Flexsteel Industries (FLXS) Profit Margin Beats Expectations, Reinforcing Bullish Narratives on Profitability

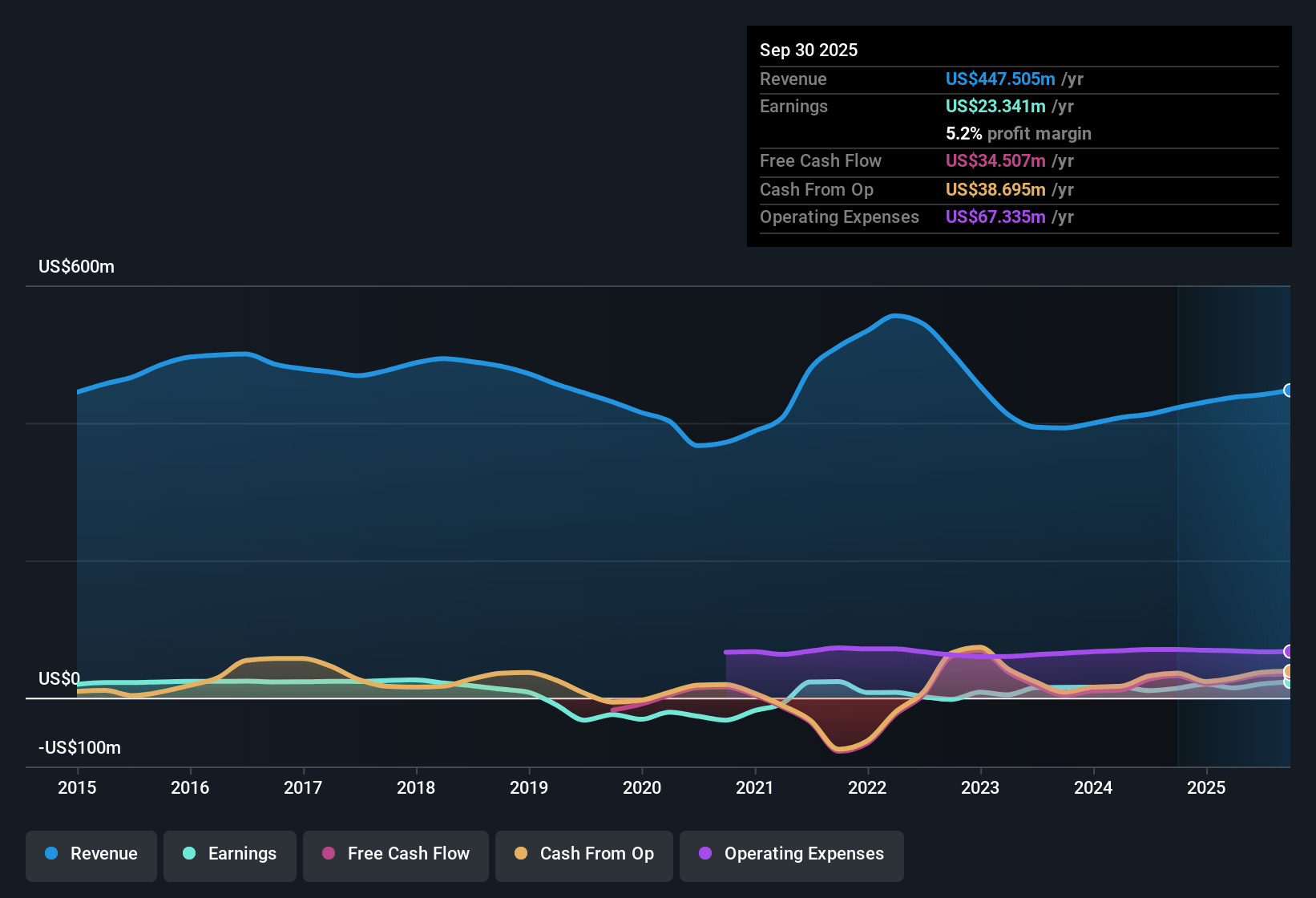

Flexsteel Industries (FLXS) posted stand-out earnings this year with net income growth of 67.7%, handily outpacing its five-year average of 41.2% per year. Profit margins climbed to 5.2% from last year’s 3.3%, and the company now trades at a P/E ratio of 8.2x, well below its industry and peer averages. With the stock changing hands at $36.49, under an estimated fair value of $37.58, investors face the dilemma of balancing declining earnings forecasts and dividend sustainability concerns against noticeably improved profitability and attractive valuation.

See our full analysis for Flexsteel Industries.Next up, we will see how these results compare with the prevailing narratives among investors and market watchers, and whether any long-held stories get supported or upended.

See what the community is saying about Flexsteel Industries

Analyst Price Target Lifts Potential Upside

- The consensus analyst price target stands at $47.00, which is 28.9% above the current share price of $36.49, setting expectations for future upside if projections hold true.

- Analysts' consensus view weighs stronger innovation and distribution efforts as key drivers for that target,

- estimates assume revenue grows 3.8% annually and earnings per share reach $4.53 by 2028, with Flexsteel needing to hit a 13.8x PE ratio at that point to justify the current target.

- this combines with assumptions that product introductions and broadening e-commerce reach can help the company outperform the slow 2.7% annual US market revenue forecast.

See how the newest analysis stacks up against this consensus narrative in detail. 📊 Read the full Flexsteel Industries Consensus Narrative.

Profit Margins Exceed Industry Pressures

- Flexsteel’s net profit margin has risen to 5.2%, up from last year’s 3.3%, despite industry-wide risks from tariffs and weak demand.

- According to the analysts' consensus view, this margin trend highlights operational agility,

- supply chain adjustments and disciplined capital management are vital as tariffs, logistics challenges, and competitive pricing could otherwise compress profits.

- the continued margin strength bolsters the narrative that modernization and cost controls can buffer against external shocks, not just in the latest period but looking ahead as well.

Valuation Discount vs. Peers Stands Out

- Flexsteel shares trade at a P/E ratio of 8.2x, which is below both the consumer durables industry average (10.4x) and the peer average (14x), while still sitting under its DCF fair value of $37.58.

- Analysts' consensus narrative sees this discount as balancing cautious near-term earnings outlooks with demonstrably improved profitability,

- recent earnings and margin growth help offset concerns about dividend sustainability and pressure from a potential 5.7% decline in annual earnings over the next three years.

- the deep discount to peers is a key point for value-focused buyers, as it remains attractive even as some sector headwinds persist.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Flexsteel Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? In just a few minutes, you can build your own narrative and share your unique outlook. Do it your way

A great starting point for your Flexsteel Industries research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite Flexsteel’s margin gains and low valuation, analysts are cautious about unstable future earnings and potential challenges with sustaining dividends over time.

If reliable income is crucial to your portfolio, check out these 2009 dividend stocks with yields > 3% to find companies delivering better dividend consistency and payout stability right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal