Gibraltar Industries’ Exit from Renewables Might Change The Case For Investing In ROCK

- In recent days, Gibraltar Industries announced it is shifting away from its renewable energy divisions to concentrate on its core building products, with sale negotiations for the renewable business well underway. This move showcases a company-wide commitment to capturing growth in the US$6 billion metal roofing sector by emphasizing direct contractor relationships.

- We'll examine how Gibraltar's pivot to building products may influence its longer-term market position and growth outlook in the metal roofing industry.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Gibraltar Industries Investment Narrative Recap

To be a shareholder in Gibraltar Industries, you need to believe in the company’s ability to grow and protect margins by capitalizing on US$6 billion metal roofing markets through focused execution and close contractor relationships, especially as it exits the renewable energy space. The news of Gibraltar’s divestiture of its renewable divisions is central to this transformation, but it also concentrates risk in construction, where ongoing weakness in new homebuilding could be the most immediate threat to earnings performance, the impact on short-term catalysts remains closely tied to residential demand trends.

The company’s recent Q2 2025 earnings announcement is particularly relevant as it reported higher sales but softer net income and margin pressure, echoing the risks from housing affordability challenges and interest rate effects already weighing on its residential segment. This financial update places more attention on the need for Gibraltar’s core pivot to offset stagnation in core markets and manage external headwinds.

In contrast, investors should be aware that increasing product concentration brings heightened sensitivity to demand shifts and material substitutions...

Read the full narrative on Gibraltar Industries (it's free!)

Gibraltar Industries' outlook anticipates $1.1 billion in revenue and $135.8 million in earnings by 2028. This reflects a 6.0% annual decline in revenue and a slight decrease in earnings, down $0.2 million from the current $136.0 million.

Uncover how Gibraltar Industries' forecasts yield a $85.00 fair value, a 30% upside to its current price.

Exploring Other Perspectives

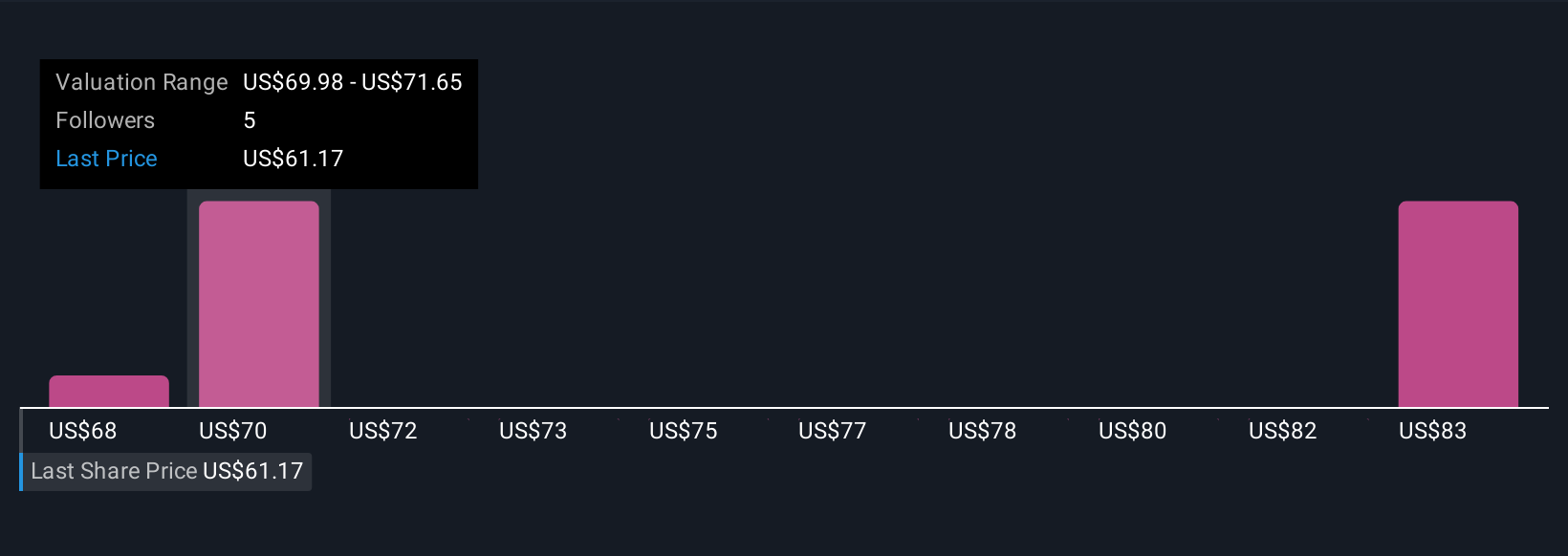

Three fair value estimates from the Simply Wall St Community range from US$68.31 to US$85. Market participants remain split while the company’s renewed focus on metal roofing heightens exposure to cycles in construction demand, making it important to consider several viewpoints before acting.

Explore 3 other fair value estimates on Gibraltar Industries - why the stock might be worth as much as 30% more than the current price!

Build Your Own Gibraltar Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gibraltar Industries research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Gibraltar Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gibraltar Industries' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal