FuelCell Energy (FCEL) Stock Soars 150% On AI Data Center Demand: What Investors Need To Know

FuelCell Energy Inc (NASDAQ:FCEL) shares are surging Friday afternoon, continuing a powerful rally that has seen the stock climb over 150% in the past month. Here’s what investors need to know.

What to Know: Investor enthusiasm in recent weeks is closely tied to the growing energy demands of the artificial intelligence sector. FuelCell’s carbonate fuel cell platforms could be positioned as a solution for providing reliable, continuous power to energy-intensive data centers.

Momentum also stems from the company’s impressive third-quarter earnings report, which revealed a 97% year-over-year revenue increase and a corporate restructuring.

This potential has captured Wall Street's attention, with analysts revising price targets upwards. While many firms maintain neutral ratings, UBS recently increased its price target to $7.25, signaling an improved outlook for the energy company as it capitalizes on the AI boom. The company has already established multi-megawatt projects with data center partners in the U.S. and Korea.

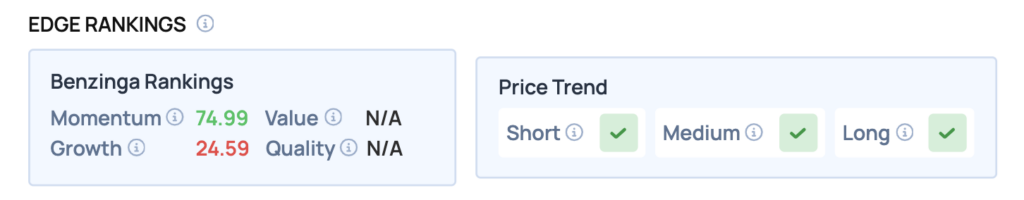

Benzinga Edge Rankings: This powerful rally is reflected in the stock’s Benzinga Edge Momentum score, which stands at a high of 74.99.

FCEL Price Action: FuelCell Energy shares were up 17.51% at $10.19 at the time of publication Friday, according to Benzinga Pro. The stock is trading within its 52-week range of $3.57 to $13.98.

FCEL is well above its 50-day moving average of $5.58 and 100-day moving average of $5.52, indicating strong bullish momentum. The stock is approaching the upper end of its 52-week range, with resistance likely near $10.66, the intraday high, while support can be identified around the 50-day moving average.

Read Also: The Last Time This Signal Flashed, Stocks Cratered—It’s Back Now

How To Buy FCEL Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in FuelCell Energy’s case, it is in the Industrials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Photo: Courtesy FuelCell Energy

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal