Keysight’s Cloud Security Appraisal for SK hynix SSDs Could Be a Game Changer for KEYS

- Earlier this month, SK hynix announced it had earned its first Open Compute Project (OCP) Security Appraisal Framework and Enablement (S.A.F.E.) recognition for a solid-state drive (SSD) solution, following an industry-first evaluation conducted by Keysight Technologies.

- This collaboration highlights Keysight’s influential role in shaping supply chain security standards as cloud adoption and AI workloads drive new data center cybersecurity demands.

- We'll examine how Keysight’s leadership in security appraisals for cloud infrastructure shapes the company's investment narrative going forward.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Keysight Technologies Investment Narrative Recap

To be a shareholder in Keysight Technologies, one needs to believe in sustained demand for advanced testing and security solutions as AI infrastructure investment and cybersecurity expectations push the industry forward. The recent SK hynix recognition underscores Keysight's technical leadership in supply chain security for data center hardware but does not materially shift the immediate risk profile, tariff-related cost pressures and uncertain mitigation effectiveness continue to be the most significant factors for short-term performance and margin outlook.

Among the wave of new announcements, the launch of Keysight's UALink 1.0 transmitter test solution stands out for its direct relationship to accelerating AI and cloud data center buildouts, aligning closely with key market catalysts identified in the investment thesis. By enabling rapid, automated high-speed interconnect compliance, this innovation supports Keysight’s position at the intersection of rising AI adoption and infrastructure modernization, a space where demand growth is expected to remain strong in the near term.

Yet, in contrast, investors should be aware that short-term results could still be heavily influenced by unforeseen cost impacts if planned tariff mitigation proves less effective...

Read the full narrative on Keysight Technologies (it's free!)

Keysight Technologies' outlook anticipates $6.3 billion in revenue and $1.2 billion in earnings by 2028. This projection relies on a 6.5% annual revenue growth rate and an increase in earnings of $656 million from the current level of $544 million.

Uncover how Keysight Technologies' forecasts yield a $187.60 fair value, a 14% upside to its current price.

Exploring Other Perspectives

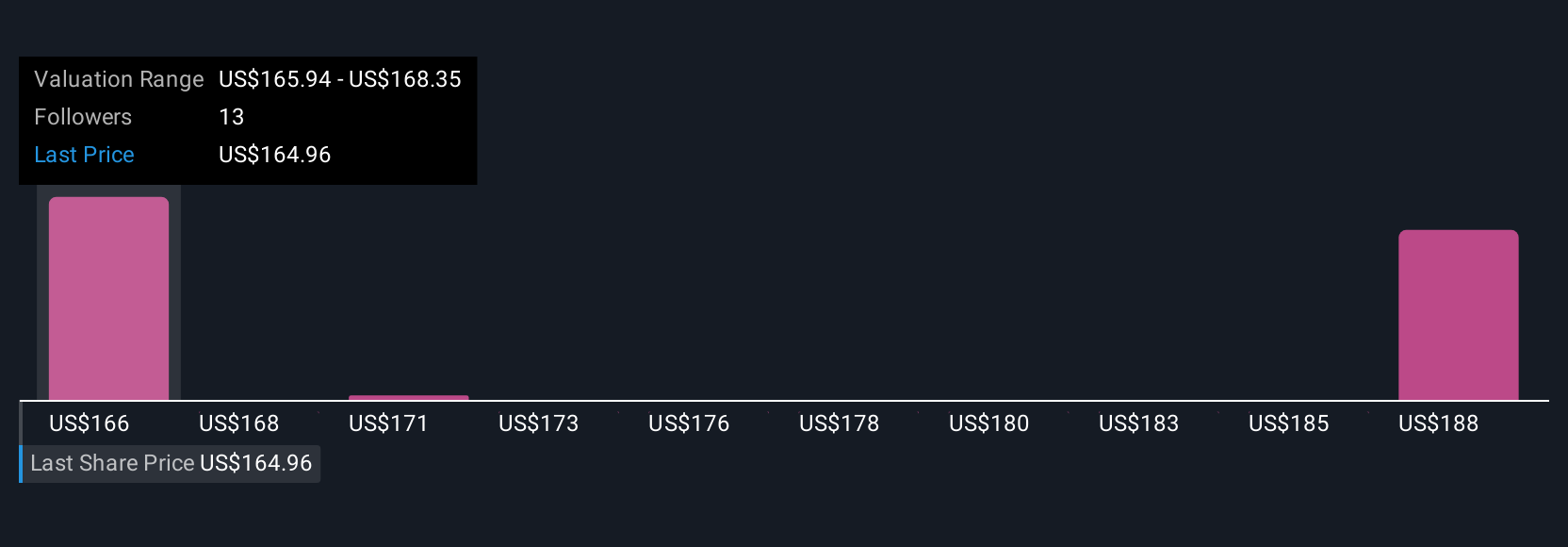

Five fair value estimates from the Simply Wall St Community range from US$152.17 to US$190.01 per share. Some investors highlight that recent cost risks from new tariffs could affect how management balances growth and profitability, prompting several alternative viewpoints worth considering.

Explore 5 other fair value estimates on Keysight Technologies - why the stock might be worth as much as 15% more than the current price!

Build Your Own Keysight Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keysight Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Keysight Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keysight Technologies' overall financial health at a glance.

No Opportunity In Keysight Technologies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal