Progyny (PGNY): A Fresh Look at Valuation as Analyst Outlook Sparks Renewed Investor Interest

Progyny (PGNY) is back in the spotlight after recent analyst commentary highlighted its favorable Zacks Rank and value grade. The focus on solid earnings estimates has sparked renewed investor interest in the fertility benefits company.

See our latest analysis for Progyny.

Progyny’s share price has experienced some turbulence lately, dipping nearly 10% over the past month. The stock still boasts a 16% gain year-to-date and a solid 1-year total shareholder return of 25%. Recent leadership recognition and a strong value rating appear to be fueling optimism about longer-term growth potential, even as near-term performance shows mixed momentum.

If Progyny’s renewed momentum has you thinking bigger, it could be the perfect time to discover other innovators through our See the full list for free.

With shares trading well below analyst price targets and boasting strong recent earnings growth, investors may be wondering if the current dip is a rare buying opportunity or if the market is already factoring in Progyny’s future potential.

Most Popular Narrative: 27% Undervalued

Progyny’s fair value, according to the most widely followed narrative, sits far above its recent close. This highlights a striking divergence between market price and long-term projections. With growth themes dominating the story, the narrative features a catalyst within the company’s evolving service offering.

Investment in an integrated women's health platform (including new services such as pelvic floor therapy, leave navigation, and enhanced digital engagement) positions Progyny to cross-sell adjacent products. This results in a higher share of wallet with current clients and additional revenue streams, supporting both topline and margin expansion.

What is the secret behind this optimistic valuation? One key detail is that the narrative is betting on accelerated earnings growth and expanding profit margins, driven by new service pillars. Want to see which numbers power that bold price target? The full narrative reveals the financial leap analysts are counting on.

Result: Fair Value of $28.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, broad-based employer benefit cutbacks or an unexpected uptick in competition could quickly challenge the current bullish outlook for Progyny’s future growth.

Find out about the key risks to this Progyny narrative.

Another View: What Do Earnings Ratios Say?

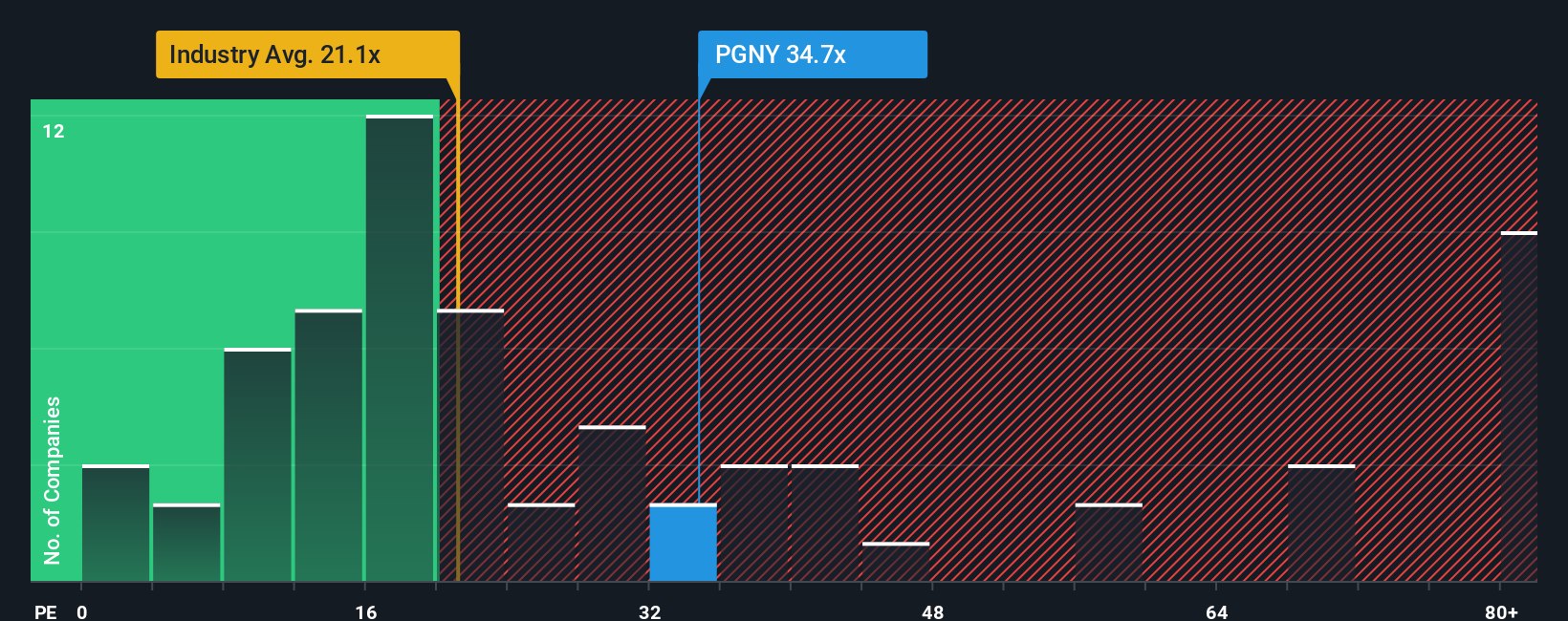

While some investors see strong upside based on future earnings growth, others point out that Progyny’s share price currently sits much higher than both its industry peers and its own fair ratio. With a price-to-earnings ratio of 33.3x compared to the industry’s 21.6x, and even further above its fair ratio of 25.3x, this suggests the market has priced in a fair amount of future optimism. Does this premium represent justified confidence, or could it be a source of risk if growth falls short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Progyny Narrative

If you think there’s another angle the market is missing or want to dive into the numbers yourself, you can build your own view in minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Progyny.

Looking for More Investment Ideas?

Don’t let the next big winner slip past you. Stay ahead of the curve and boost your portfolio by tapping into real-world growth stories with these powerful screeners:

- Capture sustainable yields and unlock potential with these 19 dividend stocks with yields > 3% offering more than 3% returns right now.

- Ride the innovation wave by targeting breakthrough companies powering the future in these 25 AI penny stocks.

- Seize opportunities others miss with these 887 undervalued stocks based on cash flows that have strong fundamentals and attractive upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal