Reliance (NYSE:RS) Valuation in Focus After Launch of Campa Sure Packaged Water and Strategy Shift

Reliance (NYSE:RS) just launched its new packaged water brand, Campa Sure, entering a massive segment with plans to compete on price and scale. The move follows a government tax cut and fresh capacity investments.

See our latest analysis for Reliance.

Reliance has been making headlines lately, not just with Campa Sure but also through a series of strategic moves, including appointing John G. Sznewajs to its Board and increasing activity in areas like telecom and options trading. The share price sits at $284.11, and while the 1-year total shareholder return is up a modest 1.4%, the longer-term trend shows a 62.7% gain over three years, suggesting solid momentum behind the stock.

Curious where else strong leadership and bold launches are shaping company performance? Now is the perfect time to expand your search and discover fast growing stocks with high insider ownership

With solid long-term returns, a new consumer launch, and a current share price below analyst targets, the key question is whether Reliance remains undervalued or if the market is already factoring in future growth potential for investors.

Most Popular Narrative: 13.7% Undervalued

With Reliance shares lately closing at $284.11, the narrative consensus suggests notable upside to the estimated fair value. The underlying assumptions driving that gap have stirred market attention, and the narrative brings some significant catalysts into focus.

Heightened data center construction, electrification projects, and publicly funded infrastructure spending (schools, hospitals, airports) are driving robust demand for Reliance's specialty steels and engineered materials. This has resulted in market share gains and recurring volume growth, which is poised to benefit both revenue and operating leverage.

Want to know the formula behind that bullish target? The main lever here is future revenue growth from surging infrastructure investment, combined with operating leverage that goes beyond industry averages. The real surprise is what this narrative expects earnings and margins to look like just a few years from now. It might change your perspective on where Reliance should be valued. This full narrative pulls back the curtain on exactly how those quantitative forecasts shape the fair value.

Result: Fair Value of $329.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued trade policy uncertainty and rising cost pressures could easily shift sentiment and undermine the upbeat scenario for Reliance stock.

Find out about the key risks to this Reliance narrative.

Another View: What Does the SWS DCF Model Say?

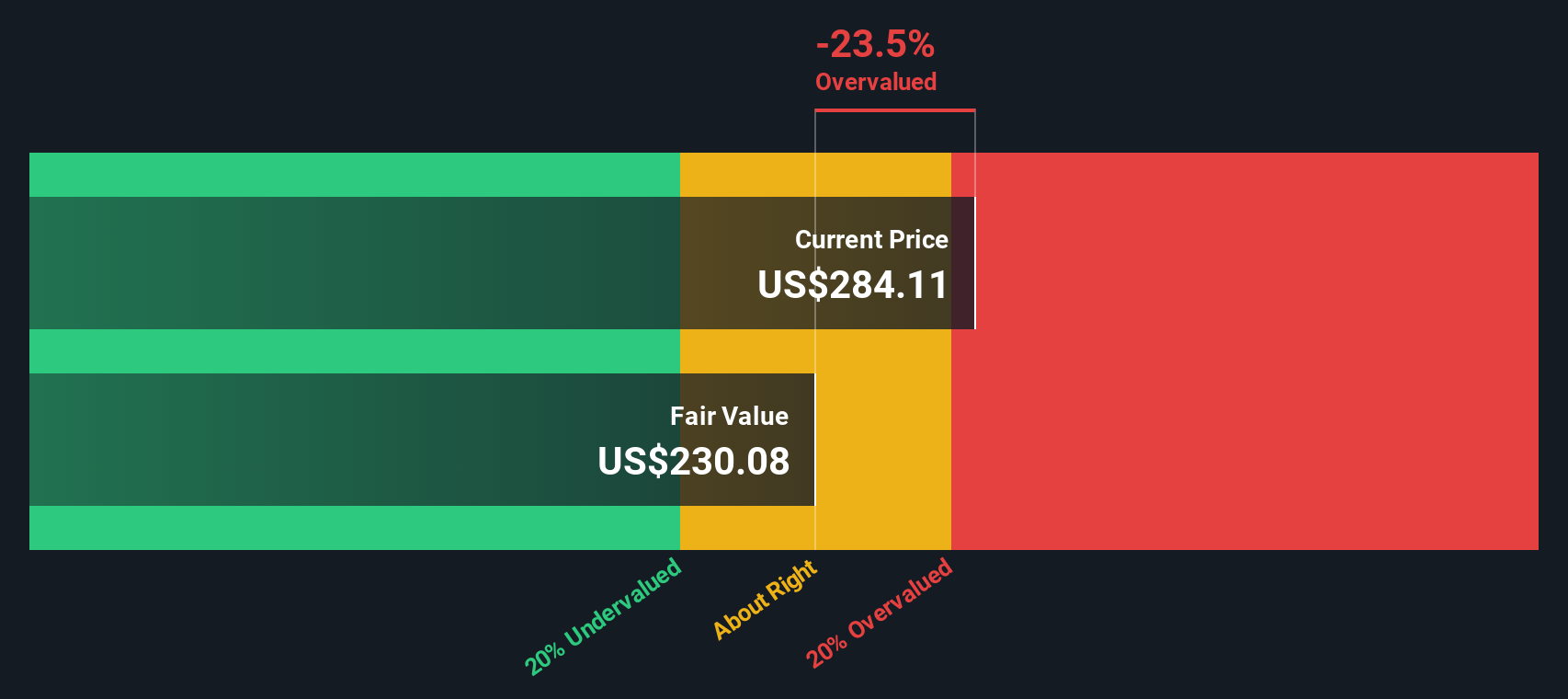

While analysts see room for upside, our DCF model suggests a more cautious stance. The SWS DCF model estimates Reliance’s fair value at $230.08, below today’s price. This result raises the question: are analyst forecasts too optimistic, or is there hidden growth the model misses?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Reliance for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Reliance Narrative

If you have a different angle or want to dig into the numbers on your own, you can piece together your own narrative in just a few minutes, and Do it your way.

A great starting point for your Reliance research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your search count with smart tools. Get ahead of the curve and secure fresh opportunities, as they go quickly when the market is watching.

- Uncover companies that offer steady income and attractive yields by tapping into these 19 dividend stocks with yields > 3% right now.

- Find promising innovators at the frontier of artificial intelligence through these 24 AI penny stocks for exposure to transformative trends.

- Catch undervalued gems with strong cash flow potential before the crowd by leveraging these 885 undervalued stocks based on cash flows as your shortcut to value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal