The Bull Case For FinVolution Group (FINV) Could Change Following Analyst Focus on Valuation Amid Volatility

- Recent analyst commentary highlights FinVolution Group's robust financial performance, emphasizing accelerating global adoption, strong revenue growth, and profitability despite significant stock volatility in the past week.

- An interesting takeaway is the company's forward price-to-earnings ratio remains well below sector averages, signaling an attractive risk/reward profile compared to its industry peers.

- We'll examine how analysts' focus on compelling financial fundamentals strengthens FinVolution's investment narrative as international expansion accelerates.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

FinVolution Group Investment Narrative Recap

To be a shareholder in FinVolution Group right now, you’ll need confidence in its ability to drive sustainable revenue and earnings growth as global adoption picks up, while navigating ongoing regulatory uncertainty in China. The recent analyst commentary highlighting strong financial performance does not materially change the main short-term catalyst for the stock, increasing international transaction volumes, and the biggest risk remains sensitivity to regulatory changes at home and abroad.

Among recent developments, the Q2 2025 results are most relevant, showing revenue up to CNY 3,577.95 million and net income climbing to CNY 747 million year-over-year. This earnings growth aligns with the ongoing international expansion that analysts have flagged as a crucial catalyst, demonstrating FinVolution’s ability to translate cross-border opportunities into bottom-line improvements.

Yet, in contrast to upbeat coverage elsewhere, investors should also be aware of how rising day-1 delinquency rates could impact future earnings if...

Read the full narrative on FinVolution Group (it's free!)

FinVolution Group's narrative projects CN¥18.1 billion revenue and CN¥3.7 billion earnings by 2028. This requires 9.5% yearly revenue growth and a CN¥0.9 billion earnings increase from CN¥2.8 billion.

Uncover how FinVolution Group's forecasts yield a $11.34 fair value, a 69% upside to its current price.

Exploring Other Perspectives

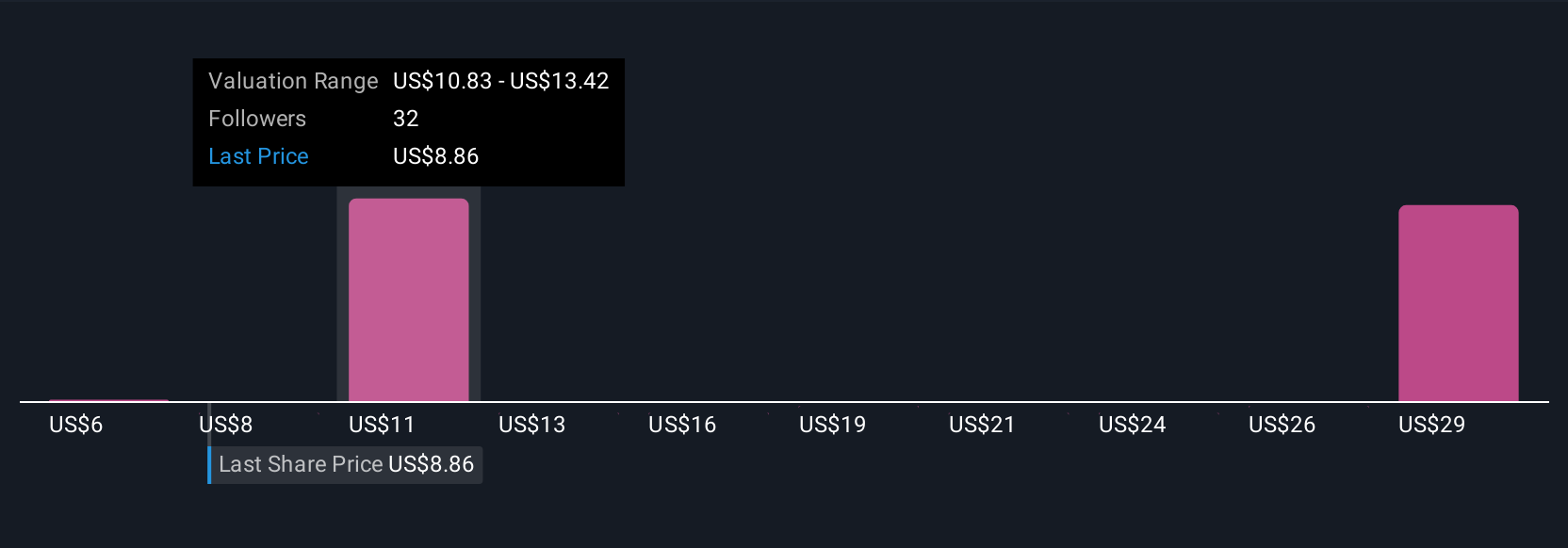

Twelve members of the Simply Wall St Community estimate FinVolution’s fair value from US$8.91 to US$27.65 per share, highlighting a wide range of views. Given the company’s accelerating international growth as a potential catalyst, you may want to explore several opinions before drawing your own conclusions.

Explore 12 other fair value estimates on FinVolution Group - why the stock might be worth just $8.91!

Build Your Own FinVolution Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FinVolution Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FinVolution Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FinVolution Group's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal