Does US Foods Stock Still Have Room to Grow After Strong 2024 Earnings Momentum?

If you have ever stood on the sidelines wondering whether now is the right moment to get involved with US Foods Holding, you are not alone. This stock has been quietly but steadily making waves, and its journey could be the sort of story long-term investors love to tell. Just look at the numbers: over the past five years, shares have soared an impressive 217.7%. The past twelve months alone have seen a robust 23.9% gain, even as the last month delivered a minor dip of 2.5% and a slight pullback of 1.3% over the past week. In other words, recent volatility has done little to slow the compelling long-term momentum.

Much of this success ties back to evolving market dynamics like supply chain improvements and shifting consumer demand for foodservice, which have helped US Foods Holding stay agile in a competitive industry. While the short-term stumbles might catch your eye, the year-to-date return still stands at a healthy 12.0%. It is clear this is a stock that knows how to bounce back and drive sustained growth for patient shareholders.

But before you decide whether now is the time to jump in or take profits, it pays to look closely at how attractively the company is valued. By measuring US Foods Holding across six major valuation checks, it currently claims a valuation score of 3, meaning it appears to be undervalued by half of these methods. So, how do these different approaches stack up, and is there an even smarter way to judge what the market might be missing? Let’s dig in and find out.

Approach 1: US Foods Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic tool for valuing a company by projecting its future cash flows and then discounting them back to today’s value. This approach helps investors judge whether a stock is trading below, above, or in line with its underlying worth, based on expected performance rather than market sentiment.

For US Foods Holding, the latest reported Free Cash Flow stands at $950.93 million. Analyst estimates suggest this figure will steadily rise, reaching $1.58 billion by 2028. While analysts typically provide projections out to five years, longer-term growth beyond that is extrapolated using trend analysis. Over the next decade, these projections suggest continued steady expansion, showing confidence in the company's ability to generate cash.

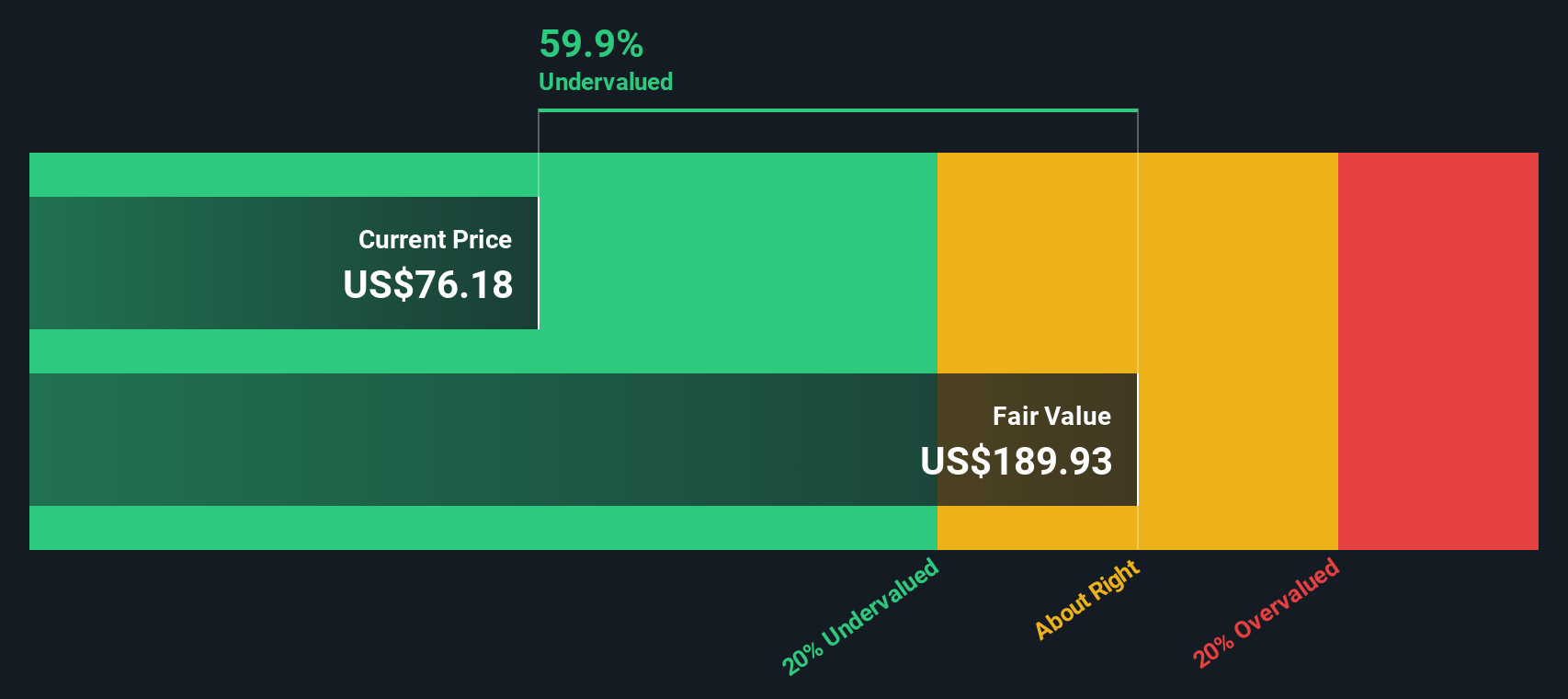

Based on the DCF approach, the estimated intrinsic value for US Foods Holding comes in at $189.85 per share. When compared to the current share price, the model implies the stock is trading at a 60.2% discount. This indicates it appears significantly undervalued relative to its projected cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests US Foods Holding is undervalued by 60.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: US Foods Holding Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies, as it directly links a company's market value to its bottom-line earnings. For investors, the PE ratio provides a simple way to gauge whether a stock’s price fairly reflects its current and expected profitability.

Growth expectations and company-specific risks play a major role in what constitutes a "normal" or "fair" PE ratio. Companies with higher expected earnings growth or lower risk profiles can command above-average PE multiples, while slower-growth or riskier companies typically trade at lower ratios.

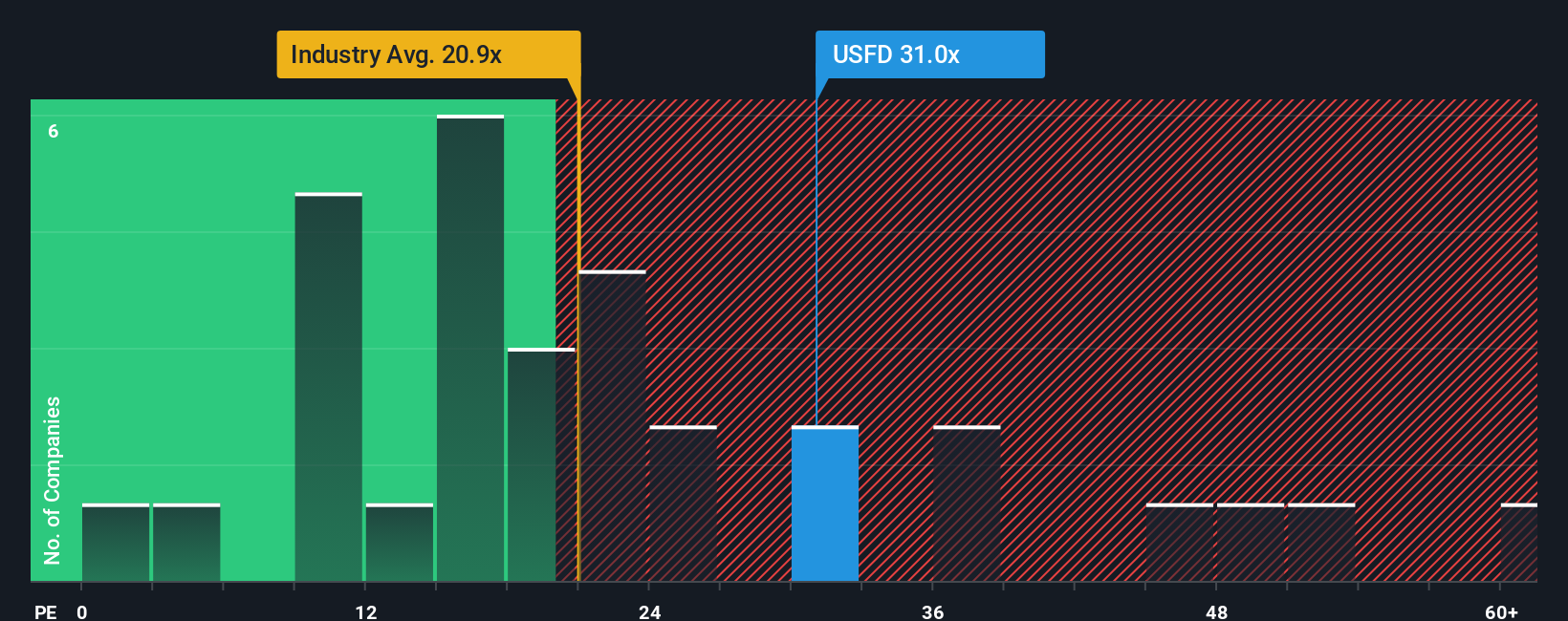

US Foods Holding currently trades at a PE ratio of 30.7x. This sits above the Consumer Retailing industry average of 20.9x and just above its peer average of 29.6x. However, Simply Wall St’s proprietary "Fair Ratio" for US Foods is calculated at 25.2x, factoring in the company’s anticipated earnings growth, industry position, profit margins, and market capitalization.

The Fair Ratio offers a more tailored benchmark than traditional industry or peer comparisons. It adjusts for the nuances that make each company unique. By considering growth prospects and risk along with industry context, the Fair Ratio gives investors a more holistic sense of what constitutes fair value for US Foods Holding.

Currently, the company’s PE ratio exceeds its Fair Ratio. This suggests US Foods may be trading above what its fundamentals alone would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your US Foods Holding Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a smarter, more dynamic approach than simply relying on numbers alone. A Narrative tells the story behind a company’s data, allowing you to combine your personal perspective about US Foods Holding’s future (for example, why you think rising demand for sustainable sourcing or execution risks in M&A matter) with your own assumptions about key financial figures, such as revenue growth, profit margins, and what fair value should be. Narratives connect the “why” of a business directly to its financial forecasts and then to a personalized sense of fair value, making your analysis both clear and actionable.

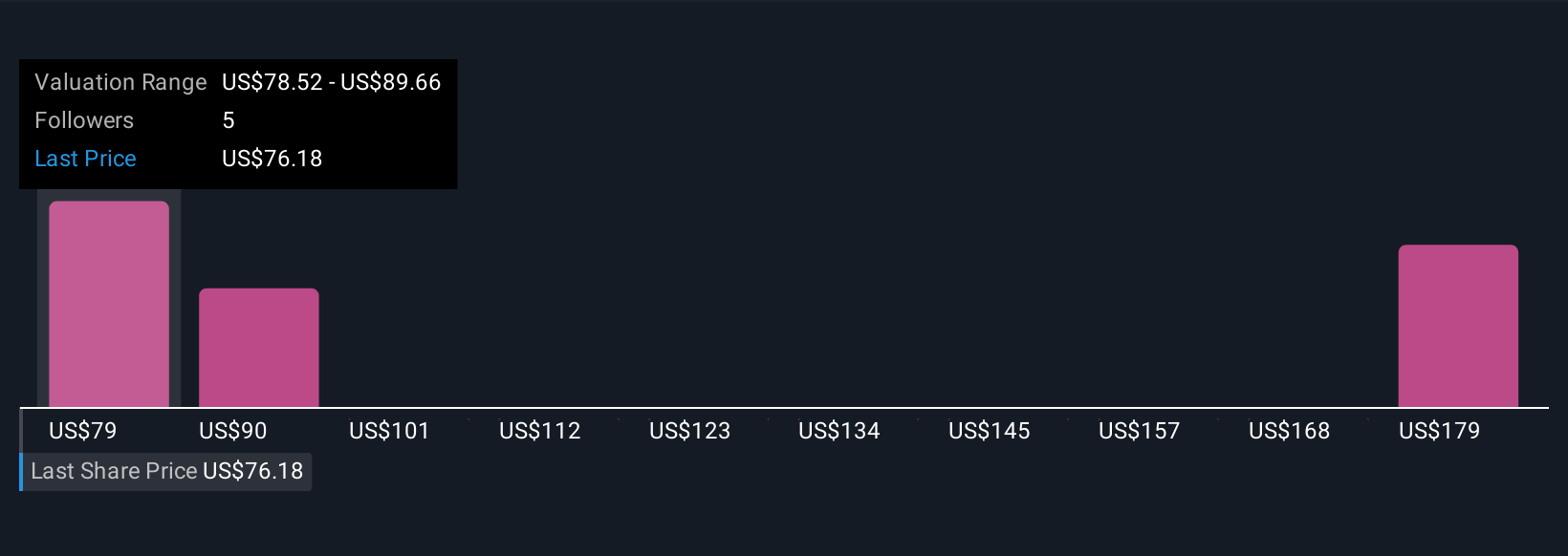

Accessible to anyone on Simply Wall St’s Community page, Narratives let millions of investors turn their views into a living forecast and compare their own fair value estimate with the current share price, helping guide decisions on when to buy or sell. They automatically update as new news or earnings data comes in, so your perspective can evolve as the facts do. For US Foods Holding, you might see one investor convinced that digital automation and sustainable demand will drive a fair value as high as $103.00 per share, while another might believe long-term challenges mean a much lower value of $82.00. Narratives make it easy to see, share, and sense-check both sides in seconds.

Do you think there's more to the story for US Foods Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal