Nucor (NUE): Evaluating Valuation After Nuclear Supply Chain Partnership and U.S. Energy Infrastructure Push

The Nuclear Company and Nucor (NUE) have teamed up through a new partnership, aiming to jump-start the U.S. nuclear supply chain and advance certified steel manufacturing for future energy infrastructure projects. This agreement follows recent federal policy directives.

See our latest analysis for Nucor.

Nucor’s share price has climbed over 20% year-to-date as investors anticipate gains from infrastructure spending, but recent choppiness, including a 2% slide in the past month, reflects mixed market sentiment. Over the past year, despite strong sales growth and bullish developments like the new strategic alliance, the company’s total shareholder return is still down nearly 7%. However, long-term returns remain stellar, up more than 200% over five years. Momentum appears in flux, and upcoming results may prove pivotal in setting the trend.

If Nucor’s positioning in America’s manufacturing resurgence has you interested, consider broadening your search and discover fast growing stocks with high insider ownership

With Nucor’s stock trading at a discount to analyst targets and federal initiatives driving renewed growth, is there value left for investors, or is Wall Street already factoring in the next upswing?

Most Popular Narrative: 13.5% Undervalued

With Nucor closing at $138.17 and the narrative placing fair value at $159.75, current pricing trails well behind optimistic future projections. This disconnect creates a storyline shaped by major strategic moves and evolving market policy.

Nucor's significant capital reinvestment of $860 million, with two-thirds directed towards projects commencing operations within two years, is expected to diversify and strengthen future earnings. This impacts revenue and net margins through enhanced production capacity and efficiencies.

Curious what’s fueling the gap between analysts’ high hopes and today’s modest price? The real turning point lies in eye-catching growth projections, ambitious margin targets, and a profit multiple that is tough to ignore. Uncover the assumptions behind this fair value call.

Result: Fair Value of $159.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro-economic uncertainty and execution risks from new project launches could quickly challenge these bullish assumptions and shift the outlook for Nucor.

Find out about the key risks to this Nucor narrative.

Another View: What About the Market’s Multiple?

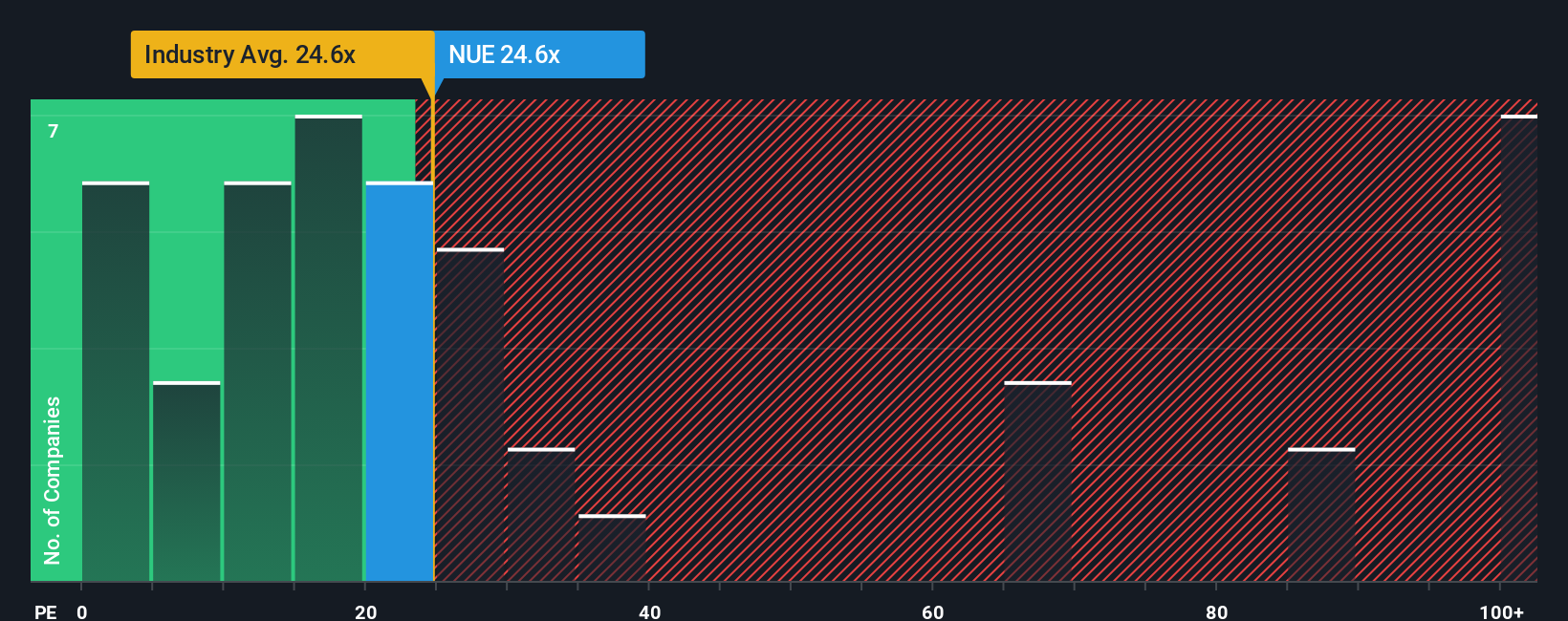

Looking at Nucor through the lens of its price-to-earnings ratio, the stock sits at 24.6x earnings, similar to the U.S. Metals and Mining industry average of 24.6x. This is far below peers that average 58x. Notably, the fair ratio for Nucor is estimated at 37.2x, hinting at possible upside, but also highlighting valuation risk if industry sentiment shifts. Could the market be missing an opportunity, or is it simply more cautious given Nucor’s recent profit swings?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nucor Narrative

If you’d rather dig into the figures yourself or have your own perspective to share, you can chart your own narrative in just a few minutes with Do it your way.

A great starting point for your Nucor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit their options, so don’t let overlooked opportunities slip by. Expand your portfolio horizons with these handpicked trends before the next wave hits.

- Capture potential tech breakthroughs by screening for innovation with these 25 AI penny stocks already gaining industry momentum.

- Unlock attractive yields and supercharge your returns by searching for income leaders in these 18 dividend stocks with yields > 3%.

- Catch early-stage growth stories by targeting value and agility with these 3575 penny stocks with strong financials paving the way for tomorrow’s market leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal