PAR Technology: Evaluating Valuation After Securing Layne’s Chicken Fingers as a Major Restaurant Tech Partner

PAR Technology has secured a new partnership with Layne's Chicken Fingers, which is adopting PAR Engagement to upgrade its digital ordering and loyalty systems as part of a rapid expansion plan. This move highlights the company's reach in restaurant technology.

See our latest analysis for PAR Technology.

PAR Technology’s new restaurant partnership arrives just as its stock is grappling with short-term volatility, including a 30-day share price return of -18.14% and a sharp 90-day slide of nearly 50%. This comes despite some forward-looking moves and client wins. Yet, over the last three years, patient shareholders have still pocketed a 26% total return, showing that momentum can build quickly for tech-focused disruptors like this when the narrative shifts in their favor.

If innovation in restaurant tech has your attention, now could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But after so much recent weakness in PAR Technology’s stock price, is the market overlooking the company’s long-term upside or already pricing in every bit of its future growth potential? Could there be a genuine buying opportunity here?

Most Popular Narrative: 50.9% Undervalued

Analysts suggest PAR Technology’s fair value is vastly higher than its recent close, pointing to major upside if expectations prove correct. This sets up a fascinating tension between current price action and what would need to unfold to reach the target.

PAR's expanded, unified, cloud-native platform (including PAR OPS, Engagement Cloud, and AI-driven tools like Coach AI) is positioned to benefit from industry-wide modernization and demand for operational efficiency, automation, and actionable analytics. These secular drivers should support sustained ARR and earnings growth.

Curious which core figures drive this bullish view? Hint: the narrative hinges on a big acceleration in recurring revenue and a bold margin turnaround that could transform future earnings. Want to know what assumptions fuel such optimism and how close PAR is to actually delivering? Dive in to see what could move the stock next.

Result: Fair Value of $71.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent rollout delays or losing major deals to competitors could threaten PAR Technology’s revenue acceleration and put pressure on long-term growth expectations.

Find out about the key risks to this PAR Technology narrative.

Another View: What Do the Numbers Suggest?

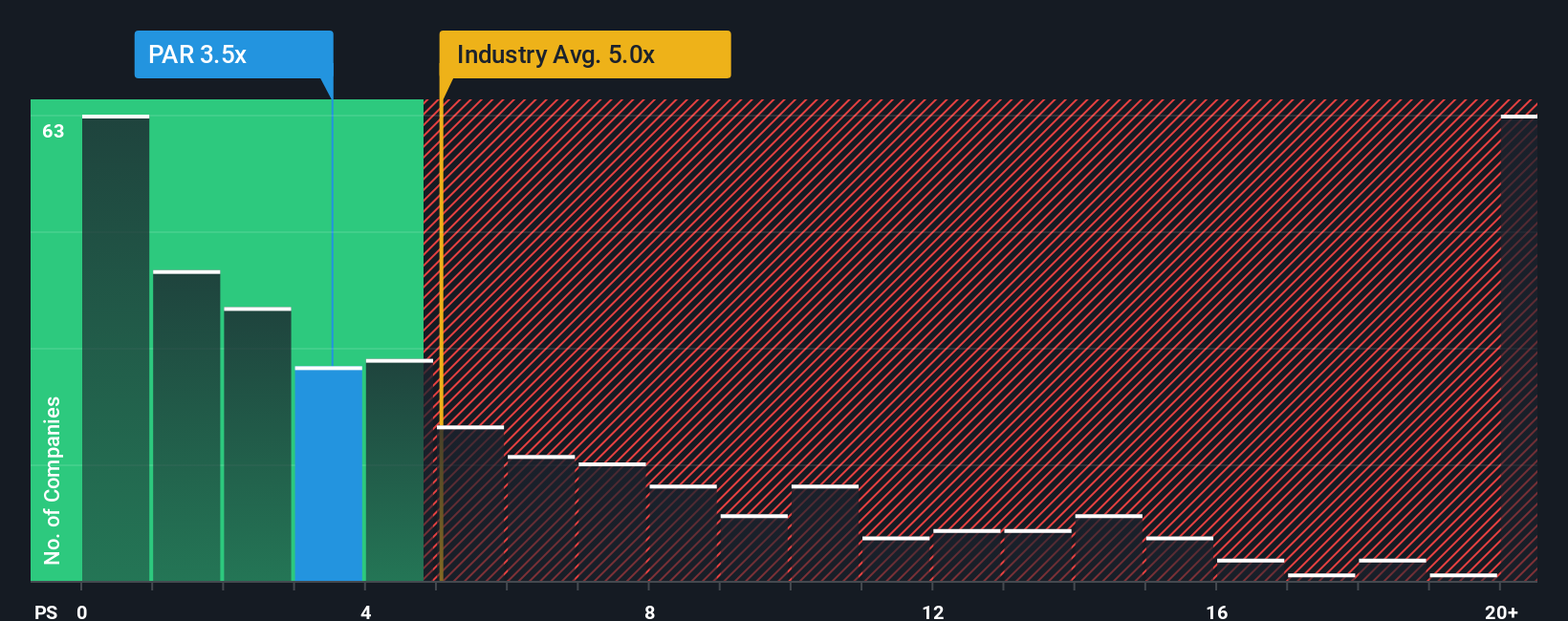

Looking at PAR Technology's price-to-sales ratio, it's currently at 3.4x, which is slightly higher than the average peer at 3.3x. It is noticeably below the broader US Software industry average of 5x. However, it remains above the fair ratio of 2.7x, suggesting that valuation risk remains if the market shifts toward this benchmark. Does this upside premium reflect lasting potential, or could it shrink if optimism fades?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PAR Technology Narrative

If you see things differently or want to dig into the details yourself, you can analyze the numbers and craft your own outlook in just minutes using our tools. Do it your way

A great starting point for your PAR Technology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities pass you by. Use the Simply Wall Street Screener to uncover stocks with surprising upside and innovative potential that fit your strategy.

- Tap into tomorrow’s breakthroughs by checking out these 24 AI penny stocks making waves with advancements in intelligent automation and transformative AI applications.

- Boost your passive income strategy as you consider these 18 dividend stocks with yields > 3% offering reliable yields above 3% and a track record of steady payments.

- Capitalize on mispriced gems by targeting these 878 undervalued stocks based on cash flows trading below their intrinsic worth and poised for stronger future returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal