How $500 Million Legal Damages at Universal Health Services (UHS) Has Changed Its Investment Story

- In September 2025, Universal Health Services disclosed that a subsidiary and its partner were ordered to pay substantial punitive damages of US$500 million following a legal dispute over physician contracts, with the company planning to appeal the ruling.

- This legal development introduces a material financial risk for Universal Health Services, as it could significantly affect the company’s financial condition if the appeal proves unsuccessful.

- We’ll examine how this potential financial liability could reshape Universal Health Services’ investment narrative and near-term risk outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Universal Health Services Investment Narrative Recap

To be a shareholder in Universal Health Services today, you need to believe in the long-term demand for inpatient and behavioral healthcare despite regulatory reimbursement pressures. The recent US$500 million punitive damages order presents a significant short-term risk, shifting the primary near-term focus from regulatory threats to the financial implications of this legal outcome, which may overshadow positive operating momentum if not successfully appealed.

Among recent announcements, UHS was dropped from the FTSE All-World Index in September 2025, a change occurring just after the legal ruling. Index removals can lead to mechanical selling by funds and may pressure the stock price, compounding the uncertainty from the current legal matter, making this development particularly timely when considering company-specific catalysts or risks.

On the other hand, investors should also factor in the ongoing risk of reimbursement rate cuts and regulatory changes that could compound the impact of...

Read the full narrative on Universal Health Services (it's free!)

Universal Health Services is projected to reach $19.0 billion in revenue and $1.5 billion in earnings by 2028. This outlook assumes a 5.0% annual revenue growth rate and a $0.2 billion increase in earnings from the current $1.3 billion.

Uncover how Universal Health Services' forecasts yield a $218.31 fair value, a 6% upside to its current price.

Exploring Other Perspectives

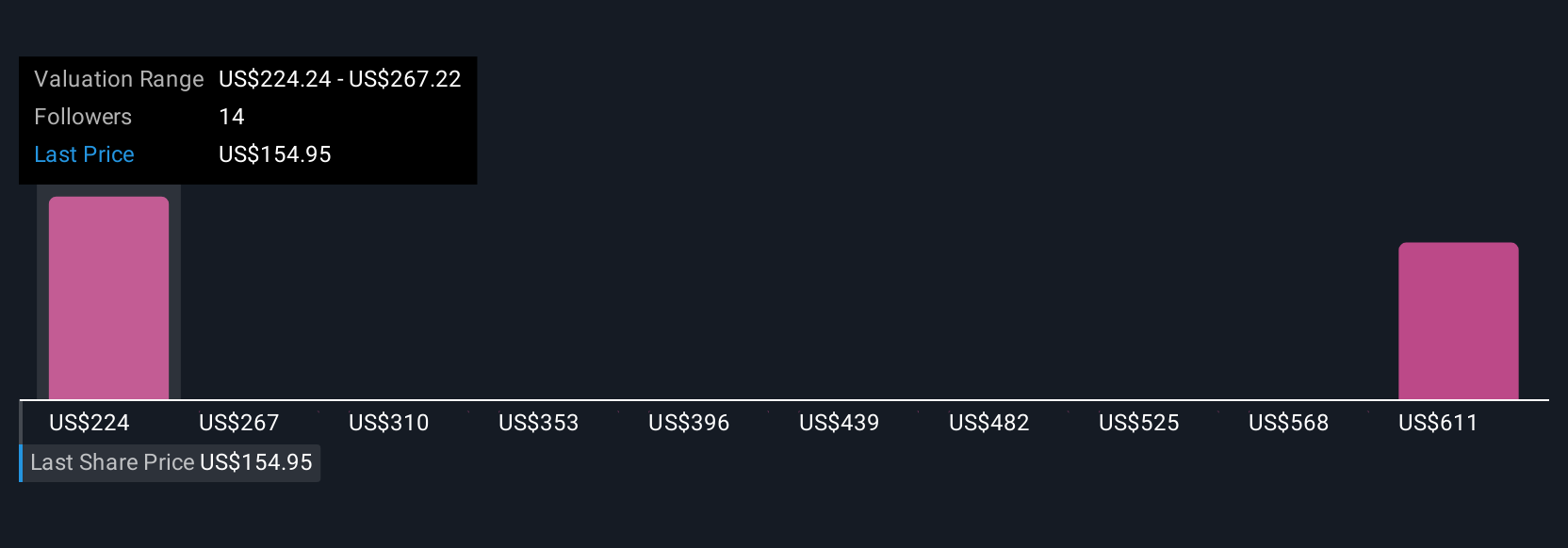

Simply Wall St Community members offered three individual fair value estimates for UHS stock, ranging from US$218 to US$644 per share. Differences in outlook reflect how risks like legal liabilities or regulatory headwinds can influence your view on the stock's performance, review a variety of opinions to round out your thinking.

Explore 3 other fair value estimates on Universal Health Services - why the stock might be worth over 3x more than the current price!

Build Your Own Universal Health Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Health Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Universal Health Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Health Services' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal