Can Moto Deal Reveal the Durability of NCR Atleos' (NATL) Recurring Revenue Model?

- Moto, the UK's leading Motorway Service Area operator, recently announced an extension of its partnership with NCR Atleos, enabling cash access for customers through the NCR Atleos Cashzone Network at more than 16,000 ATMs across the UK, including 45 motorway service stations.

- This move not only reinforces NCR Atleos’ prominent position in the UK ATM market but also highlights its ongoing efforts to promote financial inclusion and provide secure, accessible banking options to consumers.

- We'll explore how the extended Moto partnership highlights NCR Atleos' resilience in maintaining broad cash access and supporting recurring revenue streams.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

NCR Atleos Investment Narrative Recap

To own shares in NCR Atleos, investors need to believe in the continuing relevance and profitability of ATM and cash-access services even as digital payment options expand. The extended Moto partnership showcases the company's ability to secure recurring revenues, but its impact on near-term hardware demand and the most important catalyst, outsourced ATM-as-a-Service growth, remains limited, with the main risk still being consumers’ accelerating shift away from cash.

Among recent announcements, Lloyds Banking Group’s selection of Atleos’ ATM-as-a-Service for branch modernization stands out. This aligns directly with the current catalyst of rising institutional demand for outsourced cash management, reinforcing NCR Atleos' efforts to expand its services base and build a predictable revenue stream.

However, as banks and retailers upgrade their ATM networks, investors should be aware that intensifying competition from fintechs and large technology companies could ...

Read the full narrative on NCR Atleos (it's free!)

NCR Atleos' narrative projects $4.9 billion revenue and $376.6 million earnings by 2028. This requires 4.4% yearly revenue growth and a $248.6 million earnings increase from $128.0 million currently.

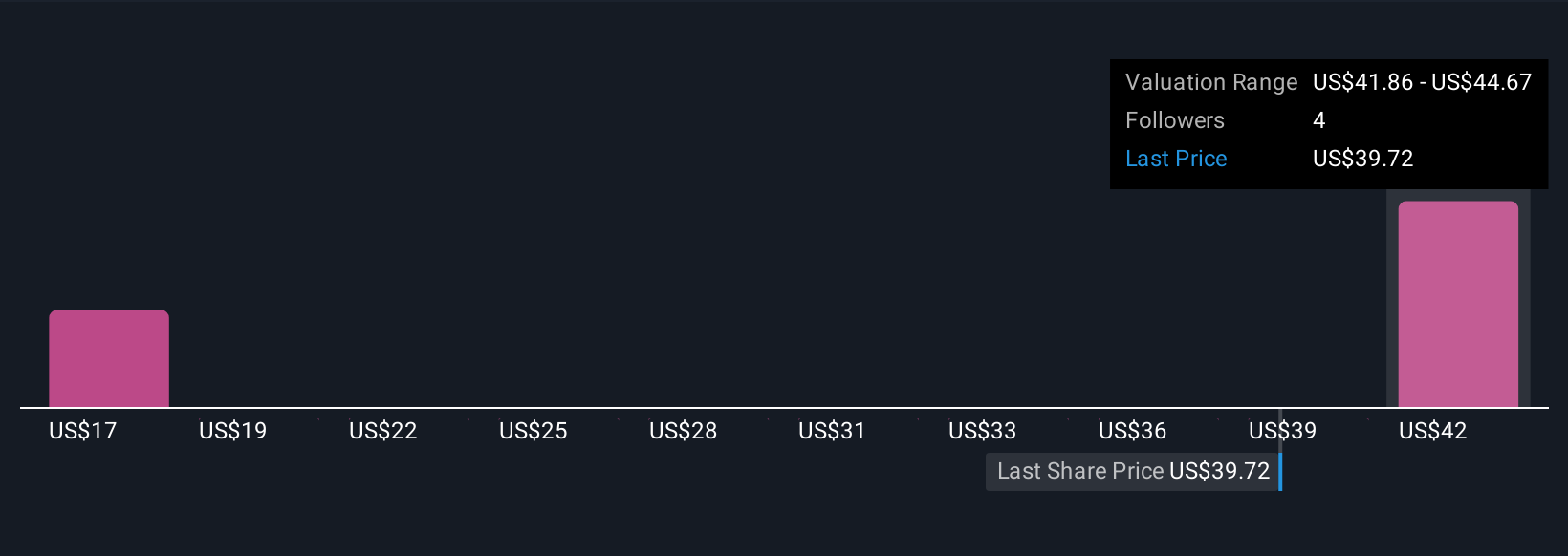

Uncover how NCR Atleos' forecasts yield a $44.67 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for NCR Atleos range widely from US$16.34 to US$44.67, with four distinct perspectives. While many see growth in ATM-as-a-Service, your outlook may hinge on how digital-only banking models might impact these recurring streams.

Explore 4 other fair value estimates on NCR Atleos - why the stock might be worth as much as 21% more than the current price!

Build Your Own NCR Atleos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NCR Atleos research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NCR Atleos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NCR Atleos' overall financial health at a glance.

No Opportunity In NCR Atleos?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal