What Diebold Nixdorf (DBD)'s Executive Leadership Changes Could Mean for Shareholders

- Earlier this month, Diebold Nixdorf announced a series of executive leadership changes, with Frank Baur set to become Chief Operating Officer in January 2026, Joe Myers named as Chief Revenue Officer, and Elizabeth Radigan expanding her responsibilities to Chief Administrative Officer, alongside the planned departure of another senior executive.

- These appointments aim to accelerate growth, boost efficiency, and better align the company’s global sales and administrative operations with its evolving strategic objectives.

- We'll explore how the expanded roles for Diebold Nixdorf’s leadership team may influence its investment narrative and operational outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Diebold Nixdorf Investment Narrative Recap

To own a stake in Diebold Nixdorf today, you need to believe the company can successfully pivot from hardware-centric roots to a software-and-services model, driving consistent margin expansion despite steady revenue declines and ongoing sector disruption. The recent executive reshuffle, while aiming to energize sales and operations, is not likely to materially move the needle on the immediate need for stronger cash flow and margin improvements, the core short-term catalyst, as the main risk remains execution on restructuring and securing recurring high-margin contracts.

Of recent corporate events, the August 2025 launch of branch automation solutions stands out for its direct connection to the short-term catalyst: increasing high-value hardware and software adoption to expand the service contract base. This innovation reflects Diebold Nixdorf’s commitment to shift toward higher-margin services, critical for stabilizing earnings as the market for physical ATMs comes under more pressure.

However, against these opportunities, execution missteps or delays in restructuring could quickly threaten ...

Read the full narrative on Diebold Nixdorf (it's free!)

Diebold Nixdorf's outlook anticipates $4.2 billion in revenue and $312.7 million in earnings by 2028. This scenario is based on 4.3% annual revenue growth and a $325.6 million increase in earnings from the current -$12.9 million.

Uncover how Diebold Nixdorf's forecasts yield a $75.67 fair value, a 34% upside to its current price.

Exploring Other Perspectives

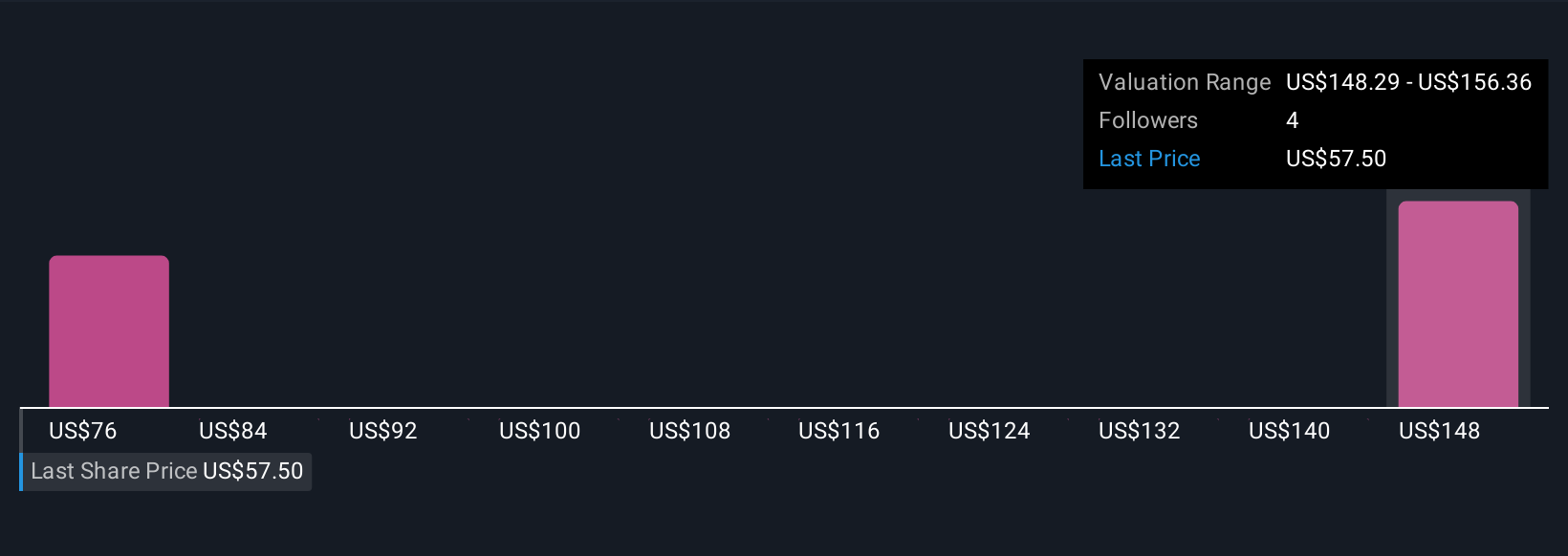

Private investors in the Simply Wall St Community value Diebold Nixdorf stock between US$75.67 and US$156.30, with just 2 opinions contributing. With execution risk front of mind, these varied outlooks highlight how differently people view prospects for margin growth and recurring revenues.

Explore 2 other fair value estimates on Diebold Nixdorf - why the stock might be worth over 2x more than the current price!

Build Your Own Diebold Nixdorf Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diebold Nixdorf research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Diebold Nixdorf research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diebold Nixdorf's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal