Dollar Tree (DLTR): Exploring Valuation Outlook as Shares Rebound 6% This Month

Dollar Tree (DLTR) shares have shown resilience in the past month, gaining 6%. However, the stock is still trailing over the past 3 months. As investors weigh recent trends, attention turns to how these moves fit into the stock’s longer-term recovery.

See our latest analysis for Dollar Tree.

While Dollar Tree’s share price jumped 6.3% over the past month, the stock’s 31.6% year-to-date share price return points to gathering momentum after a tough stretch. However, the three-year total shareholder return still lags well below water. Recent gains suggest the company could be regaining investor confidence, with potential for further growth now on the radar for many watchers.

If you’re open to discovering what else is gaining traction beyond retail, now is a great chance to broaden your investing horizons and check out fast growing stocks with high insider ownership

With shares up recently but still well below their historical highs, the debate is on: has Dollar Tree’s comeback potential been fully baked into the current price, or could there be untapped upside for investors?

Most Popular Narrative: 7.1% Undervalued

Dollar Tree’s narrative-based fair value lands above the last close at $108.35. This suggests further upside as analysts weigh ongoing momentum against execution risks.

The retailer's rapid rollout of multi-price point assortments beyond the historic $1.25 price cap has expanded average basket size and created margin uplift, while still retaining core value appeal. This provides a structural path to gross margin improvement and potential EPS growth.

What’s really driving this bullish fair value? The core of this narrative is bold changes to the company’s pricing strategy and shifting consumer behavior. Want to know the analyst forecasts behind this higher target and what makes Dollar Tree’s future stand out from its retail peers? Discover the full story fueling this valuation.

Result: Fair Value of $108.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures and unpredictable consumer demand could still threaten Dollar Tree’s margin recovery and challenge the latest upbeat valuations.

Find out about the key risks to this Dollar Tree narrative.

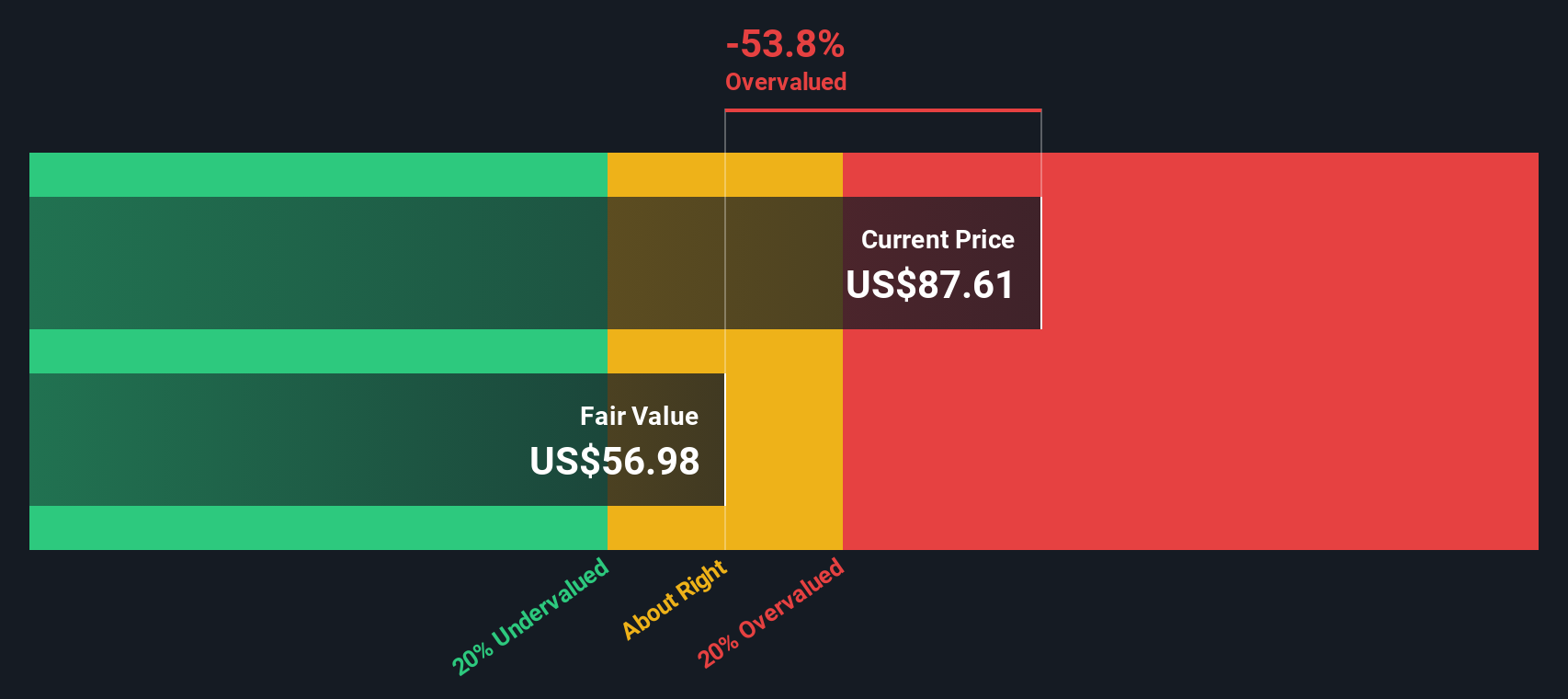

Another View: Discounted Cash Flow Calls for Caution

While the narrative-based valuation points to upside, our DCF model tells a different story. According to this approach, Dollar Tree's current share price is actually much higher than what future cash flows suggest is fair value. This may indicate potential downside if growth stalls.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dollar Tree for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dollar Tree Narrative

Whether you see the story differently or want to dig into the numbers yourself, building your own view takes just a few minutes. So why not Do it your way

A great starting point for your Dollar Tree research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the best opportunities can slip away fast, so don’t let the next big winner pass you by. Take action now with these hand-picked stock themes. There is something for every savvy portfolio.

- Tap into powerful growth stories by checking out these 27 AI penny stocks, where emerging innovators are shaping the future of artificial intelligence.

- Boost your portfolio’s income stream and find stability with these 17 dividend stocks with yields > 3%, featuring companies offering attractive yields above 3%.

- Get ahead of the curve in digital finance by exploring these 80 cryptocurrency and blockchain stocks, highlighting businesses driving the blockchain and cryptocurrency revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal