Chemed (CHE): Examining Valuation with Modest Share Price Movement and Analyst Discount

See our latest analysis for Chemed.

Chemed’s recent price movement, while modest, is part of a larger story that has seen the stock post a negative total shareholder return of just under 0.25% over the past year, with longer-term figures treading water. Despite steady underlying business growth, momentum has cooled and the current price reflects a more cautious investor outlook compared to previous years.

If you’re keeping an eye out for what’s next, this could be the perfect time to uncover fresh opportunities by exploring See the full list for free.

With Chemed trading at a notable discount to analyst targets despite steady growth, it raises the question: is there value hidden beneath the surface, or has the market already priced in every bit of its future potential?

Most Popular Narrative: 24% Undervalued

With Chemed’s last close at $442.04 against a narrative fair value of $582.25, there is a substantial gap that frames the current valuation discussion. This perspective highlights how analyst expectations for future growth and margin restoration may be underappreciated in the stock’s recent price action.

The ramp-up of new Certificate of Need (CON) locations in underserved Florida counties (e.g., Pinellas and Marion) is expected to materially expand VITAS's service footprint. This aligns with the continued aging U.S. population and the shift toward home-based care, both of which are key drivers of higher patient volumes and long-term top-line revenue growth.

Curious about the growth forces that could reset Chemed’s valuation? The secret is a demographic wave, new locations and a powerful combination of margin optimism and market positioning. Want to know the model that justifies a premium price-to-earnings level and targets robust future profits? Dive in for a look at the numbers most investors have yet to see.

Result: Fair Value of $582.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Medicare reimbursement and shifting patient mix could present challenges to the optimistic outlook for Chemed's growth and future profitability.

Find out about the key risks to this Chemed narrative.

Another View: Market Ratios Offer a Mixed Signal

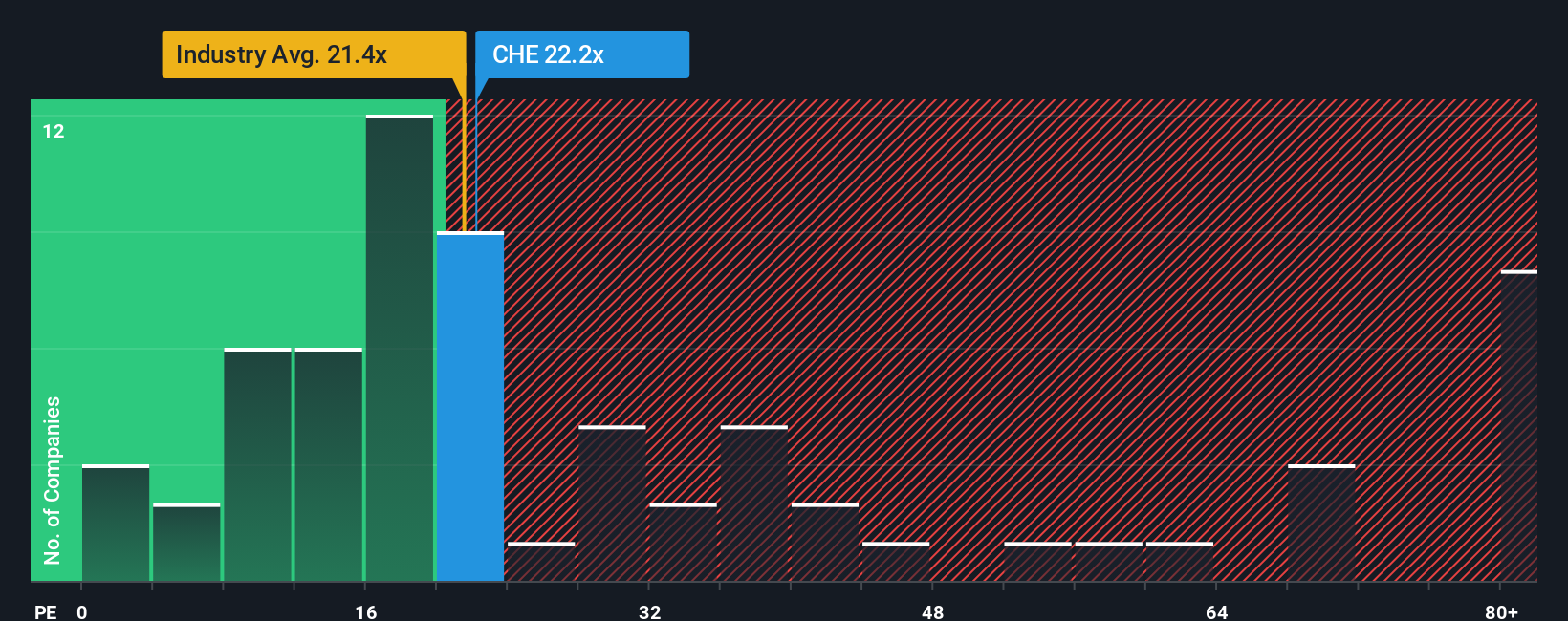

Looking at Chemed through the lens of price-to-earnings, the stock trades at 22.1x, just above the US Healthcare industry’s 21.2x. However, compared to the estimated fair ratio of 19.6x and peers averaging 48.4x, the current valuation sends mixed messages about risk and opportunity. Is the market pricing in caution, or is there untapped value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chemed Narrative

If you see things differently or want to take the reins with your own perspective, you can build a personal narrative in just a few minutes. All it takes is a fresh look, some thoughtful analysis, and Do it your way.

A great starting point for your Chemed research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t just watch from the sidelines. Now’s your chance to take action and uncover high-potential investment themes with the Simply Wall Street Screener. Miss out and you might leave opportunity on the table.

- Catch momentum early by checking out these 26 quantum computing stocks, which uncovers companies pushing the boundaries in quantum computing and futuristic tech.

- Unlock serious yield potential by targeting these 19 dividend stocks with yields > 3% to spot businesses delivering reliable dividend income above 3%.

- Stay ahead of the curve with these 24 AI penny stocks, featuring innovative AI upstarts at the forefront of smart automation and data-driven industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal