Is Diebold Nixdorf Stock Attractive After 29% Rally and New Q1 Earnings Report?

If you have been eyeing Diebold Nixdorf’s stock and wondering whether now is the right time to move, or if the train has already left the station, you are not alone. In just the last year, shares have gained 19.6%, and year-to-date performance is even stronger, up 29.2%. This is despite a rougher patch in recent weeks, with the stock slipping 5.7% over the past 7 days and showing a 7.8% drop in the last month. After such a strong start to the year, it is normal for investors to ask if this is a healthy pause or a warning sign. Some market watchers have linked the recent near-term volatility to broader sector jitters rather than anything specific to Diebold Nixdorf’s core prospects, suggesting the fundamentals could remain intact.

What really jumps out, though, is the company’s valuation score: a perfect 6 out of 6 across multiple checks for undervaluation. That is a rare achievement, and one that demands a closer look. How do different valuation approaches stack up for Diebold Nixdorf, and can they help explain whether this rally still has room to run? In the next section, I will dig into the numbers and methods behind that valuation score. But stick around, at the end, I will share what I believe is the smartest way to size up Diebold Nixdorf’s value right now.

Approach 1: Diebold Nixdorf Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting all expected future cash flows and discounting them back to today's value. For Diebold Nixdorf, this involves analyzing its Free Cash Flow (FCF) trend and forecasting how these cash flows might evolve in the years ahead, all in US dollars.

Currently, Diebold Nixdorf is generating $179 million in Free Cash Flow. Analyst expectations and modeled projections see this growing consistently over the next decade, with FCF expected to reach around $255 million by 2026 and rising to nearly $498 million by 2035. While analysts only supply five-year estimates, the following years have been mathematically extrapolated for a longer-term view.

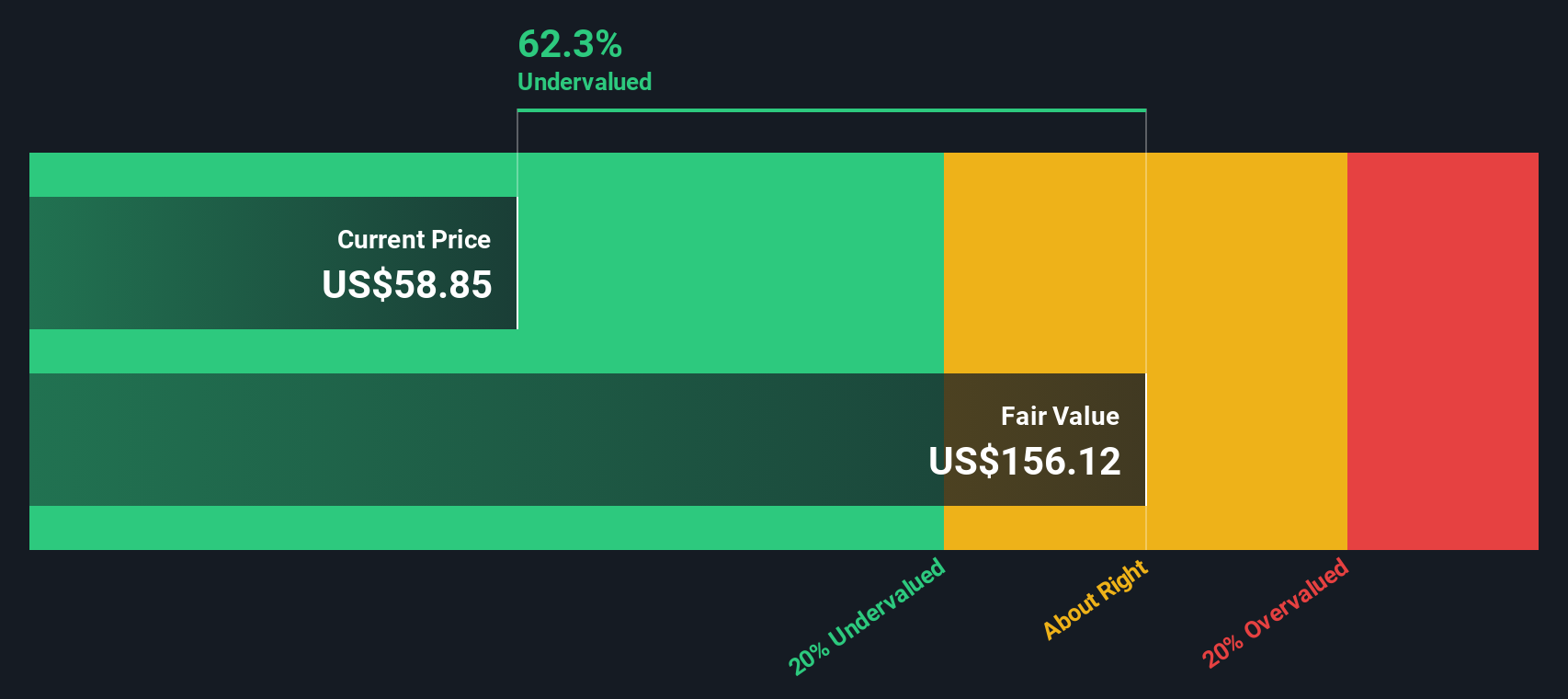

Running these figures through a two-stage DCF model yields an estimated intrinsic value of $157.11 per share. This calculation indicates a significant implied discount, suggesting the stock is 65.1% undervalued based on current market prices.

In sum, the DCF model presents a valuation picture for Diebold Nixdorf that indicates potential upside. If these cash flow projections are realized, investors at current levels may benefit from this valuation gap.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Diebold Nixdorf is undervalued by 65.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Diebold Nixdorf Price vs Sales

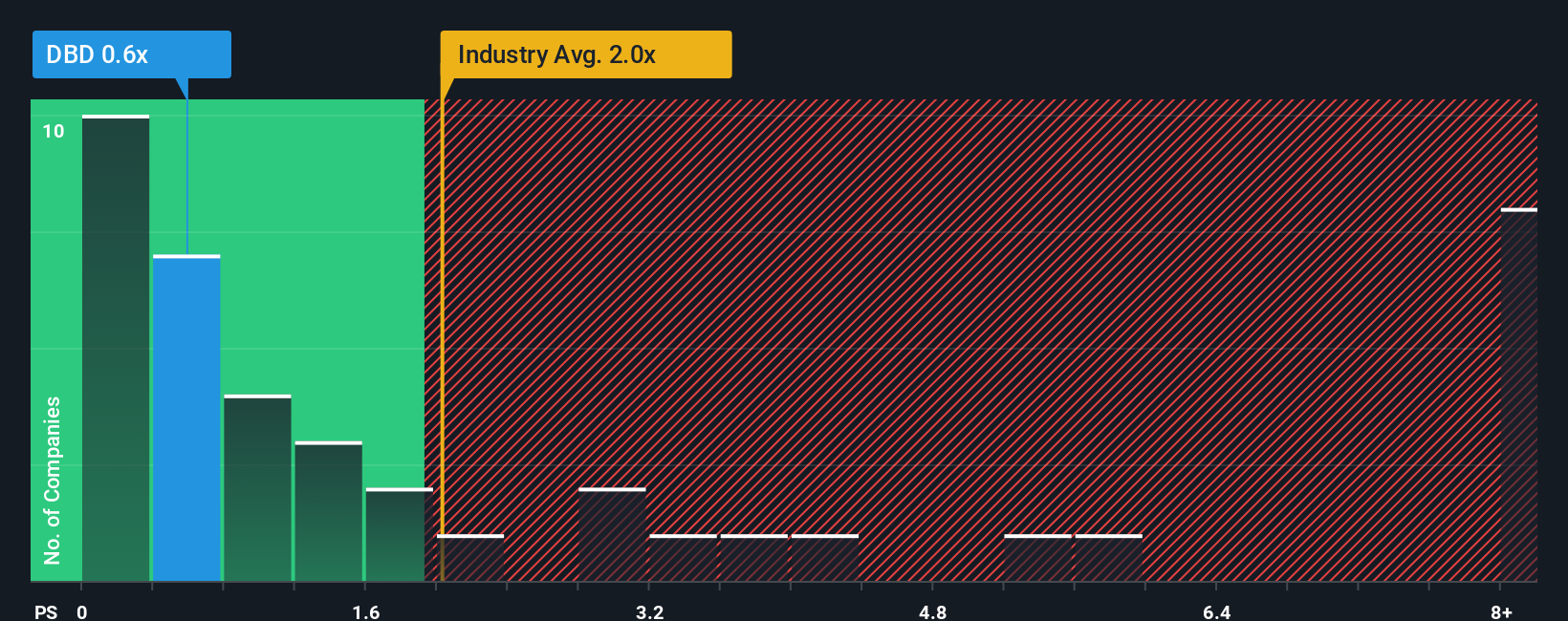

The Price-to-Sales (P/S) ratio is a widely used metric for valuing companies in the tech sector, especially when profits are volatile or negative and revenue provides a more stable base for analysis. For growing or restructuring businesses like Diebold Nixdorf, focusing on sales can offer a clearer read on valuation than earnings-based metrics, as revenue is less affected by short-term swings or one-time charges.

Typically, a “normal” or “fair” P/S multiple is shaped by growth expectations and perceived risk. Faster-growing, more stable businesses can justify higher P/S ratios, while slow-growers or riskier companies tend to trade at lower multiples. Diebold Nixdorf currently trades at a P/S of 0.55x, which stands out compared to both the tech industry average of 2.33x and its listed peers at 2.25x. That is a significant discount at face value, suggesting the market sees more risk or less growth here compared to others in the sector.

However, Simply Wall St’s proprietary “Fair Ratio” for Diebold Nixdorf is 1.01x. This metric looks beyond simple peer or industry averages and adjusts for specific factors, including Diebold’s earnings potential, profit margins, market cap, and its risk profile. By accounting for these elements, the Fair Ratio provides a much more tailored benchmark for what counts as “reasonable” for this particular company.

Comparing Diebold Nixdorf’s actual P/S of 0.55x to its Fair Ratio of 1.01x, the stock appears undervalued by this measure. The discount is more than justifiable by industry fundamentals. It may represent an opportunity for investors comfortable with the company’s specific risks and outlook.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Diebold Nixdorf Narrative

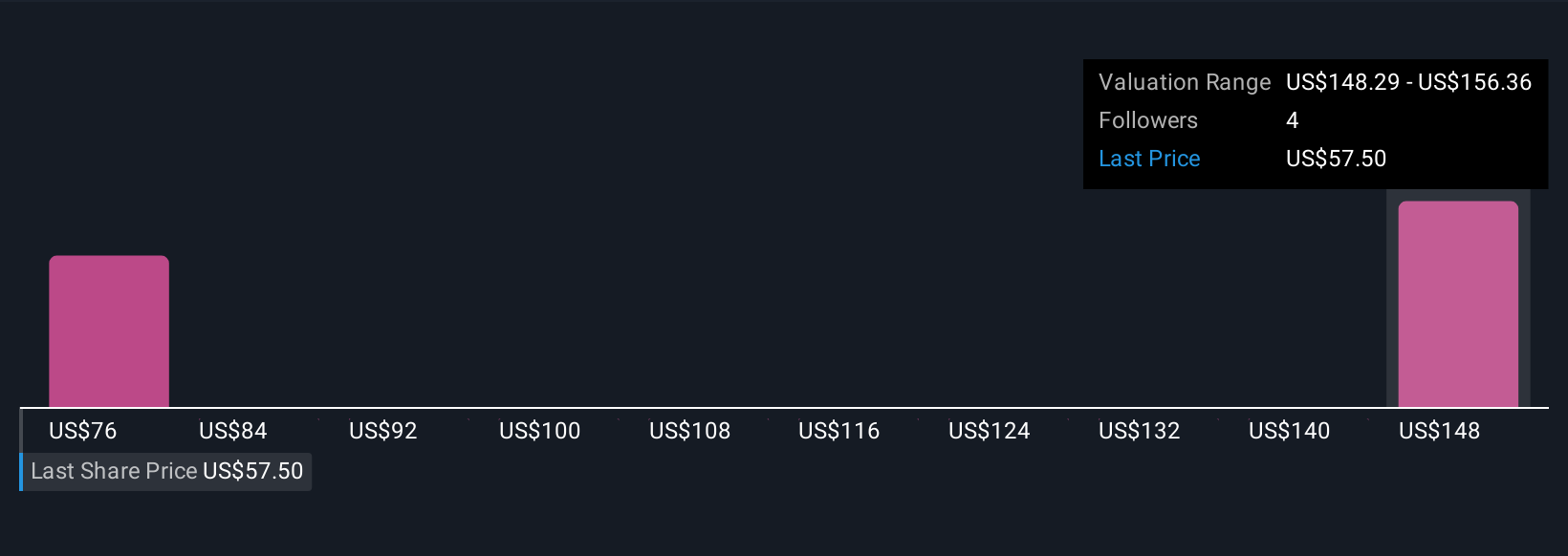

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply a story you tell about a company, your perspective on where it is headed, supported by your assumptions about its future revenue, margins, and fair value. Narratives link the company’s big-picture story to a financial forecast and then to an actionable estimate of what the stock could be worth.

This approach isn’t reserved for experts. On Simply Wall St’s Community page, millions of investors use Narratives as an easy, structured way to lay out their viewpoints, track them over time, and compare them to others. Narratives help you make more informed buy or sell decisions by automatically comparing each Fair Value to the current share price, so you see immediately what different investor perspectives imply. Best of all, Narratives are kept up to date as new information comes in, including earnings or news events, ensuring your view stays relevant.

For example, some investors see Diebold Nixdorf’s transformation and forecast aggressive market expansion, projecting a fair value closer to $157, while others adopt a more cautious stance, looking for $75 based on risks from digital disruption and margin headwinds.

Do you think there's more to the story for Diebold Nixdorf? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal