Worthington Enterprises (WOR) Margin Surge Challenges Concerns Over One-Off Impacts

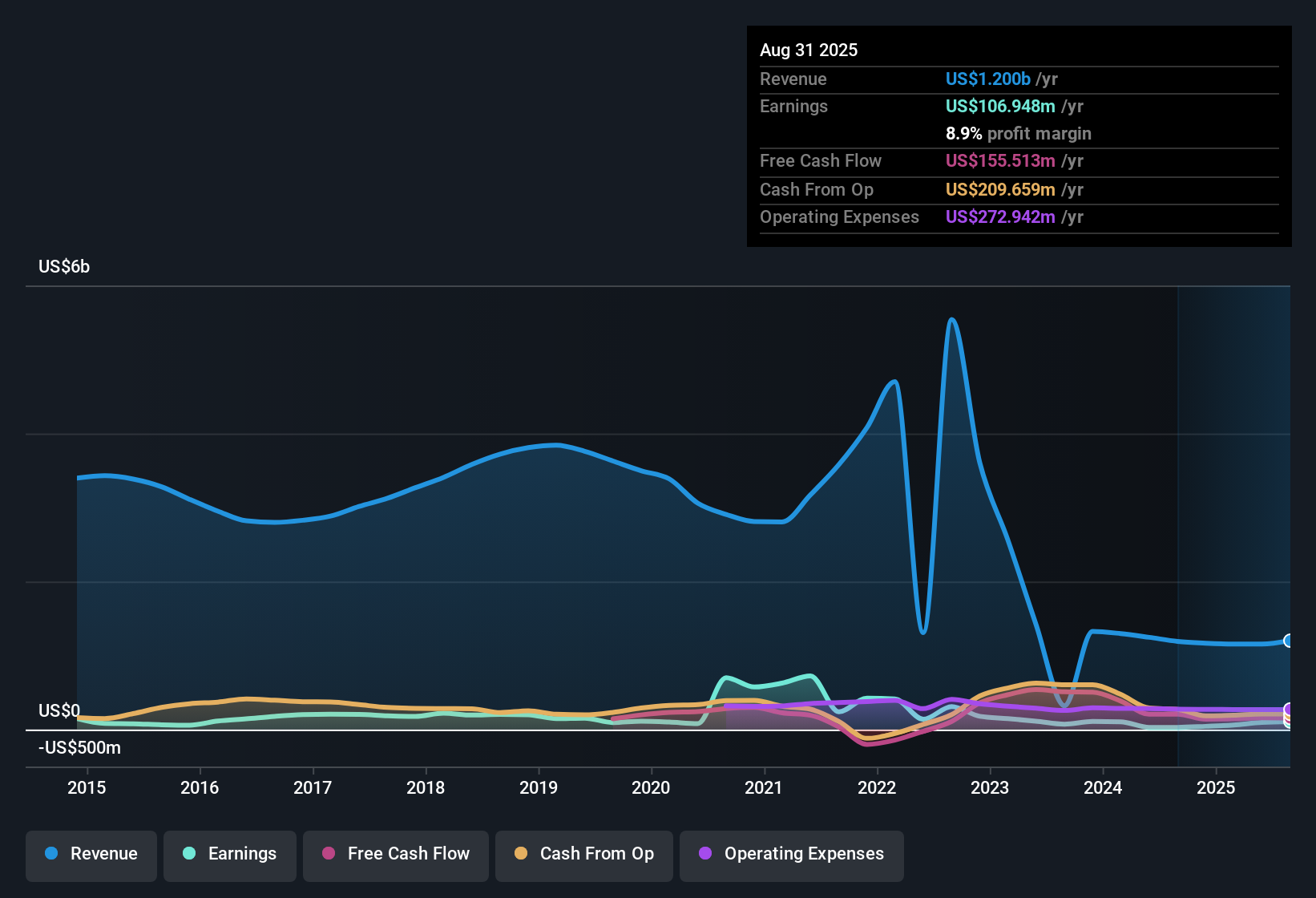

Worthington Enterprises (WOR) saw a sharp turnaround in its latest results, recording net profit margins of 8.9%, a big jump from last year’s 2.4%. Even after factoring in a one-off $67.7 million loss that weighed on recent results, earnings have grown an eye-catching 271.3% year over year, reversing several years of declines. Looking ahead, analysts expect annual earnings growth of 15.18%, with revenue projected to climb 5.7% per year. Both of these figures trail the wider US market’s pace. Shares currently trade at $55.7, well below the estimated fair value of $94.61, despite a price-to-earnings ratio of 25.9x that sits under the peer average but above the sector. Investors will be weighing decent growth prospects against the effect of non-recurring items on recent earnings quality.

See our full analysis for Worthington Enterprises.The next section looks at how these numbers compare with the most widely followed narratives on Worthington Enterprises, exploring where the data backs up market chatter and where it might raise fresh questions.

See what the community is saying about Worthington Enterprises

Margin Expansion Signals Stronger Core Operations

- Net profit margins jumped to 8.9% from 2.4% a year ago. This rise stands out even after accounting for a $67.7 million one-off loss that affected results.

- Analysts' consensus view points to operational efficiency initiatives, such as facility modernization and automation, as key drivers behind the healthier margin.

- Consensus narrative notes that these efficiency efforts and higher-margin acquisitions like Ragasco are expected to further lift net margins, possibly reaching 14.9% in three years.

- What is surprising is that, despite short-term pressure from one-time expenses, analysts largely agree on a multi-year improvement in underlying profitability.

- To see how bears and bulls debate these margin trends, read the full consensus narrative for Worthington Enterprises. 📊 Read the full Worthington Enterprises Consensus Narrative.

Forecasts Trail Market Yet Point Upwards

- Projected earnings and revenue growth for Worthington Enterprises are 15.18% and 5.7% per year, respectively. Both figures are lower than the US market averages of 15.4% and 9.9%.

- Analysts' consensus view holds that new product launches and expanded distribution partnerships (like those with Tractor Supply and Walmart) will gradually accelerate growth.

- Consensus narrative highlights that innovation via new IoT-enabled products is forecasted to bump future revenues, but pressure from market and trade challenges could keep growth just under the wider market pace.

- Consensus also acknowledges that revenue expansion, though healthy, may lag due to industry-specific and broader macro risks such as shifting consumer sentiment.

Discount to DCF Fair Value Despite Above-Average P/E

- Shares trade at $55.7, below the DCF fair value of $94.61. The P/E ratio of 25.9x is lower than the peer average of 37.4x but higher than the US Machinery industry’s 24.7x.

- Analysts' consensus view argues that the relatively modest gap between share price and consensus price target (8.3% upside) suggests much of the expected profit improvement is already reflected.

- Consensus narrative points out that for the current price to be justified, Worthington would need to hit $213.4 million in earnings and trade at a future P/E of 19.6x, a drop from today’s valuation multiples.

- What is notable is that the DCF fair value signals larger potential upside than the analyst target, spotlighting a debate around which method better captures Worthington’s growth runway and risks from one-off hits to earnings quality.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Worthington Enterprises on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Bring your perspective to life by building your own narrative in just a few minutes: Do it your way.

A great starting point for your Worthington Enterprises research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Worthington Enterprises’ revenue and earnings growth are forecast to lag broader market averages, with profits pressured by one-off expenses and sector-specific risks.

If you want a smoother ride, focus on companies known for consistent performance by using our stable growth stocks screener to spot those with reliable growth across good times and bad.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal