Assessing Progyny’s 71% Price Gap Following Analyst Upgrades in 2025

If you are on the fence about Progyny, you are not alone. Investors are weighing whether to stick with this fertility benefits innovator or look for opportunities elsewhere. If you have watched the stock chart lately, you know it has been anything but smooth. Over the past week, Progyny dipped 7.1%, and it is down 11.3% for the past month. That might sound troubling, but zoom out and the story is surprisingly nuanced. Progyny is still up 12.8% year-to-date and a solid 22.5% over the past year. However, longer-term holders have experienced more turbulence, with three- and five-year returns sitting at -47.8% and -31.6% respectively.

Some of this whiplash can be traced to shifting perceptions of risk in the digital health and benefits space as the market digests broader sector moves and regulatory updates. Despite all the volatility, interest in Progyny’s growth potential has never fully disappeared. The company operates in a sector where demographic trends and employer interest keep the spotlight on innovation.

When it comes to valuation, Progyny currently scores a 3 out of 6 on a popular multi-check system for identifying undervalued stocks. That shows it has some attractive value signals, but the story does not end there. Up next, we will break down exactly what goes into that valuation score and how each method measures up for Progyny. If you are looking for the most insightful way to think about this company’s true worth, stick around for the wrap-up at the end.

Approach 1: Progyny Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to their present value. This method is widely used to understand whether a stock is undervalued or overvalued based on its long-term earning power rather than short-term market movements.

For Progyny, the analysis starts with a current Free Cash Flow (FCF) of $194.87 million. Projections show FCF is expected to rise steadily, reaching an estimated $293.91 million by 2035. While analyst estimates extend through 2029, future numbers beyond that are extrapolated using modest growth assumptions. All figures remain in the millions to provide a clear picture of Progyny's growing cash generation capability over time.

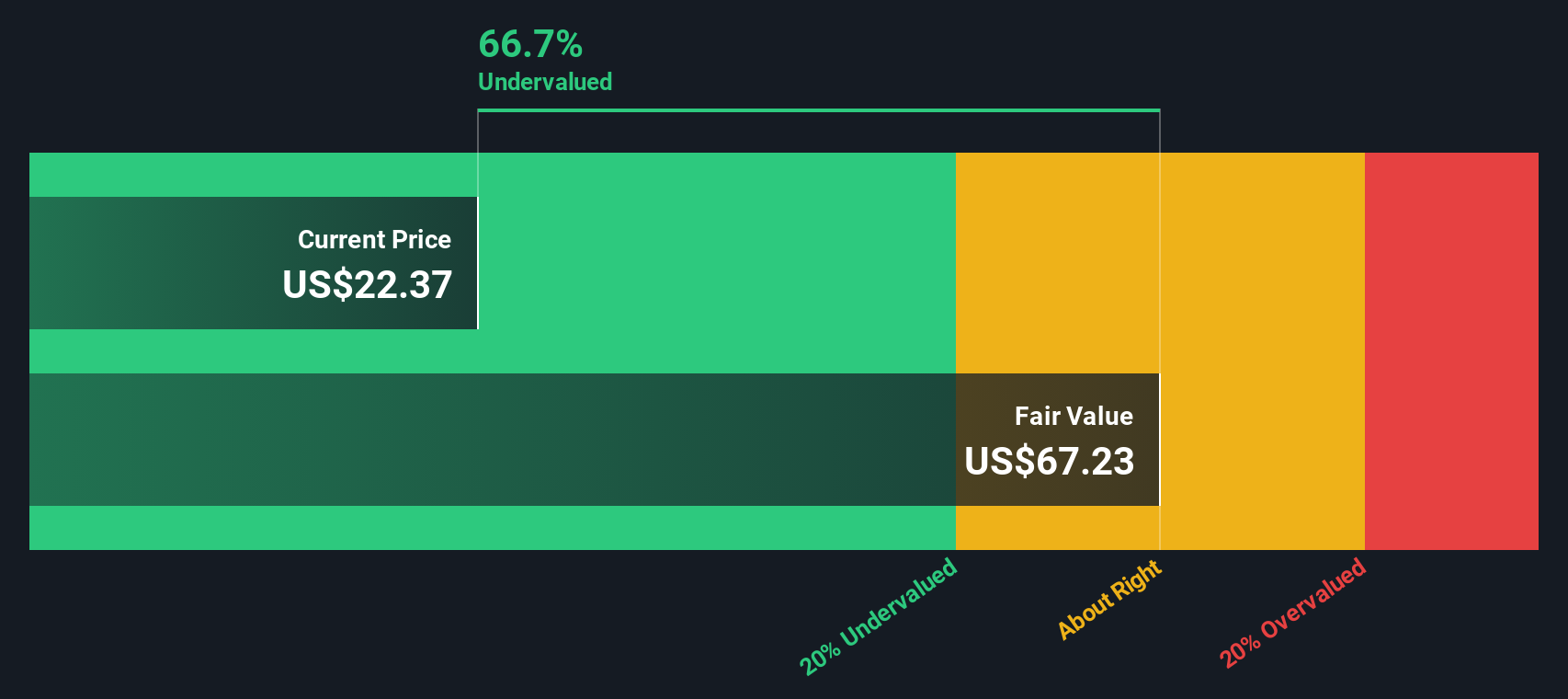

Based on these cash flows, Progyny's intrinsic value is calculated at $69.42 per share. Compared to its current share price, this DCF suggests the stock is trading at a 71.2% discount to its estimated underlying worth. This analysis highlights the potential for investors willing to look past short-term volatility and focus on long-term fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Progyny is undervalued by 71.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Progyny Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies such as Progyny, as it relates the company's share price directly to its earnings. This multiple is especially meaningful when a business has a consistent profit history because it captures investor expectations about growth and risk. When a company is growing quickly or seen as less risky, a higher PE is typically justified, while slower growth or more uncertainty can push the appropriate multiple lower.

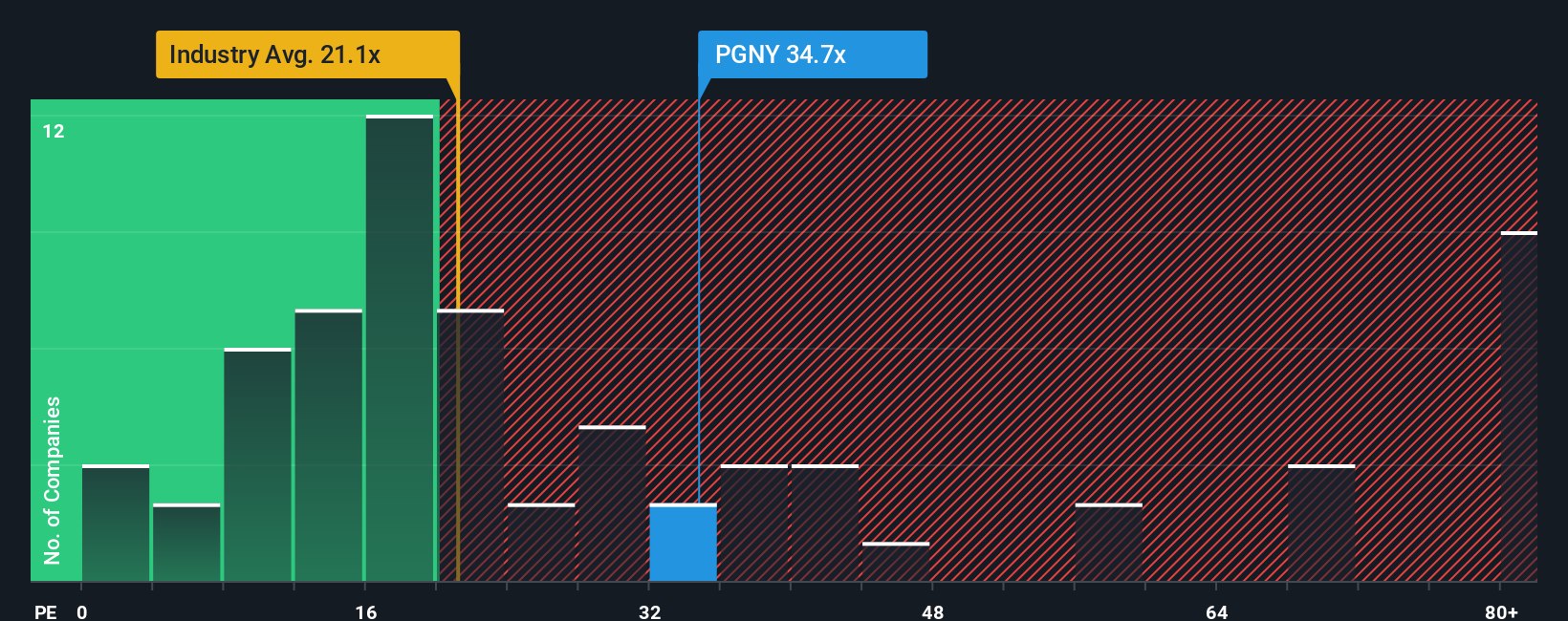

Progyny currently trades at a PE ratio of 32x. That's noticeably above the healthcare industry average of 21x and also higher than its peer average of 23x. While sticker shock is understandable, raw comparisons like these can miss the nuance of Progyny's unique growth trajectory and risk profile. That is where the “Fair Ratio” comes in, a proprietary benchmark from Simply Wall St. This figure accounts for more than just comparable stocks, incorporating earnings growth forecasts, profit margin, company size, market risk factors, and the characteristics of Progyny's specific industry.

For Progyny, the Fair Ratio clocks in at 25x. Because this is still below the current multiple of 32x, the implication is that the market price is running a bit hot compared to a balanced view of growth and risk factors unique to Progyny. In essence, while the company deserves a premium for its growth, investors are paying even more than these fundamentals would suggest.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Progyny Narrative

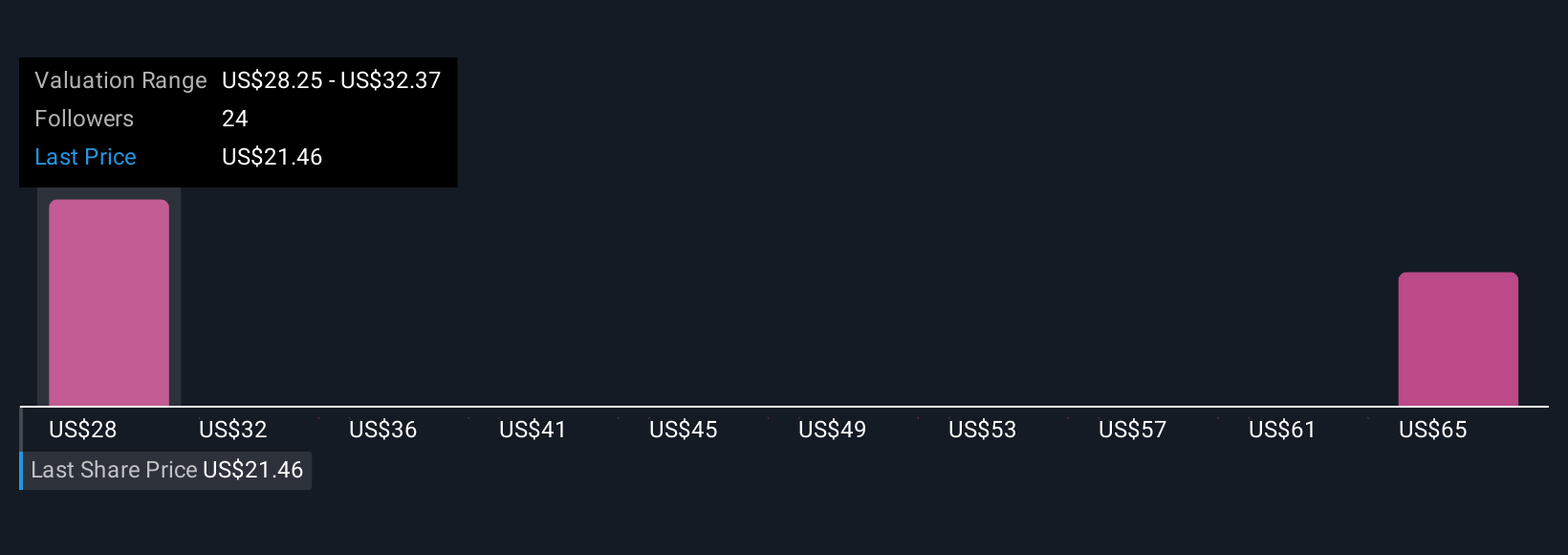

Earlier we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives, a fast and intuitive way to combine your view of Progyny’s story with a financial forecast and a fair value estimate directly on Simply Wall St’s Community page.

A Narrative is simply your personal explanation of what you think is driving Progyny’s future, paired with your own expectations for its revenue, earnings, and profit margins. It then calculates a fair value from your forecast, helping you decide whether the current share price is above or below what you think the business is truly worth. Narratives bring the numbers to life by connecting the bigger picture, such as industry trends or company strategy, with real accounting and up-to-date market data.

Best of all, Narratives update automatically as new news, earnings, or forecasts are released, so your thesis always stays fresh. For example, one investor might see the rising demand for women’s health and strong client growth as reasons to set a fair value of $32.00. Another, more cautious about competition and cost pressures, might put that fair value at just $23.00.

With Narratives, you can easily compare your thesis to the latest consensus, share your view with the Simply Wall St community, and make buy or sell decisions that truly suit your perspective.

Do you think there's more to the story for Progyny? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal