Assessing Dollar General (DG): Is the Recent Recovery Signaling a Shift in Valuation?

See our latest analysis for Dollar General.

Zooming out, the stock's year-to-date share price return stands at an impressive 36.96%, which suggests that momentum has picked up again after a rough patch over the last few years. While the one-year total shareholder return is a robust 31.10%, longer-term holders are still well below water. This indicates that the recent uptrend is working to repair earlier damage rather than build on historic highs.

If Dollar General's rebound has you curious about what else is out there, consider broadening your view and discovering fast growing stocks with high insider ownership

With shares bouncing back and revenue on the rise, is Dollar General currently trading below its real worth? Or has all the good news already been factored in, leaving investors to wonder if there is true upside left?

Most Popular Narrative: 13.8% Undervalued

Dollar General's widely followed narrative places a fair value of $120.11 on the shares, a solid premium to the most recent closing price of $103.58. Rather than seeing the recent rally as overdone, this viewpoint suggests the stock still offers upside that has not yet been fully realized.

Rapid scaling of digital initiatives, including same-day delivery partnerships (DoorDash, Uber Eats), in-house DG delivery, and the DG Media Network, positions Dollar General to capture incremental market share and drive higher-margin omni-channel revenue streams. This could boost both sales and earnings over the long term.

What does the future hold for Dollar General’s bottom line? Big assumptions on faster earnings growth, better margins, and a re-rating that rivals industry leaders are built in. Craving the details that fuel this fair value? The narrative’s quantitative targets might surprise you. Find out what is behind the optimism and see if the numbers add up.

Result: Fair Value of $120.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition among discount retailers and slower digital progress could undermine long-term growth if Dollar General cannot keep pace with evolving consumer trends.

Find out about the key risks to this Dollar General narrative.

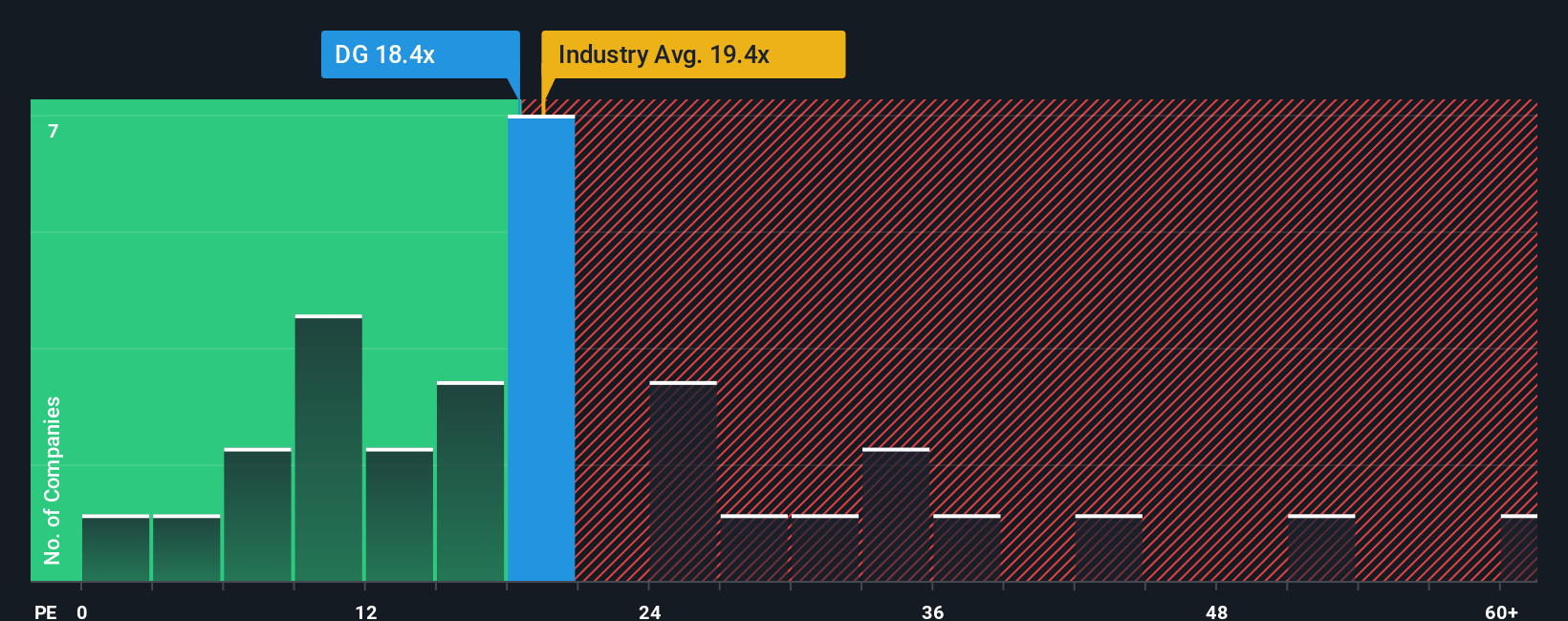

Another View: The Market's Multiple Tells a Different Story

While many see Dollar General as undervalued, a closer look at its price-to-earnings ratio suggests a more cautionary view. The current ratio sits at 19.1x, almost identical to its peer average. However, it is noticeably below the US Consumer Retailing industry average of 21.2x and well under the fair ratio of 22.5x. This means the market is pricing Dollar General conservatively, possibly signaling skepticism about its ability to outperform rivals or return to stronger growth. Does this restraint mask an opportunity investors are missing, or are the risks still underestimated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dollar General Narrative

If the prevailing stories do not line up with your own perspective, take a hands-on approach and tailor your own narrative using the latest data in just minutes. Do it your way

A great starting point for your Dollar General research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Ideas?

Capitalize on the shifts and stay ahead by looking beyond Dollar General. Simply Wall Street’s tailored screeners spotlight game-changing opportunities you will not want to miss.

- Catch the next wave of breakthroughs by checking out these 27 quantum computing stocks, which is setting the pace in cutting-edge computing and advanced technology innovation.

- Enhance your portfolio with income-focused picks by exploring these 17 dividend stocks with yields > 3%, offering standout yields and resilient cash flows.

- Ride the artificial intelligence boom and unleash growth potential with these 26 AI penny stocks, making headlines for their disruptive advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal