How Leadership Changes in Sand and Logistics at Atlas Energy Solutions (AESI) Have Altered Its Investment Story

- On October 21, 2025, Atlas Energy Solutions Inc. announced that Chris Scholla has departed from his position as Executive Vice President & President of Sand and Logistics, with CEO John Turner temporarily assuming leadership of the division.

- This leadership transition impacts oversight of a core business segment, which may influence operational continuity and strategic planning within the company's sand and logistics operations.

- We'll explore how the change in executive leadership and direct CEO involvement in sand and logistics could affect Atlas Energy Solutions' long-term investment case.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Atlas Energy Solutions Investment Narrative Recap

For anyone invested in Atlas Energy Solutions, the core belief rests on the company’s ability to capitalize on an eventual rebound in Permian Basin completion activity and to leverage integrated logistics to unlock margin expansion. The recent departure of Chris Scholla and direct CEO oversight of the sand and logistics division do not appear to materially change the key short-term catalyst, recovery in sand demand, nor the ongoing risk from end-market volatility and weak sand pricing.

Of recent company developments, the timing of the upcoming Q3 2025 earnings report (scheduled for November 3, 2025) stands out, as results will provide the clearest early read on any near-term operational or leadership impact. Investors will likely be watching for management commentary on sand demand, project utilization and whether operational continuity is maintained as the CEO steps in on an interim basis.

Yet, amid this transition, investors should also be alert to the potential for continued demand weakness in the Permian Basin and what this could mean for...

Read the full narrative on Atlas Energy Solutions (it's free!)

Atlas Energy Solutions is forecast to achieve $1.2 billion in revenue and $148.5 million in earnings by 2028. This outlook relies on annual revenue growth of 2.2% and a substantial earnings increase of $134.5 million from the current $14.0 million.

Uncover how Atlas Energy Solutions' forecasts yield a $13.68 fair value, a 29% upside to its current price.

Exploring Other Perspectives

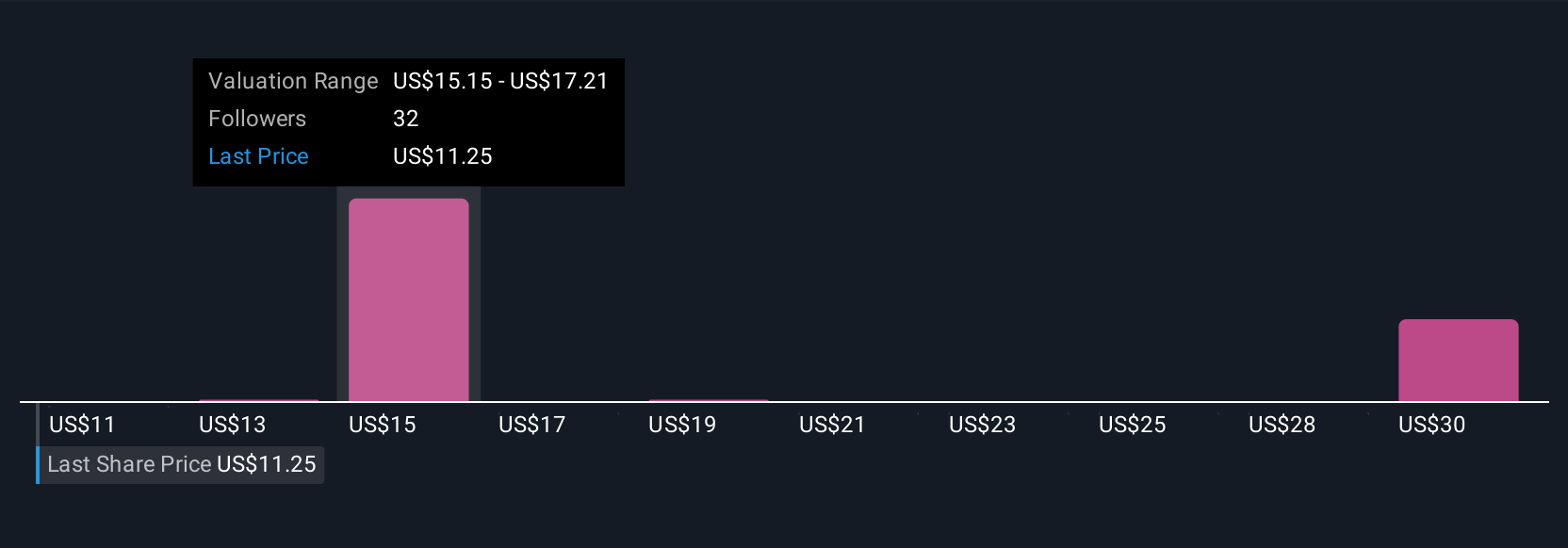

Eight different fair value estimates from the Simply Wall St Community range from US$10.00 to US$27.57 per share. With consensus still highlighting end market volatility as a significant ongoing risk, it’s clear there are many angles to consider when assessing Atlas Energy Solutions' outlook.

Explore 8 other fair value estimates on Atlas Energy Solutions - why the stock might be worth over 2x more than the current price!

Build Your Own Atlas Energy Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlas Energy Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Atlas Energy Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlas Energy Solutions' overall financial health at a glance.

No Opportunity In Atlas Energy Solutions?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal