How Surging Short Interest and Financial Risk at Omnicom Group (OMC) Has Changed Its Investment Story

- In late September 2025, it was reported that Omnicom Group became the most shorted stock in the communication services sector, with 15.74% of its shares targeted by short sellers across global markets.

- This increased short interest comes despite Omnicom’s historically strong operating margins and steady revenue growth, though its financial risk profile is under scrutiny given an Altman Z-Score indicating financial distress.

- With bearish sentiment and financial risk indicators on the rise, we'll assess how these developments could reshape Omnicom's long-term investment story.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Omnicom Group Investment Narrative Recap

To be a shareholder in Omnicom Group, you need to believe in its ability to execute on large-scale integrations and drive value from data-driven marketing technology, even as the business model faces pressures from evolving client demands. The latest surge in short interest has heightened scrutiny on Omnicom’s financial risk profile, but so far, there are no clear signs it will materially change the near-term catalyst: closing and successfully integrating the Interpublic acquisition. Financial leverage, however, remains the most immediate risk to watch in the short term.

One recent announcement that stands out is Omnicom’s extension of the exchange offers for Interpublic notes, a key step in progressing the merger. This move has direct relevance, as the successful closing and integration of Interpublic is widely seen as essential to Omnicom’s growth ambitions and cost synergy targets, likely providing the biggest catalyst for operating performance in the months ahead.

Despite anticipated synergies, the company’s leverage remains a factor that investors should be aware of if...

Read the full narrative on Omnicom Group (it's free!)

Omnicom Group's narrative projects $17.3 billion revenue and $1.7 billion earnings by 2028. This requires 2.8% yearly revenue growth and a $0.3 billion earnings increase from $1.4 billion currently.

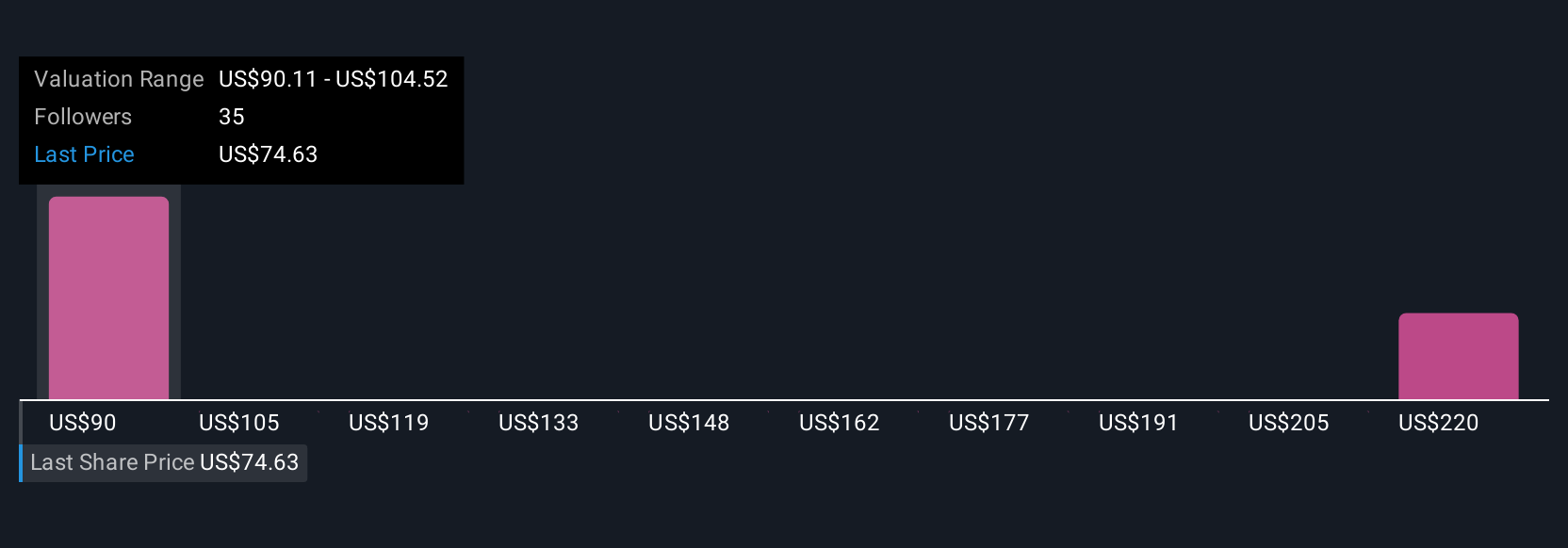

Uncover how Omnicom Group's forecasts yield a $99.67 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community estimated Omnicom’s fair value from US$78 to US$231.98, showing wide disagreement. As you consider these opinions, keep in mind how high debt levels could impact future earnings and potential outcomes.

Explore 6 other fair value estimates on Omnicom Group - why the stock might be worth just $78.00!

Build Your Own Omnicom Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Omnicom Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Omnicom Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Omnicom Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal