Worthington Enterprises (WOR): Evaluating Valuation Following Strong Earnings and Building Products Growth

Worthington Enterprises (WOR) posted quarterly results that beat analyst expectations for both revenue and adjusted earnings. Management pointed to strong momentum in Building Products and benefits from recent acquisitions, even as tariffs and a wary consumer put pressure on margins.

See our latest analysis for Worthington Enterprises.

This quarter’s upbeat results follow a string of recent moves from Worthington Enterprises, including a new ESOP-related shelf registration, steady share buybacks, and another dividend affirmation for long-term shareholders. The share price has been steady in the short term. When you zoom out, total shareholder returns over the last three years show clear long-term momentum building for investors who stuck with the story.

If you’re curious what other companies combine insider conviction with growth, now’s the perfect moment to discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets and strong fundamentals showing through, the question now is whether Worthington remains undervalued or if the market has already accounted for the company’s future growth prospects.

Most Popular Narrative: 19% Undervalued

At $55.90, Worthington Enterprises sits well below the most widely followed fair value estimate of $69. With analysts largely in agreement about growth, investors are left wondering if the market is missing the bigger story.

Worthington Enterprises is leveraging innovation to drive growth, as evidenced by the launch of new IoT-enabled and consumer products like SureSense and Balloon Time Mini, which are expected to increase revenues. The company is investing in operational efficiencies through facility modernization projects and automation, anticipated to improve net margins over time.

Want to see why this price target stands out? Find out which bold new product launches and aggressive margin expansion forecasts are propelling the company’s valuation higher. The underlying growth thesis for Worthington may surprise you. Discover the ambitious assumptions shifting the balance.

Result: Fair Value of $69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariffs and recent declines in steel prices may pressure Worthington’s margins. This creates market uncertainty, which remains a lingering risk for the bullish outlook.

Find out about the key risks to this Worthington Enterprises narrative.

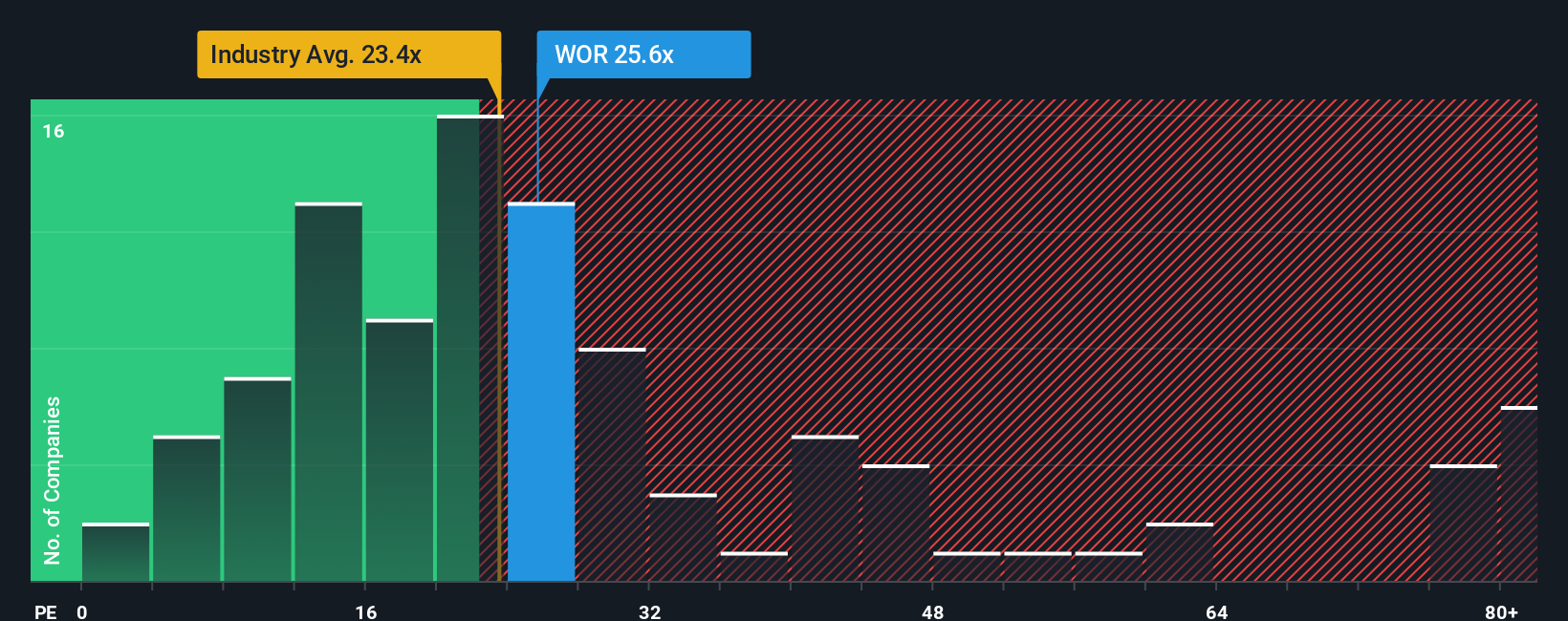

Another View: Looking at Multiples

Our SWS DCF model found Worthington Enterprises is trading well below its estimated fair value, but a quick check of valuation multiples paints a more cautious picture. The company's price-to-earnings ratio is 26x, slightly above the US Machinery industry average of 24.1x and the projected fair ratio of 25.2x. This means investors may not have as much margin of safety at current levels as the DCF suggests. So, which verdict do you trust more: future cash flows or the market's current pricing power?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Worthington Enterprises Narrative

If you see things differently or want to dig deeper into Worthington Enterprises yourself, you can quickly build your own story and perspective in just a few minutes. Do it your way

A great starting point for your Worthington Enterprises research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t just wait for the next opportunity to come to you. Put your money to work by exploring these fast-moving corners of the market right now:

- Find tomorrow’s standout players by scanning for these 900 undervalued stocks based on cash flows that are poised to outperform as market sentiment shifts in their favor.

- Unlock potential from cutting-edge health care by targeting innovation leaders via these 31 healthcare AI stocks, and see which companies are setting new medical frontiers.

- Secure consistent payouts and beat cash drag when you check out these 19 dividend stocks with yields > 3%, offering robust yields backed by reliable performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal