Stock Market Today: S&P 500, Nasdaq Futures Tumble As Fed Minutes Signal Tariff-Related Uncertainty—PepsiCo, Delta Air Lines, Levi Strauss In Focus

U.S. stock futures fell on Thursday following Wednesday’s mixed close. Futures of major benchmark indices were lower.

The AI frenzy is still in full swing. Advanced Micro Devices Inc. (NASDAQ:AMD) surged over 11%, while Micron Technology Inc. (NASDAQ:MU) gained around 6% on Wednesday.

Meanwhile, the Fed minutes released on Wednesdays showed that President Donald Trump‘s trade tariffs continue to weigh on the outlook for growth and inflation, raising concerns over how long the Federal Reserve can stick with its planned cycle of interest rate cuts.

Additionally, Trump announced on Wednesday that both Israel and Hamas have agreed to the initial phase of a peace plan.

The 10-year Treasury bond yielded 4.13% and the two-year bond was at 3.59%. The CME Group's FedWatch tool‘s projections show markets pricing a 94.6% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | -0.02% |

| S&P 500 | -0.07% |

| Nasdaq 100 | -0.13% |

| Russell 2000 | -0.32% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell in premarket on Thursday. The SPY was down 0.040% at $673.11, while the QQQ declined 0.10% to $610.82, according to Benzinga Pro data.

Stocks In Focus

PepsiCo

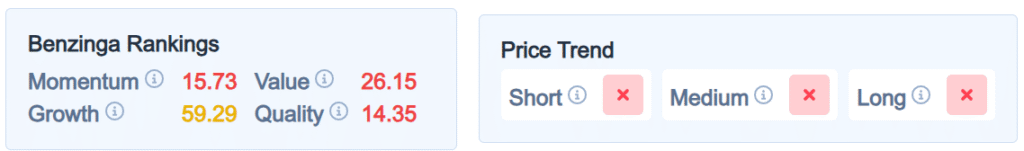

- PepsiCo Inc. (NASDAQ:PEP) was up 0.27% in premarket on Thursday, ahead of its earnings scheduled to be released before the opening bell. Analysts expect earnings of $2.26 per share on revenue of $23.83 billion.

- PEP maintained a weaker price trend over the short, medium, and long terms, with a poor quality ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Turn Therapeutics

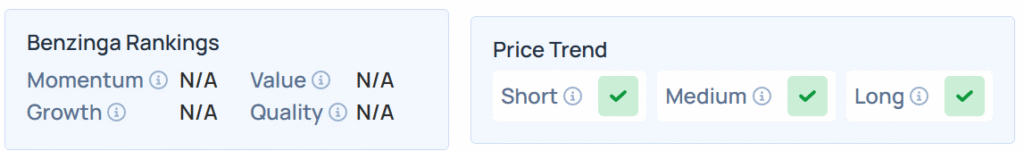

- Turn Therapeutics Inc. (NASDAQ:TTRX) surged 271.43% after the clinical-stage biotechnology company commenced trading on the Nasdaq Capital Market on Wednesday.

- Benzinga’s Edge Stock Rankings indicate that TTRX had a stronger price trend. Additional performance details are available here.

AiRWA

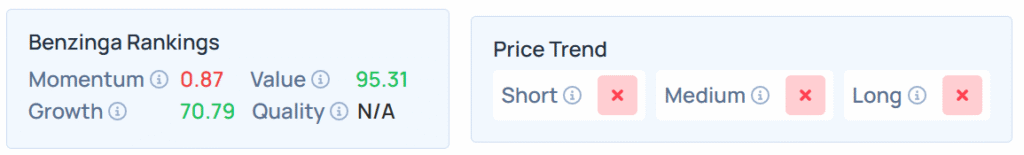

- AiRWA Inc. (NASDAQ:YYAI) gained 47.72% after the Maryland-based technology company rebranded itself from Connexa Sports Technologies Inc., marking a shift from sports technology to Web3 and blockchain-based financial services.

- YYAI maintained a weaker price trend over the short, medium, and long terms, with a strong value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Delta Air Lines

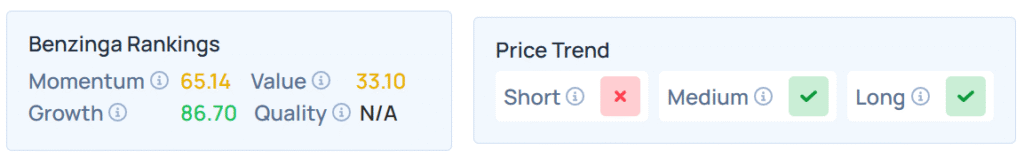

- Delta Air Lines Inc. (NYSE:DAL) was up 0.75% ahead of its earnings scheduled to be released before the opening bell. Analysts expect earnings of $1.52 per share on revenue of $15.04 billion.

- Benzinga’s Edge Stock Rankings indicate that DAL maintains a stronger price trend in the long and medium terms, but a poor price trend in the short term, with a moderate value ranking. Additional performance details are available here.

Levi Strauss

- Levi Strauss & Co. (NYSE:LEVI) was 0.32% higher as analysts expect it to post quarterly earnings of 31 cents per share on revenue of $1.50 billion after the closing bell.

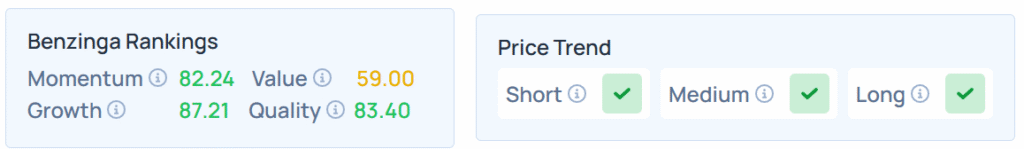

- LEVI maintained a stronger price trend over the short, medium, and long terms, with a robust growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Recording the biggest gains on Wednesday, industrials, information technology, and utilities stocks led most S&P 500 sectors to a positive close, though energy and financial stocks bucked the overall market trend and ended lower.

U.S. stocks settled mostly higher, with the Nasdaq Composite surging over 1% to fresh all-time intraday and closing highs following another relentless surge in technology stocks.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 1.12% | 23,043.38 |

| S&P 500 | 0.58% | 6,714.59 |

| Dow Jones | -0.0026% | 46,601.78 |

| Russell 2000 | 1.04% | 2,483.99 |

Insights From Analysts

Professor Jeremy Siegel remains “constructive on equities,” viewing them as looking “better than long bonds on a 6-12-month horizon”.

He sees the current “market uptrend remains intact with AI capex proceeding apace”. This positive outlook is tempered by a note of caution, as he is closely watching the “tariff test” this quarter to see how consumers and companies adapt to potential price increases and demand shifts.

Meanwhile, Darshan Desai, the CEO of Aspect Bullion & Refinery, said that gold prices were easing because of a peace deal between Israel and Hamas. He said that the deal eased demand for safe-haven assets.

“However, the main driver of the decline appears to be the technically overbought conditions in the bullion following the recent surge. If we see more positive developments in the Middle East or on the trade front, further upside in gold prices could be limited as investors would continue to lock in gains. That said, any sharp correction might offer a good buying opportunity given the continuing geopolitical & economic uncertainty,” he added.

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on Thursday;

- Federal Reserve Chair Jerome Powell will speak at 8:30 a.m. ET, initial jobless claims data for the week ending Oct. 4 will be delayed owing to the shutdown, and wholesale inventories data will be released at 10:00 a.m. ET.

- Federal Reserve Vice Chair for Supervision Michelle Bowman will speak at 8:35 a.m. and later at 3:45 p.m., Minneapolis Fed President Neel Kashkari and Fed Governor Michael Barr will speak at 12:45 p.m., and San Francisco Fed President Mary Daly will speak at 4:10 p.m. and later at 9:40 p.m. ET.

Commodities, Gold, Crypto And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 0.32% to hover around $62.68 per barrel.

Gold Spot US Dollar fell 0.08% to hover around $4,038.31 per ounce. Its last record high stood at $4,059.34 per ounce. The U.S. Dollar Index spot was 0.12% higher at the 99.0300 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.88% lower at $121,512.96 per coin.

Asian markets closed higher on Thursday, except Hong Kong's Hang Seng index. South Korea's Kospi, China’s CSI 300, Australia's ASX 200, Japan's Nikkei 225, and India’s NIFTY 50 indices rose. European markets were mixed in early trade.

Read Next:

Photo courtesy: Shutterstock

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal