How Investors May Respond To Harmonic (HLIT) Powering NESN’s Live Sports Streaming Upgrade

- New England Sports Network (NESN) recently announced it has chosen Harmonic and Astound Business Solutions to overhaul live sports delivery to 4 million homes using advanced media processing, 4K HDR streaming, and localized ad insertion.

- This agreement highlights Harmonic's ability to rapidly deploy cutting-edge video delivery platforms that increase monetization opportunities for major broadcasters.

- We’ll explore how this NESN partnership and Harmonic's focus on efficient, scalable video distribution may impact its investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Harmonic Investment Narrative Recap

To be a Harmonic shareholder, you need to believe that advances in cloud-based video and broadband technology, along with growing demand for premium streaming, will propel Harmonic’s solutions into broader adoption. The NESN partnership underscores Harmonic’s ability to deliver at scale, but given the company’s heavy reliance on major clients and broader competitive pressures, its immediate impact on short-term revenue catalysts and concentration risks is likely limited.

Among recent announcements, Harmonic’s showcase of its cOS virtualized broadband platform at Network X 2025 further highlights the company’s commitment to scalable technologies, an approach also supporting the efficiencies seen in the NESN rollout. Growing adoption of these cloud and fiber solutions remains key for unlocking incremental revenue gains.

By contrast, while partnerships like NESN can boost visibility, investors should be aware that customer concentration risk remains significant if...

Read the full narrative on Harmonic (it's free!)

Harmonic's outlook forecasts $695.5 million in revenue and $70.6 million in earnings by 2028. This scenario assumes a -0.3% annual revenue decline and a $2 million earnings increase from the current $68.6 million.

Uncover how Harmonic's forecasts yield a $10.50 fair value, in line with its current price.

Exploring Other Perspectives

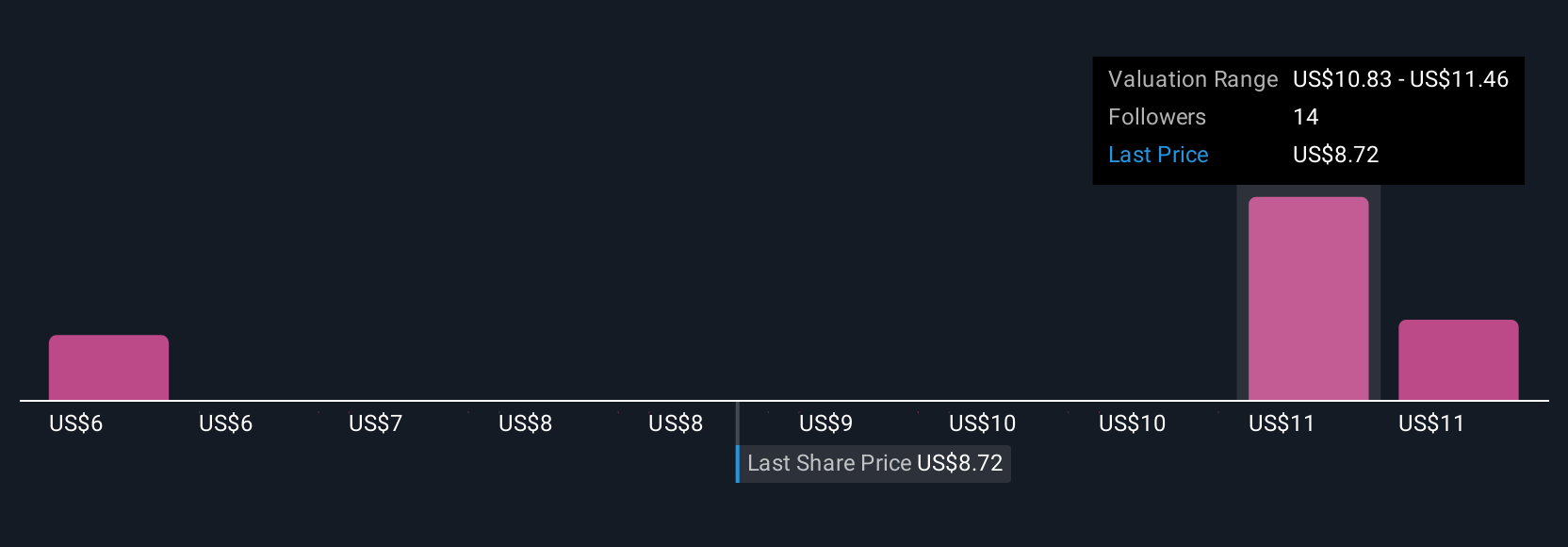

Simply Wall St Community members estimate Harmonic’s fair value between US$5.16 and US$12.10, across three distinct analyses. Despite this divergence, the ongoing shift toward software and cloud-based solutions could influence both profitability and future valuations, consider diverse viewpoints before forming your opinion.

Explore 3 other fair value estimates on Harmonic - why the stock might be worth as much as 18% more than the current price!

Build Your Own Harmonic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harmonic research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Harmonic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harmonic's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal