Atlas Energy Solutions (AESI): Evaluating Valuation After Sudden Departure of Key Division Leader

Atlas Energy Solutions (AESI) announced the sudden departure of Chris Scholla, Executive Vice President and President of Sand and Logistics. Company President and CEO John Turner will lead the division while the search for a permanent successor is underway.

See our latest analysis for Atlas Energy Solutions.

Chris Scholla’s abrupt exit comes at a tricky time for Atlas Energy Solutions, with the share price down nearly 56% year-to-date and the 1-year total shareholder return showing a substantial 45% loss. The swiftness of recent declines suggests that market sentiment is cautious, likely reflecting both operational leadership uncertainty and broader challenges for the stock. Whether Turner’s interim stewardship can restore confidence or momentum remains a key question for investors watching the company’s next steps.

If you’re tracking leadership shifts and want to see what else is moving, this is a great chance to discover fast growing stocks with high insider ownership.

With shares trading well below analyst price targets and at a steep discount to estimated intrinsic value, investors are left to wonder if Atlas Energy Solutions is now undervalued, or if the market is already pricing in all future risks and growth.

Most Popular Narrative: 28.6% Undervalued

Atlas Energy Solutions finished at $10.13, while the most widely followed narrative estimates fair value at $14.18. This sets up a notable gap to analyst expectations and invites scrutiny of the assumptions underpinning that optimism.

Atlas' expanding integrated sand production, logistics, and technology offering (including Dune Express and PropFlow) positions the company to deepen "sticky" long-term relationships with a diversified base of large E&P operators in the Permian, enhancing revenue predictability and supporting higher cash flow stability.

What’s driving this bullish price target? The method behind this narrative rests on pipeline expansions, profit margin boosts and a leap in future earnings per share. The core of this calculation is a projected growth rate and profit profile that could shift perceptions about Atlas’s potential. Want to know why the long-term forecast looks so ambitious? Dive in to compare your views with the full set of numbers behind this valuation.

Result: Fair Value of $14.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in Permian Basin activity or continued pressure on sand prices could undermine Atlas’s recovery narrative and limit future earnings growth.

Find out about the key risks to this Atlas Energy Solutions narrative.

Another View: Multiples vs. Fundamentals

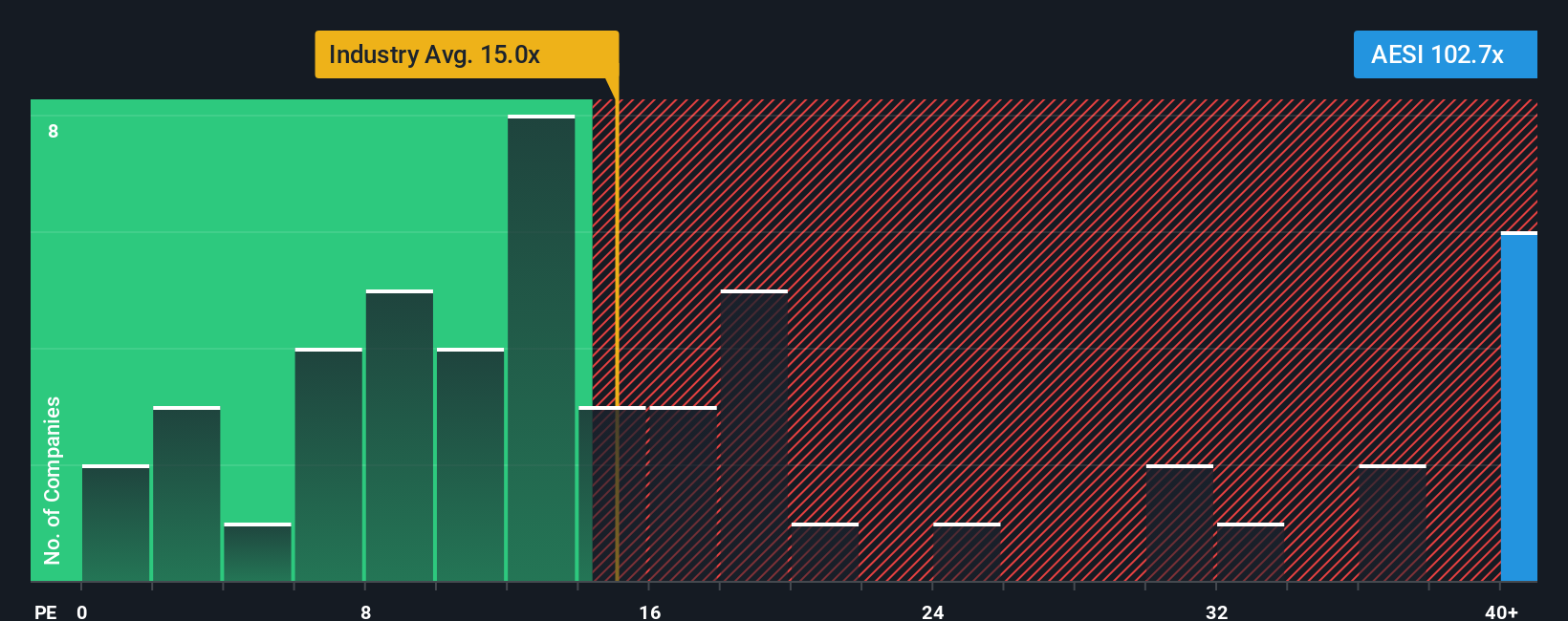

While the narrative points to Atlas Energy Solutions being undervalued, a quick look at its price-to-earnings ratio tells a different story. Trading at 89.7x earnings versus an industry average of 15.1x and a fair ratio of 33.1x, Atlas looks expensive on this measure. Does the market see hidden risks? Alternatively, could valuations eventually revert if fundamentals improve?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atlas Energy Solutions Narrative

If you think there’s more to the story or want to interpret the numbers from your own angle, it takes under three minutes to build a custom view. Do it your way

A great starting point for your Atlas Energy Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock even more opportunities as smart investors expand their horizons beyond a single stock. See what’s rising, what’s yielding, and who’s outpacing the trends now.

- Capture the next big tech breakthrough in artificial intelligence by checking out these 26 AI penny stocks reshaping industries worldwide.

- Maximize your cash flows and stability with these 17 dividend stocks with yields > 3% offering yields above 3% for consistent income seekers.

- Capitalize on undervalued stocks that the market may be missing by scanning these 874 undervalued stocks based on cash flows based on real cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal