3 Reliable Dividend Stocks To Consider With Up To 5% Yield

In recent days, the U.S. stock market has experienced a notable rebound, driven by a softer tone from President Trump regarding China and significant corporate developments such as Broadcom's partnership with OpenAI. Amidst this backdrop of fluctuating market sentiments, dividend stocks remain an attractive option for investors seeking steady income, particularly those offering yields up to 5%, as they can provide stability and potential growth even in volatile times.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 11.16% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.63% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.90% | ★★★★★☆ |

| Heritage Commerce (HTBK) | 5.40% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 6.02% | ★★★★★★ |

| Ennis (EBF) | 5.77% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.91% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.60% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.76% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.56% | ★★★★★☆ |

Click here to see the full list of 136 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

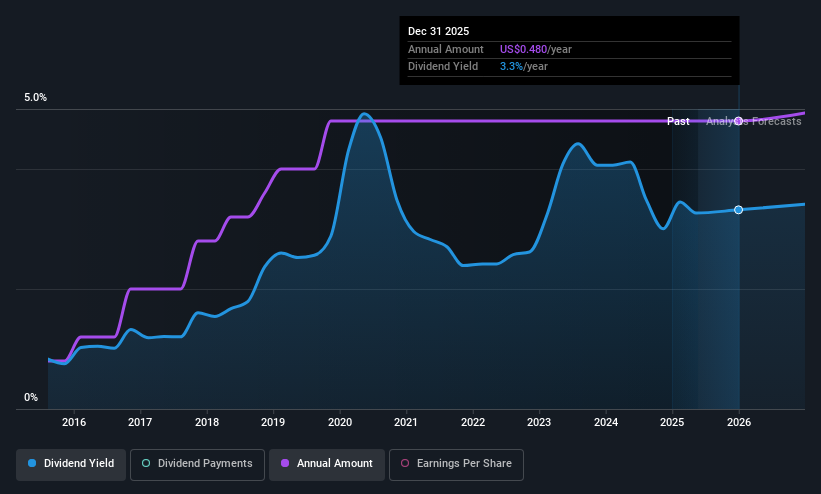

Shore Bancshares (SHBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shore Bancshares, Inc. is a bank holding company for Shore United Bank, N.A., with a market cap of $517.64 million.

Operations: Shore Bancshares, Inc. generates its revenue primarily through its Community Banking segment, which accounted for $208.21 million.

Dividend Yield: 3%

Shore Bancshares offers a stable dividend yield of 3.05%, with payments reliably growing over the past decade. Despite its lower yield compared to top-tier payers, its dividends are well covered by earnings, reflected in a payout ratio of 29.8%. Recently added to the S&P Regional Banks Select Industry Index, Shore reported strong earnings growth and consistent net income increases, enhancing its appeal for dividend investors seeking value in regional banks.

- Click here and access our complete dividend analysis report to understand the dynamics of Shore Bancshares.

- Our valuation report here indicates Shore Bancshares may be undervalued.

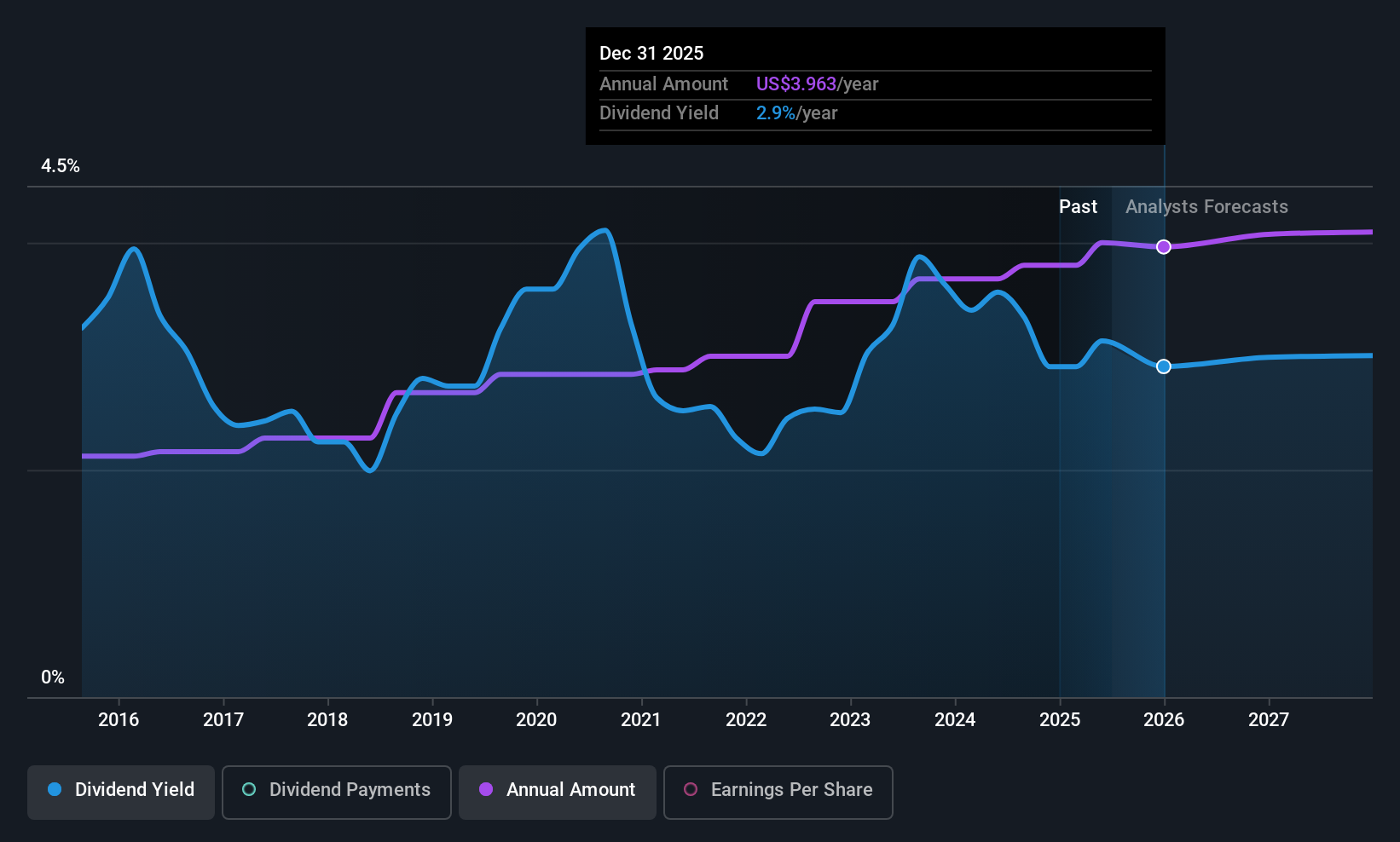

Cullen/Frost Bankers (CFR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cullen/Frost Bankers, Inc. is the bank holding company for Frost Bank, offering commercial and consumer banking services in Texas with a market cap of $7.90 billion.

Operations: Cullen/Frost Bankers, Inc. generates revenue through its primary segments: Banking with $1.88 billion and Frost Wealth Advisors contributing $211.47 million.

Dividend Yield: 3.2%

Cullen/Frost Bankers provides a stable dividend yield of 3.19%, supported by a payout ratio of 41.4%, indicating strong coverage by earnings. Despite its lower yield compared to top-tier dividend payers, the company has consistently grown its dividends over the past decade with minimal volatility. Recent earnings growth and declared cash dividends further solidify its position as a reliable choice for investors seeking steady income from regional banks in the U.S.

- Click here to discover the nuances of Cullen/Frost Bankers with our detailed analytical dividend report.

- Our valuation report here indicates Cullen/Frost Bankers may be overvalued.

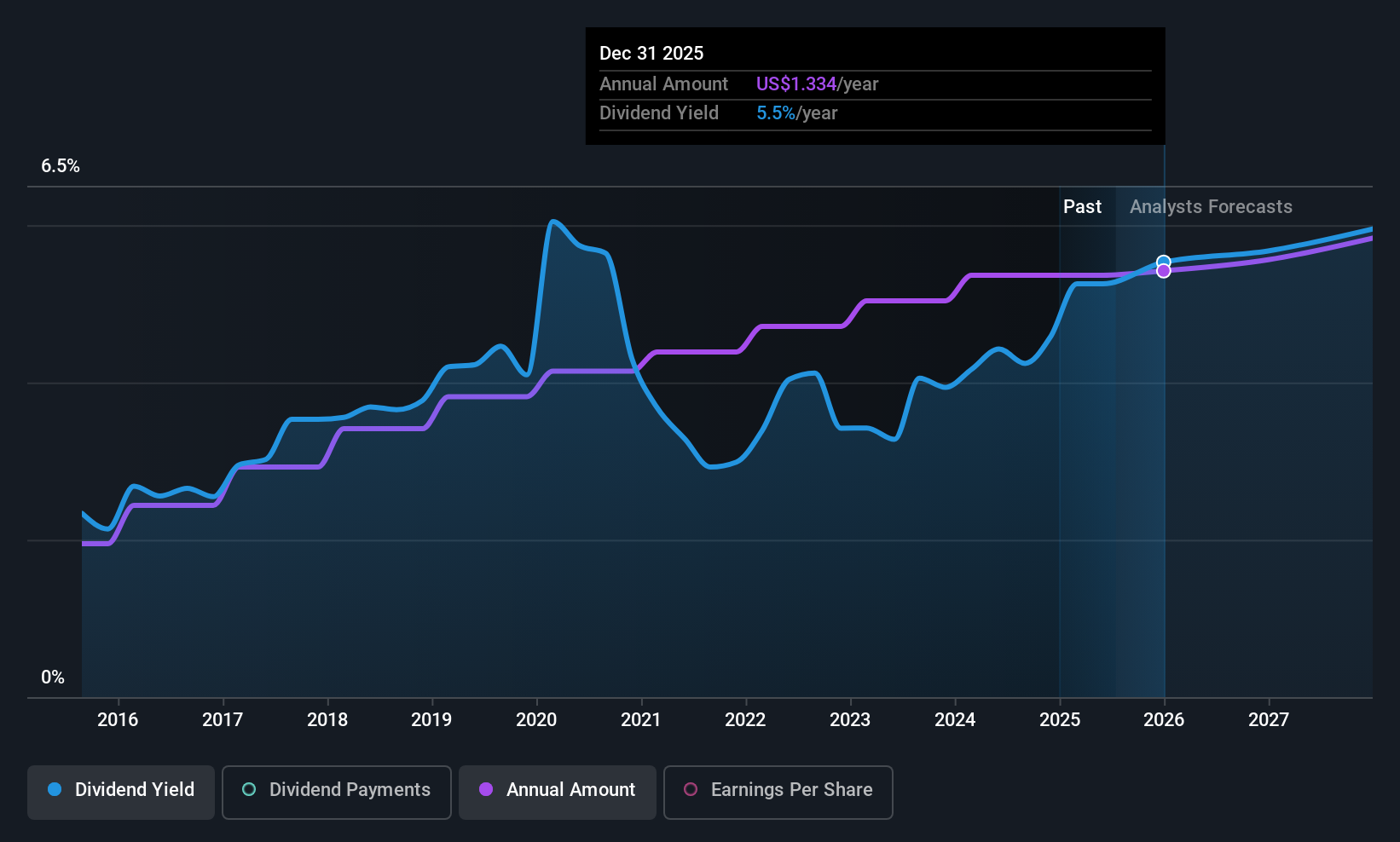

Interpublic Group of Companies (IPG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Interpublic Group of Companies, Inc. is a global provider of advertising and marketing services with a market cap of approximately $9.57 billion.

Operations: Interpublic Group of Companies generates revenue through three main segments: Media, Data & Engagement Solutions ($4.03 billion), Integrated Advertising & Creativity Led ($3.39 billion), and Specialized Communications & Experiential Solutions ($1.43 billion).

Dividend Yield: 5.1%

Interpublic Group of Companies offers a dividend yield in the top 25% of U.S. payers, yet its sustainability is questionable due to high payout ratios not fully covered by earnings. While the company has maintained stable and growing dividends over the past decade, recent financial challenges include declining profit margins and revenue drops. The selection as Bayer's global agency partner could bolster future prospects, but its removal from the FTSE All-World Index may affect investor sentiment.

- Delve into the full analysis dividend report here for a deeper understanding of Interpublic Group of Companies.

- The analysis detailed in our Interpublic Group of Companies valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Investigate our full lineup of 136 Top US Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal