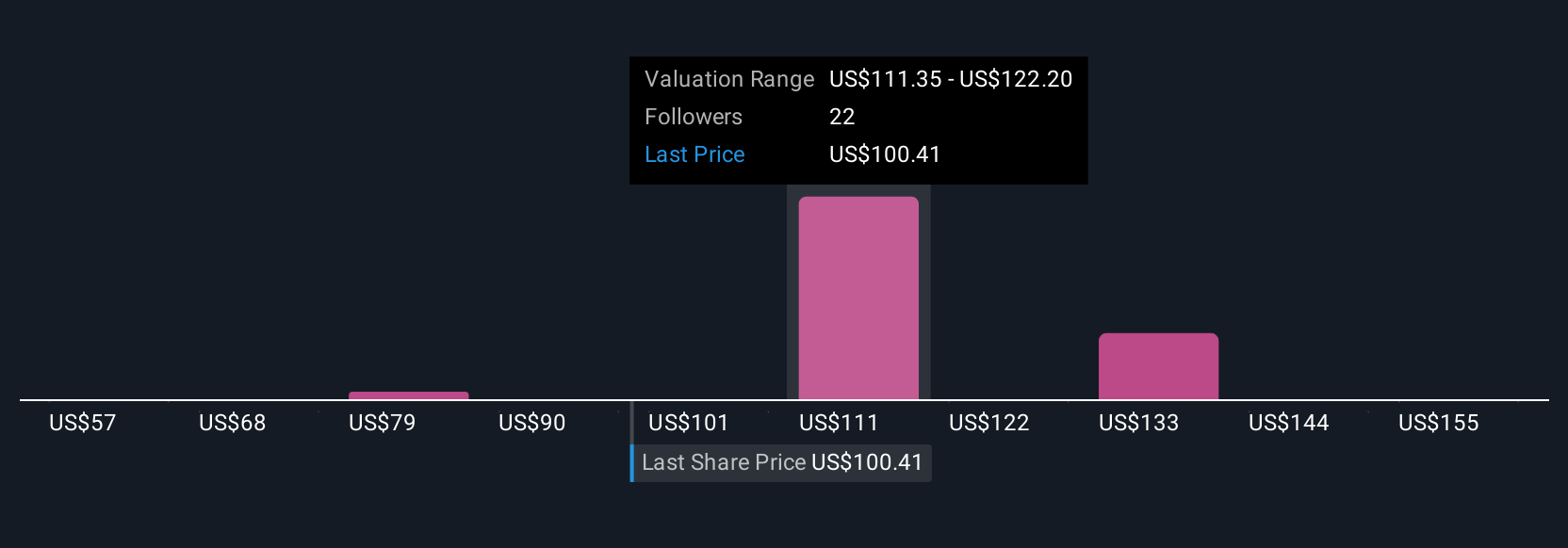

Simply Wall St Community members provided six fair value estimates for EnerSys, ranging from US$85 to US$165.59 per share. While opinions vary widely, ongoing macro risks like unpredictable customer buying due to tariff pressures are a focal point shaping future outcomes.

Explore 6 other fair value estimates on EnerSys - why the stock might be worth 30% less than the current price!

Build Your Own EnerSys Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EnerSys research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EnerSys research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EnerSys' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal