Sector-Wide Streaming Weakness Might Change The Case For Investing In fuboTV (FUBO)

- Earlier this week, fuboTV reported third-quarter earnings below expectations, coinciding with Netflix's weaker results and forecast, which heightened negative sentiment towards the streaming industry.

- This sector-wide disappointment reflects ongoing investor concerns about the streaming market’s overall health and hints at broader challenges facing companies like fuboTV.

- We'll explore how sector-wide earnings disappointment, especially around Netflix's results, could influence fuboTV's current investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

fuboTV Investment Narrative Recap

For an investor in fuboTV, the core belief centers around the company’s ability to capture cord-cutters seeking live sports and entertainment through distinctive, sports-focused streaming bundles. The recent sector-wide negative sentiment following both fuboTV's and Netflix’s earnings misses does not materially change the most important catalyst: fuboTV's expansion into sports-centric and affordable streaming (such as the upcoming Fubo Sports launch). Still, the biggest risk remains persistent subscriber declines, which could slow any turnaround despite new product efforts.

Among the recent announcements, the launch of Fubo Sports stands out as most relevant to the evolving competitive pressures highlighted by this news. Arriving in September, this new skinny bundle aims to attract price-conscious sports fans and could play a key role in addressing recent revenue and user retention challenges by strengthening fuboTV's differentiation at a time when investor attention is tightly focused on sustainable growth drivers.

By contrast, what investors should really be watching is the continued year-over-year subscriber decline, because ...

Read the full narrative on fuboTV (it's free!)

fuboTV's narrative projects $1.8 billion in revenue and $200.4 million in earnings by 2028. This requires 3.8% yearly revenue growth and a $112.7 million earnings increase from the current $87.7 million.

Uncover how fuboTV's forecasts yield a $4.50 fair value, a 24% upside to its current price.

Exploring Other Perspectives

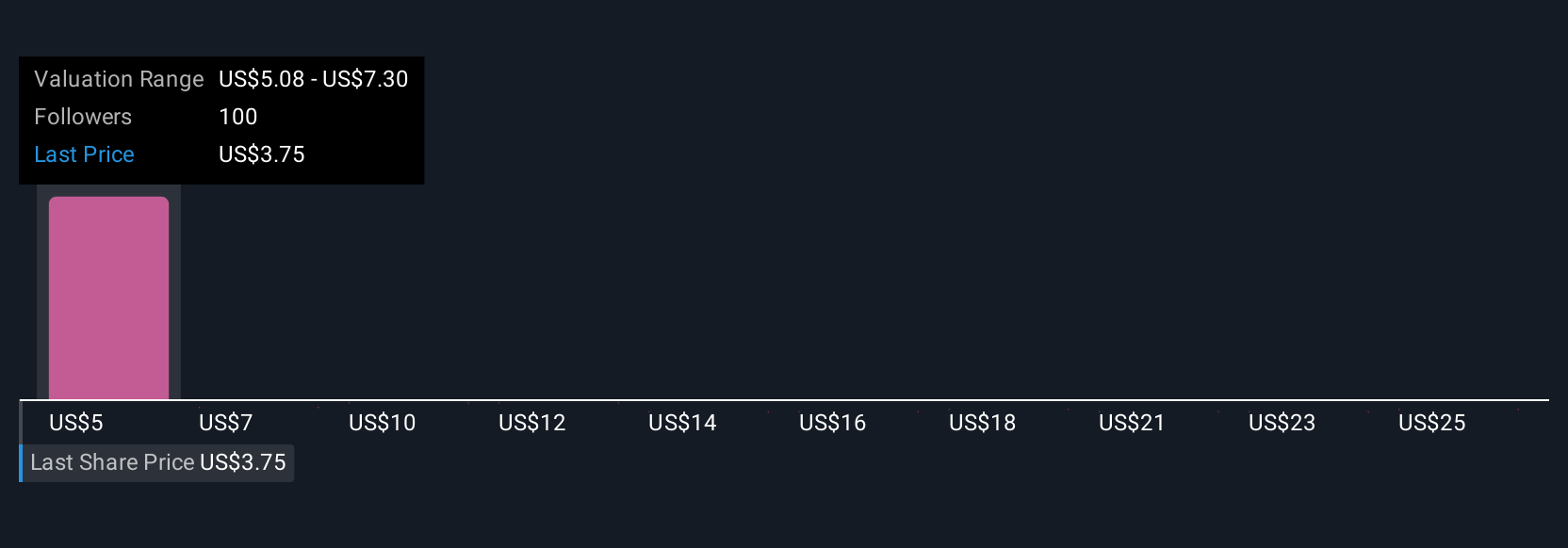

Eighteen members of the Simply Wall St Community have estimated fuboTV's fair value between US$4.11 and US$18.62 per share, reflecting a wide spectrum of expectations. These diverse viewpoints illustrate how much opinions can differ, especially when ongoing subscriber declines weigh heavily on medium-term prospects.

Explore 18 other fair value estimates on fuboTV - why the stock might be worth just $4.11!

Build Your Own fuboTV Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your fuboTV research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free fuboTV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate fuboTV's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal