The Bull Case For Zenas BioPharma (ZBIO) Could Change Following Major Capital Raise and Transformational Deal

- In early October 2025, Zenas BioPharma announced a series of capital-raising activities including the filing of a US$200 million at-the-market follow-on equity offering, a shelf registration covering multiple types of securities, and the completion of a US$119.99 million private placement with significant institutional and insider participation, alongside hosting a special call to discuss a transformational license agreement and business strategy update.

- The rapid succession of these announcements highlights both strong interest from major investors and potential shifts in the company's strategic trajectory.

- We’ll explore how the transformational license agreement and new capital positions Zenas BioPharma for its next phase of business development.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Zenas BioPharma's Investment Narrative?

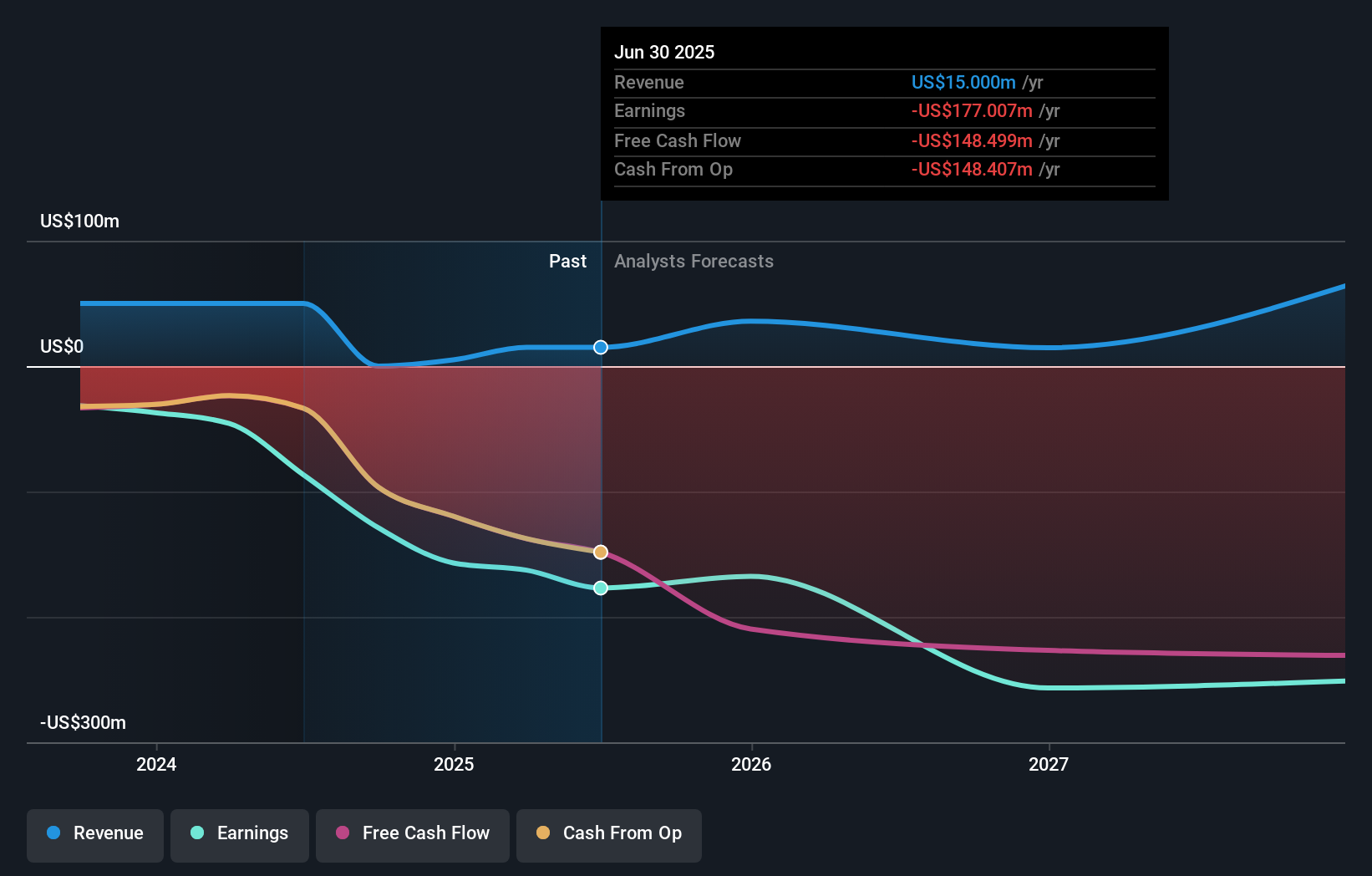

For anyone considering Zenas BioPharma, the story now hinges on whether the company can translate fresh capital and a new license agreement into clinical and commercial success. The recent US$200 million follow-on offering, combined with a US$120 million private placement, gives Zenas a healthy financial cushion, potentially supporting its clinical programs and extending its operating runway. This may ease some previous concerns over near-term funding risks and lets management focus on advancing obexelimab and other pipeline assets. On the flip side, the influx of new shares could introduce more volatility in the stock and shifts risk to effective use of cash rather than simple survival. Investors should also watch whether the still-inexperienced management team uses this expanded war chest efficiently, especially while profit and revenue growth remain uncertain. While these updates appear material, the biggest catalysts and risks, regulatory outcomes, clinical trial milestones, and product launches, are now more closely tied to how management executes with this added flexibility. However, there’s still reason to keep an eye on how execution risk plays out given the company’s track record.

Our valuation report here indicates Zenas BioPharma may be overvalued.Exploring Other Perspectives

Explore another fair value estimate on Zenas BioPharma - why the stock might be worth as much as 27% more than the current price!

Build Your Own Zenas BioPharma Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zenas BioPharma research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Zenas BioPharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zenas BioPharma's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal