Why RealReal (REAL) Is Up 8.6 Percent After Analysts Boost Sales Momentum Outlook

- Shares of The RealReal surged recently as several analysts signaled growing confidence in the company's continued sales momentum for the third quarter and maintained expectations for steady full-year guidance, with updates following in-depth research into the company's operating performance.

- An intriguing element is The RealReal's expanding edge as the largest dedicated online luxury resale platform in the US, which is underpinned by unique authentication capabilities and diversified supply channels that support elevated take rates compared to its peers.

- We will explore how growing analyst optimism about The RealReal's sustained sales momentum shapes the company's investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

RealReal Investment Narrative Recap

To be a shareholder in The RealReal, you need to believe in the expanding demand for authenticated, sustainable luxury goods, and the company’s ability to leverage its position as the largest US online luxury resale platform. The recent analyst upgrades and price target increases are notable, but they did not fundamentally alter the ongoing short-term catalyst, the company’s sales momentum, and do not address the key risk of slowing long-term revenue growth and margin pressure from take rate shifts.

The upcoming release of third-quarter 2025 financial results on November 10 stands out as the most immediate announcement relevant to recent analyst activity. This event remains a major focal point for investors, with sales momentum and the company’s ability to maintain full-year guidance likely to be scrutinized as potential drivers of further optimism or caution among analysts and the market alike.

However, in contrast to the current optimism, investors should be mindful that declining average revenue per user and a heavy reliance on higher-ticket items could affect future profit potential...

Read the full narrative on RealReal (it's free!)

RealReal's narrative projects $842.8 million revenue and $40.0 million earnings by 2028. This requires 9.8% yearly revenue growth and a $75.4 million earnings increase from -$35.4 million.

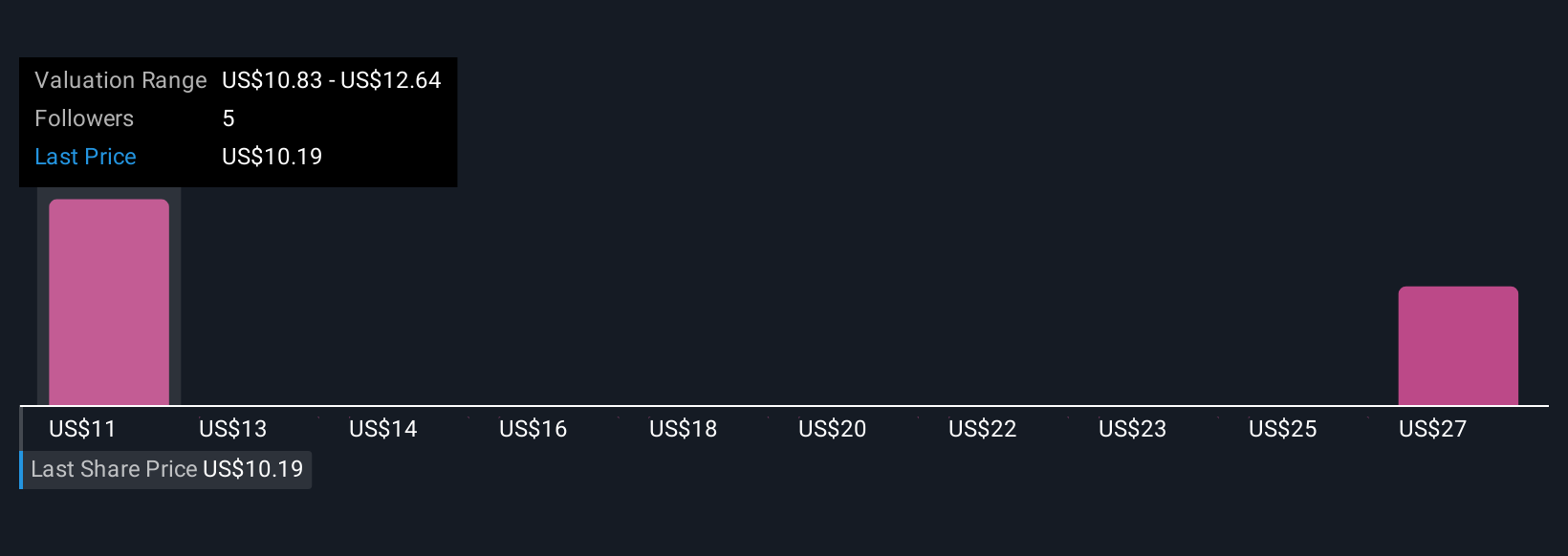

Uncover how RealReal's forecasts yield a $10.83 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for The RealReal range widely from US$10.83 to US$29.31, based on 2 independent investor perspectives. While many remain focused on robust sales momentum as a key catalyst, individual views differ sharply on long-term growth and valuation, inviting you to consider several alternative viewpoints.

Explore 2 other fair value estimates on RealReal - why the stock might be worth over 2x more than the current price!

Build Your Own RealReal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RealReal research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free RealReal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RealReal's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal