Will Taco Bueno Win and Lower Growth Outlook Change PAR Technology's (PAR) Narrative?

- Following its selection by Taco Bueno to provide point-of-sale and hardware solutions across 140 locations, PAR Technology experienced heightened attention amid its recent reduction in organic annual recurring revenue growth guidance, influenced by a softer restaurant spending environment and delays in project rollouts earlier in the year.

- This combination of landing a major multi-unit customer while lowering growth expectations has drawn focus to the balance between PAR Technology's long-term partnerships and its near-term revenue challenges.

- Now, we'll assess how PAR Technology's updated annual recurring revenue outlook influences its broader investment narrative and future growth assumptions.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

PAR Technology Investment Narrative Recap

PAR Technology’s investment case centers on achieving high-margin, recurring revenues from multi-unit restaurant clients through its unified cloud platform, balanced against the challenge of delivering on growth targets amid delays and a cautious restaurant sector. The recent Taco Bueno win highlights the company’s ability to secure enterprise-scale partnerships, but the lowered organic annual recurring revenue guidance and project rollout delays remain the principal near-term catalyst and risk; the short-term financial impact of the Taco Bueno deal does not materially shift these factors.

The Taco Bueno partnership, announced in August 2025, is particularly relevant as it demonstrates ongoing traction with large restaurant brands and supports the company’s longer-term narrative of cross-selling and expanded product adoption, a key path to improving visibility and stickiness in recurring revenue.

By contrast, investors should be aware that even as new contracts are signed, recurring revenue acceleration could be hindered if...

Read the full narrative on PAR Technology (it's free!)

PAR Technology's narrative projects $608.8 million revenue and $55.1 million earnings by 2028. This requires 13.4% yearly revenue growth and a $146.6 million earnings increase from -$91.5 million.

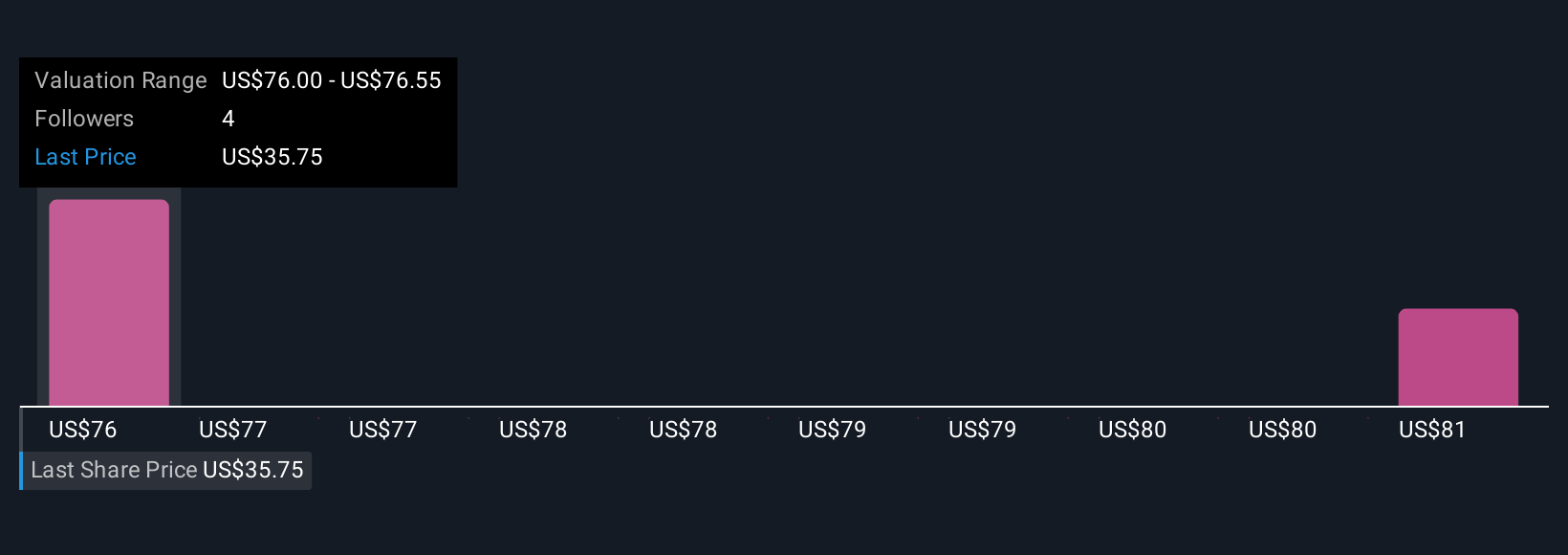

Uncover how PAR Technology's forecasts yield a $76.00 fair value, a 106% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for PAR ranging from US$76.00 to US$81.09, signaling a possible gap with the recent share price. As growth projections soften due to delayed rollouts, you can see there are several viewpoints worth considering when assessing future opportunities and risks.

Explore 2 other fair value estimates on PAR Technology - why the stock might be worth just $76.00!

Build Your Own PAR Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PAR Technology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PAR Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PAR Technology's overall financial health at a glance.

No Opportunity In PAR Technology?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal