Andersons (ANDE) Valuation: Is There More Upside After a 10% Three-Month Gain?

See our latest analysis for Andersons.

While Andersons' share price has been trending higher recently, broader context shows that momentum has only modestly returned after a rocky year. Despite a 9.9% share price gain over the past three months, the one-year total shareholder return is still down 13.5%. This suggests that recent optimism may be driven by renewed confidence in its growth potential or an improving risk outlook.

If Andersons’ shift in fortunes has you wondering what other opportunities are out there, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With Andersons’ share price close to analyst targets and recent gains already factored in, the key question now is whether the stock remains undervalued or if the market has already priced in its future growth potential.

Most Popular Narrative: 10.1% Undervalued

The most widely followed narrative places Andersons’ fair value at $46.67, which is meaningfully above its latest close of $41.94. This hints at overlooked upside compared to today’s market price. This sets the stage for a story shaped by major expansion bets and growth-focused investments driving future performance.

Full ownership of ethanol plants and carbon initiatives enhance cash flow, tax benefits, and profit margins as regulatory support grows for renewable fuels. Strategic grain processing investments, logistics upgrades, and exiting low-margin businesses target higher profits and greater international growth opportunities.

Curious what numbers fuel this bullish view? There is a bold bet on future profit margins and ambitious revenue expansion, plus a profit multiple that suggests investors expect a big transformation. Only the full narrative reveals what underlying assumptions drive that target price.

Result: Fair Value of $46.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising debt from expansion and volatile commodity prices could challenge Andersons’ growth story if earnings do not improve as forecasted.

Find out about the key risks to this Andersons narrative.

Another View: Typical Ratios Paint a Cautious Picture

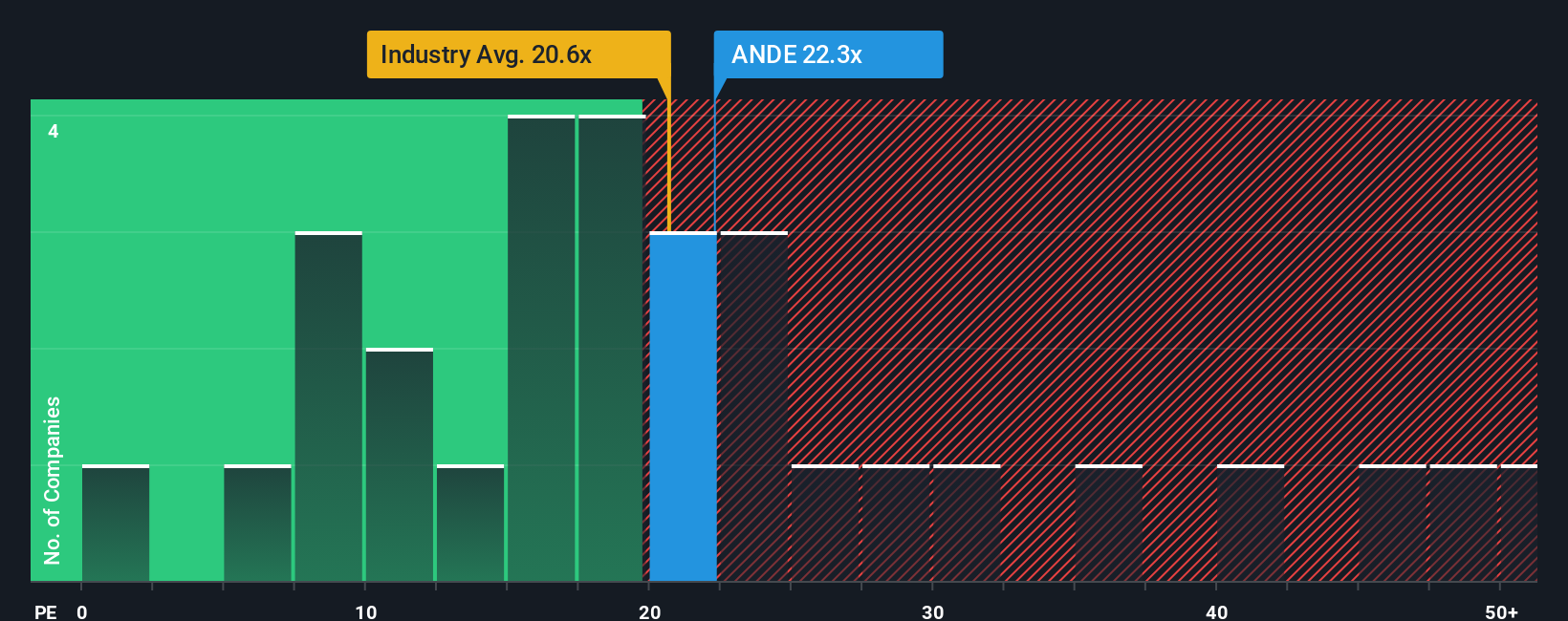

Stepping away from growth forecasts, traditional value indicators suggest Andersons is trading at a price-to-earnings ratio of 17.7 times, which is lower than the industry average of 20.5 times and well below the peer average of 26.2 times. Compared to its fair ratio of 24.8 times, there may be some headroom, but it also leaves questions about why the market is more cautious. What risk or doubt is holding the price back?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Andersons for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Andersons Narrative

If you see the story differently or want to dig into the numbers on your own terms, you can shape your own analysis in just a few minutes, Do it your way

A great starting point for your Andersons research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Level up your portfolio right now with these unique stock searches that target some of today’s most promising markets:

- Target unstoppable potential by scanning for these 898 undervalued stocks based on cash flows that experts believe are trading at a discount to their true worth.

- Accelerate your growth strategy when you spot these 25 AI penny stocks primed to power the future of artificial intelligence innovation.

- Secure reliable income streams as you tap into these 19 dividend stocks with yields > 3% that consistently reward shareholders with robust yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal