Assessing RealReal (REAL) Valuation After a 60% 3-Month Share Price Surge

See our latest analysis for RealReal.

RealReal’s share price has increased over 59% in the past three months, as investors respond to a mix of improving sentiment and speculation around growth potential. Despite some short-term volatility, the company has delivered a remarkable 239.74% total shareholder return over the past year, indicating that momentum is building and investor confidence is on the rise.

If you’re inspired by this kind of turnaround, it could be the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With the stock’s advance far outpacing its recent revenue growth, investors may wonder whether RealReal is trading below its true value or if the market has already taken the company’s future prospects into account, leaving limited upside.

Most Popular Narrative: 5.3% Undervalued

With RealReal’s fair value sitting at $10.83, modestly above its last close of $10.26, the most widely followed narrative implies there is more room for upside if growth assumptions hold. This setup intensifies debate about whether the recent momentum reflects changing fundamentals or just exuberance.

Continuous investment in AI-driven automation (Athena and other initiatives) is delivering ongoing reductions in processing costs per unit and streamlining authentication, enabling scalable operational efficiencies that lower unit costs and support sustained margin expansion and improved EBITDA.

How exactly could automation power a multi-year leap in margins? The main ingredient driving this fair value is an ambitious blueprint that hinges on operational efficiency gains, not just topline growth. Curious which financial levers get pulled hardest in this thesis? The answers may surprise you.

Result: Fair Value of $10.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in commission margins or delays in automation progress could challenge the positive outlook. These factors could potentially impact future profitability and growth.

Find out about the key risks to this RealReal narrative.

Another View: Is the Market Getting Ahead of Itself?

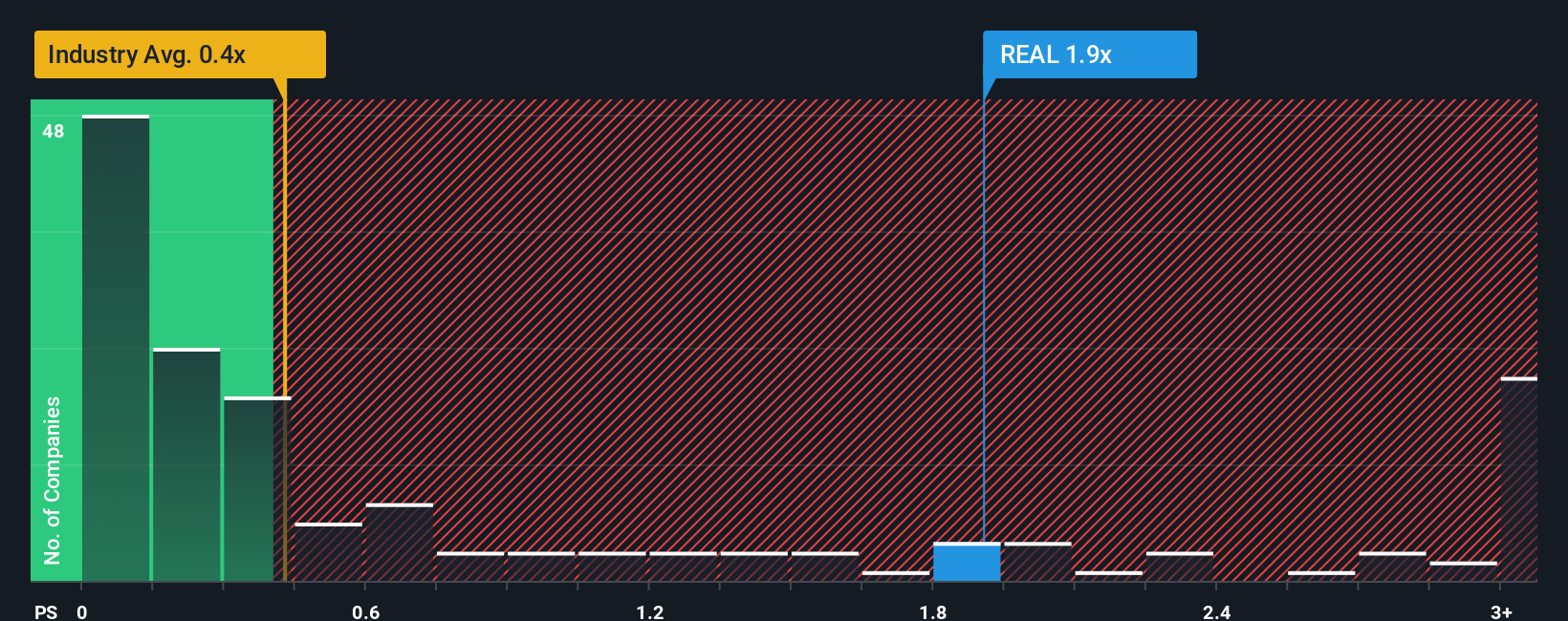

While the recent fair value assessment paints RealReal as undervalued, a look at its price-to-sales ratio tells a different story. RealReal trades at 1.9 times sales, which is higher than both the industry average of 0.4 and what our fair ratio suggests at 1.5. This gap points to increased valuation risk if growth stumbles. This raises questions about whether upside is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RealReal Narrative

If this perspective differs from your own or you like building on your own analysis, you can craft your own story around RealReal’s numbers in just a few minutes. Do it your way

A great starting point for your RealReal research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let powerful opportunities pass you by. Broaden your portfolio with exceptional companies identified through the Simply Wall Street Screener and position yourself for tomorrow’s winners.

- Capitalize on overlooked potential by analyzing these 872 undervalued stocks based on cash flows that the market may be underestimating right now.

- Seize growth in rapidly evolving industries by reviewing these 24 AI penny stocks that are harnessing artificial intelligence and shaping new market frontiers.

- Boost your income strategy with these 18 dividend stocks with yields > 3% that offer attractive yields above 3% and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal