Figma (FIG): Assessing Valuation After a 7% Share Price Jump

Figma (FIG) stock drew attention today after its most recent trading session saw a 7% jump. Investors are taking a fresh look at the company, examining recent results and sentiment as the software sector experiences shifts.

See our latest analysis for Figma.

Figma’s 7% jump today has many wondering if momentum is shifting after what has been a relatively muted year for the stock. While the 1-month and 7-day share price returns have seen modest gains, the year-to-date share price return remains slightly negative. This suggests investors are reassessing the company's prospects amid broader sector dynamics and recent shifts in sentiment.

If you’re ready to see what’s next in the world of tech and software, it might be the perfect moment to discover See the full list for free.

The question now is whether Figma’s recent jump signals that the market is undervaluing the company, or if the current price already reflects all the growth that lies ahead. This would leave little room for upside.

Most Popular Narrative: 13.3% Undervalued

Figma’s last close at $56.96 sits noticeably below the narrative’s estimated fair value of $65.70. This indicates potential for upside if the assumptions in play are accurate. The narrative, authored by TickerTickle, outlines the mechanisms that might unlock this higher valuation and what sets Figma apart as the sector evolves.

AI-driven product expansion: Buzz, Make, Sites, Slides, and Draw launched with AI features and deep integration. Enterprise adoption: 13M+ active users and approximately 95% of Fortune 500 companies use Figma.

What’s behind this bullish target? The fair value is powered by ambitious projections for profit margins and forward earnings multiples rarely seen outside the fastest-growing software stories. Curious about which numbers really drive this narrative? The full breakdown reveals growth levers that could surprise even confident bulls.

Result: Fair Value of $65.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if major rivals advance their AI features or if Figma’s growth slows down, the market’s view on its valuation could quickly change.

Find out about the key risks to this Figma narrative.

Another View: Discounted Cash Flow Model Raises Doubts

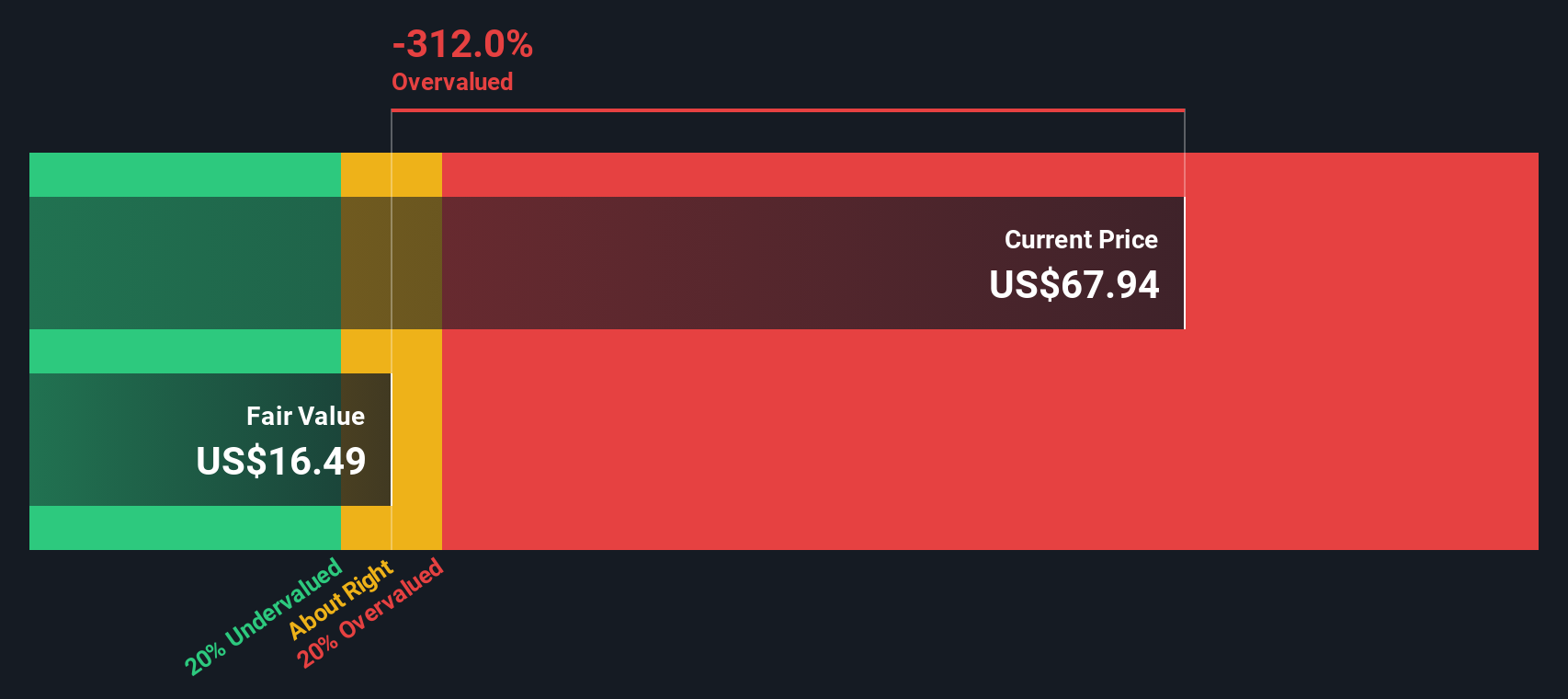

While the narrative method suggests Figma is undervalued, our DCF model tells a very different story. According to this approach, Figma’s current price of $56.96 is far above the DCF estimated fair value of $16.47. Is the market too optimistic about growth, or is the model missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Figma for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Figma Narrative

If you think differently or want to dive into the numbers yourself, you can craft a narrative in just minutes. Do it your way.

A great starting point for your Figma research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Smart Opportunities?

Don’t let your next winning stock slip through your fingers. These handpicked ideas show where other investors are looking for tomorrow’s growth and resilient income. Take control of your portfolio by choosing your next move today.

- Spot undervalued gems before the crowd by acting early with insights from these 894 undervalued stocks based on cash flows and see which companies could be trading below their true worth.

- Accelerate your strategy by focusing on high-yield choices. Tap into these 19 dividend stocks with yields > 3% for a shortlist of stocks with strong, above-market dividends.

- Ride the next AI innovation wave and gain an edge by exploring these 25 AI penny stocks that are redefining industries and capturing real investor attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal