Should Investors Revisit Progyny After Its 22.6% Gain and Recent Market Volatility?

Deciding what to do with Progyny stock right now probably feels like standing at a crossroads. Maybe you’re tempted by its double-digit year-to-date gain, or maybe you’re feeling cautious after seeing that recent 30-day dip of -8.2%. Either way, it’s clear that interest in Progyny is heating up again, especially after a 22.6% surge over the past year that has caught the attention of growth-focused investors. At the same time, there’s no denying the echoes of the past. Over a three-year window, shares are still down 46.5%, and the five-year return stands negative, at -25.4%.

What’s driving these shifts? Some of it reflects the broader conversation around fertility benefits and how companies like Progyny are positioned as workplace priorities change. When Wall Street gets bullish about long-term healthcare innovations, stocks like Progyny often get swept up in the momentum, even if short-term headlines and macro trends can spark pullbacks or lead to periods of volatility.

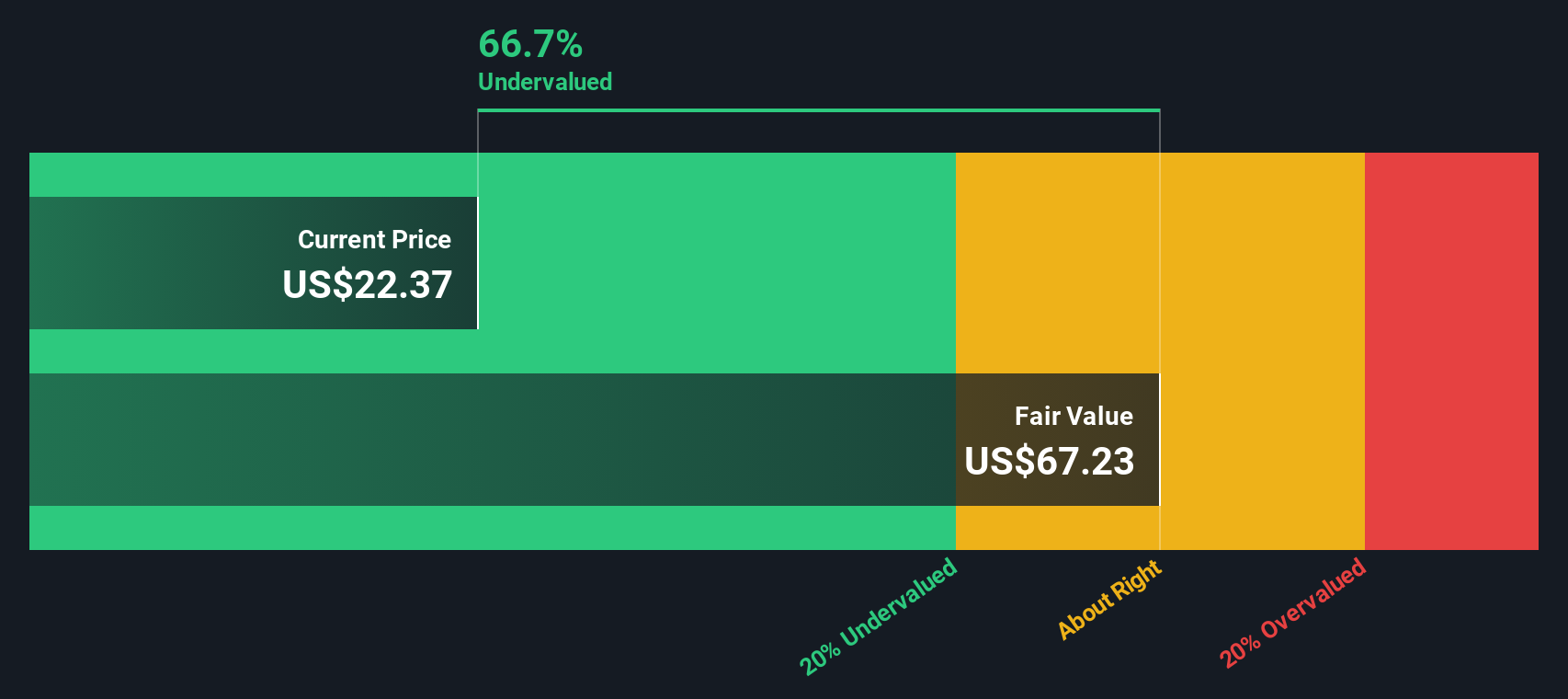

So, is Progyny undervalued right now, or has it just found its level after a dramatic ride? According to a standard valuation score, where companies get 1 point for each of six checks that indicate they’re undervalued, Progyny scores a 3. That is right down the middle: undervalued by half the measures, but not across the board.

Let’s break down exactly which valuation methods reveal hidden upside, and where the numbers might be sending a different signal. We’ll dive into those classic approaches and then wrap up with a smarter lens for thinking about Progyny’s true worth in today’s market.

Approach 1: Progyny Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic worth by extrapolating its future cash flow projections and discounting them back to today's value. For Progyny, this approach focuses on its ability to generate cash from ongoing operations and how those cash flows might evolve over time.

Progyny's latest twelve months Free Cash Flow stands at $194.87 million, serving as the foundation for the valuation. Analysts have provided yearly forecasts up to five years out, with Simply Wall St extrapolating further growth to reach projected Free Cash Flow of $293.91 million by 2035. These ongoing increases reflect expectations that Progyny will continue expanding. However, future cash flow estimates become less certain the further out we go.

After discounting all those future values back to the present, the DCF model arrives at an estimated fair value for the stock of $69.42 per share. Compared to the current share price, this implies Progyny is trading at a 70.7% discount to its intrinsic value.

This signal suggests the market may be underestimating Progyny's long-term cash generation potential, making it look significantly undervalued by this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Progyny is undervalued by 70.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Progyny Price vs Earnings

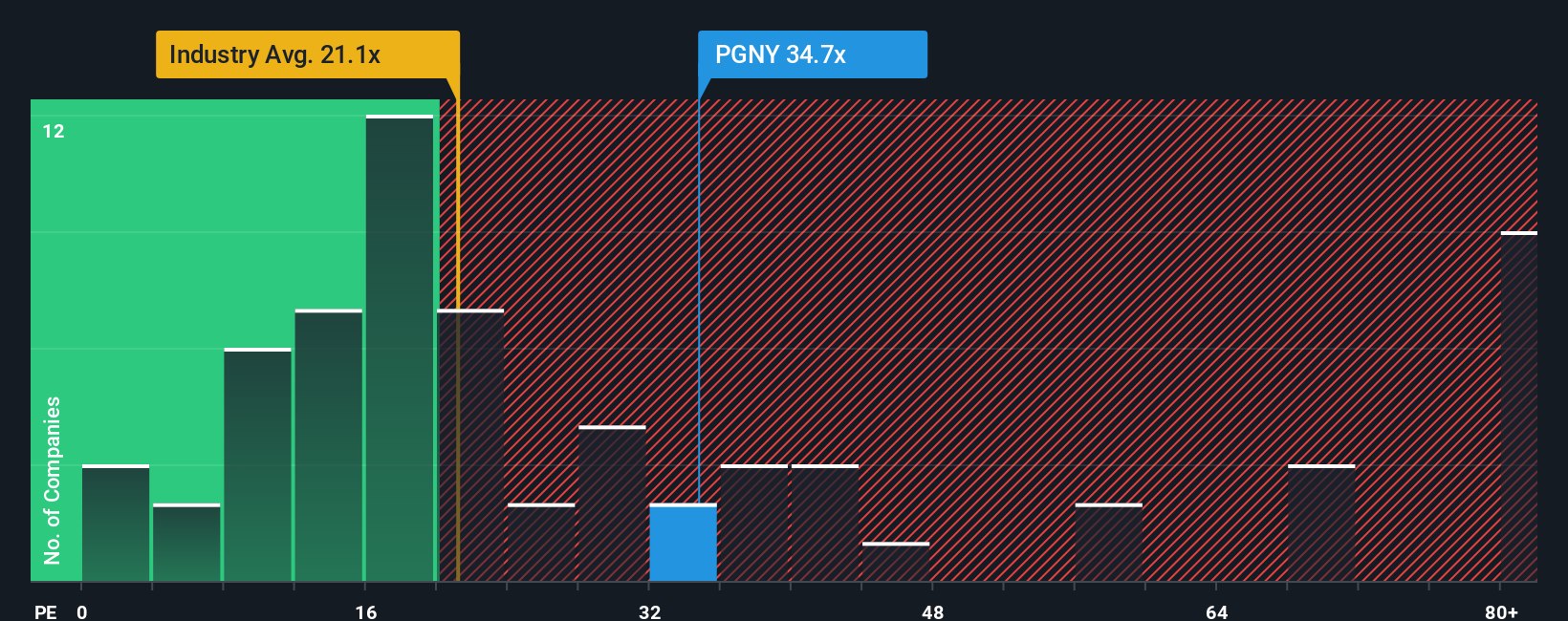

For a profitable company like Progyny, the price-to-earnings (PE) ratio is a widely used and meaningful way to gauge valuation. The PE ratio essentially tells investors how much they are paying for each dollar of earnings, giving a sense of whether expectations embedded in the stock price are reasonable. Typically, higher growth prospects or lower risk will justify a higher "normal" or "fair" PE ratio, while slower growth or more uncertainty calls for a lower one.

Progyny is currently trading at a PE ratio of 32.9x. For context, this sits well above the healthcare industry average of 20.8x and the average among its close peers at 23.1x. At first glance, this premium might make the stock look expensive. However, raw PE ratios do not tell the whole story, since each business has unique growth targets, market positions, and risk profiles.

That is where Simply Wall St's proprietary “Fair Ratio” comes in. The Fair Ratio is tailored to each company’s specific strengths and risks. It incorporates not just the sector and market cap, but also factors like earnings growth, profit margins, and risk. For Progyny, the Fair Ratio is 25.3x, which is lower than both its current PE and the peer average. Because this metric gives a fuller picture than simply benchmarking against the industry, it provides a more nuanced yardstick for valuation.

Comparing Progyny’s current PE ratio of 32.9x to its Fair Ratio of 25.3x suggests the stock is trading above what would be considered a justified fair value given its fundamentals. Based on this approach, Progyny stock looks overvalued at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Progyny Narrative

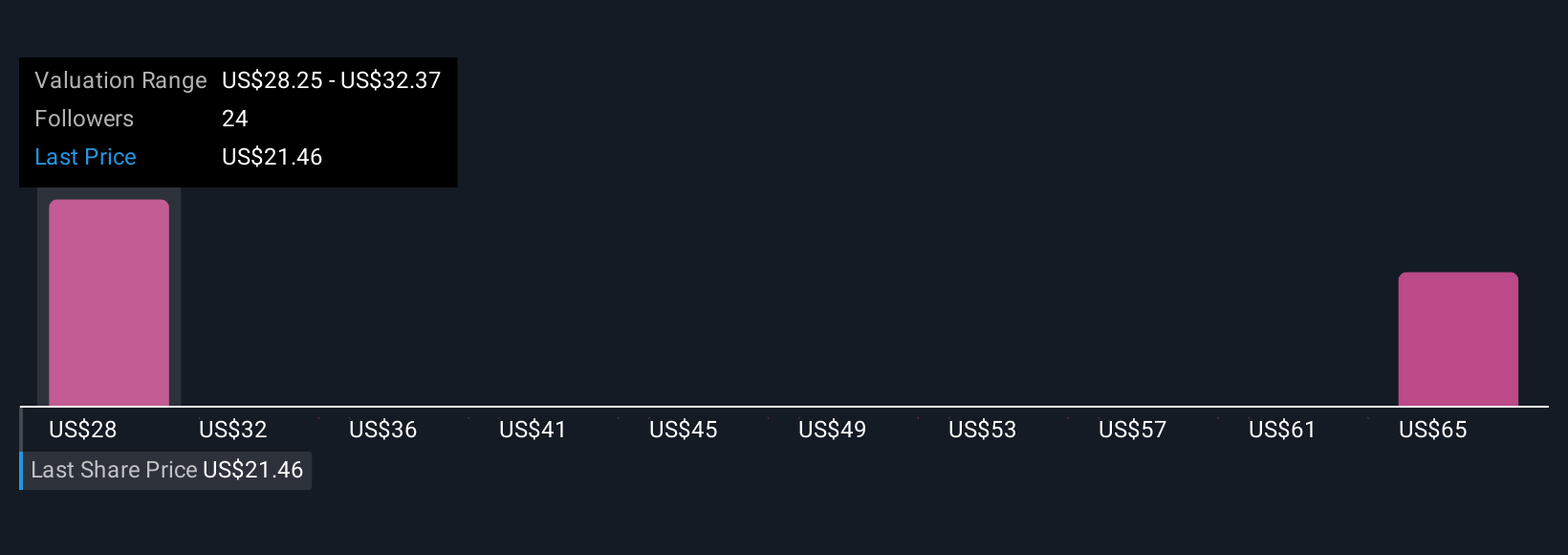

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative puts your perspective front and center, connecting Progyny’s story, its business drivers, risks, and market opportunity, directly to a forecast of future revenue, margin, and fair value.

Rather than relying solely on rigid valuation metrics, Narratives bring your assumptions and insights into the equation, allowing you to create a personalized view of what Progyny is truly worth. Simply Wall St’s Community page makes building or following Narratives easy, with millions of investors already using this collaborative tool to share views, forecasts, and valuation ranges.

With Narratives, you can instantly compare your estimated fair value to the current share price and decide whether you believe Progyny is a buy, a hold, or a sell, all while seeing how others update their expectations as new earnings or news emerge. Because Narratives are dynamic, each new analyst report or company development is incorporated, keeping your perspective fresh and relevant.

For example, recent Community Narratives for Progyny reflect a broad spectrum. Some users forecast a bullish $32.00 fair value based on aggressive earnings growth and market expansion, while others are more cautious, targeting $23.00 due to risks like competition and margin pressure. This helps you see how sentiment shifts and which assumptions lead to different decisions.

Do you think there's more to the story for Progyny? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal