Will Persistent Caution on Med-Tech and China Exposure Reshape Novanta's (NOVT) Investment Narrative?

- Conestoga Capital Advisors highlighted in its third-quarter 2025 investor letter that Novanta Inc. underperformed due to underwhelming revenue growth and cautious outlooks, despite exceeding earnings expectations.

- An interesting insight is that persistent concerns regarding med-tech capital equipment and China-exposed components led to selling pressure and a reduction in hedge fund holdings during the quarter.

- We'll explore how ongoing investor caution tied to med-tech and China exposure could influence Novanta's forward-looking investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Novanta Investment Narrative Recap

To be a Novanta shareholder, you need conviction in the company’s ability to capitalize on robotics, automation, and healthcare spending, while managing short-term challenges in med-tech capital equipment and China-exposed components. The recent news, highlighting hedge funds rotating out following subdued revenue growth and cautious outlooks, reinforces that near-term risk remains most acute around macro headwinds and med-tech demand; the impact on long-term catalysts appears minor for now.

Among recent announcements, Novanta’s intensified pursuit of acquisitions in high-growth medical and software markets stands out. This anticipated strategy directly supports the company’s growth narrative, especially at a time when organic growth is limited and investors weigh the importance of acquisitive expansion against short-term volatility.

Yet, with trade tensions persisting and China-related sales at risk, investors should be aware that...

Read the full narrative on Novanta (it's free!)

Novanta's narrative projects $1.1 billion revenue and $135.3 million earnings by 2028. This requires 5.8% yearly revenue growth and a $73.9 million earnings increase from $61.4 million today.

Uncover how Novanta's forecasts yield a $141.50 fair value, a 19% upside to its current price.

Exploring Other Perspectives

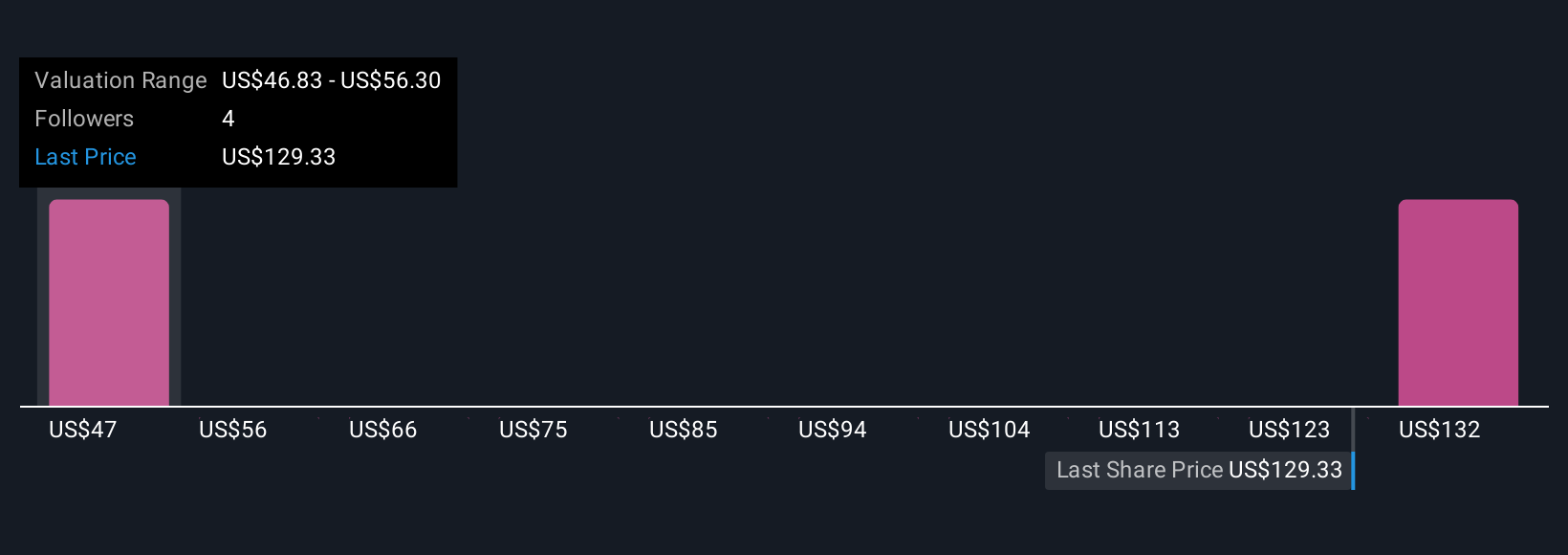

Three Simply Wall St Community fair value estimates for Novanta range from US$36.78 to US$141.50 per share, reflecting a wide spectrum of outlooks. Some believe acquisitions could drive future earnings, while others remain mindful of near-term headwinds for organic growth.

Explore 3 other fair value estimates on Novanta - why the stock might be worth less than half the current price!

Build Your Own Novanta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novanta research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Novanta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novanta's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal